JANUARY 24, 2018

By Vijay Kumar

I stopped writing on tax six months before GST barged into our lives and for the last six months, I have been trying and trying really hard to go through the maze of laws and commentaries and clarifications to make head and tail of what was happening. The wise Prime Minister says it is a Good and Simple Tax and a wiser opposition leader says it is a Gabbar Singh Tax. After all, what is politics if there is no chasm between the views of the ruling party and the opposition party?

But everybody seems to know about GST - my watchman, barber, cab driver, friends trying to make their lives meaningful - all have total knowledge and a different opinion on every aspect of GST, all acquired through the tsunami of information that is billowing from all sorts of media. I was wondering whether I am the only one who failed to understand the simple tax, until I found somebody of my tribe in Film actress Kajol. She recently said, "I don't think I have the financial expertise to discuss GST - of course like the many experts, she also had her opinion on GST on Sanitary Napkins - "after all, if rice and milk are taxed, why not napkins?" But is there GST on rice and milk? Well, that was only an expression. Anyway, it is good to see beautiful people talk GST, certainly much better than the professionally poignant experts. See this

https://www.youtubecutter.com/watch/97030e67/

Then there is the one and only creative director Ram Gopal Varma (RGV) who has come up with his own GST - It is God, Sex and Truth. And perhaps this is the best representative wisdom as all the three concepts are as difficult to understand as the GST.

Incidentally, there was also another film by the name GST - Galti Sirf Tumhari released last December but which sank without a trace.

In our country, some people become famous by building temples, some by demolishing them and that seems to be true for taxes too. We should understand that even the great scientist Einstein found it difficult to understand taxes. Einstein's Tax accountant Leo Mattersdorf wrote about this, "One year while I was at his Princeton home preparing his return, Mrs. Einstein, who was then still living, asked me to stay for lunch. During the course of the meal, the professor turned to me and with his inimitable chuckle said: ‘The hardest thing in the world to understand is income taxes.' I replied: ‘There is one thing more difficult, and that is your theory of relativity.' 'Oh, no,' he replied, 'that is easy."

Prime Minister Modi is aware of this Einstenian handicap. Launching the GST on that fateful night of June 30th 2017 from Parliament, the Prime Minister said, "Once Albert Einstein, an eminent scientist had said that the most complex thing to understand in this world is Income tax. I was wondering if he was present here then how he would have reacted looking at the plethora of taxes."

Imagine Albert Einstein as an assessee, officer, consultant, commentator or a simple citizen in India's GST regime.

We all would like our laws to be simple, meaningful, concise, precise and in understandable language. Making the laws simple is not a simple thing, especially for the modern lawmakers. In the olden days laws were understood to be un-understandable and in a particular linguistic style. But today everybody wants simple language in laws. So, the law drafter has to keep his language simple, but ensure that there are no flaws and in this situation even the simplest person would draft the most complicated laws, because he has to play a game of chess and foresee all the possible moves of the best legal brains of the country.

Laws must be plain, simple, unambiguous and in the required few words. But the big question is how to do it? People criticize our laws and their complicated nature but has anyone ever told the Government that these are the most suitable words for a particular law and can anyone assure a trouble free and litigation free simple law?

Fiscal laws are bound to be complicated and confusing and we have no option - it is simply inevitable and we should relax and enjoy it. After some time, you will get used to it. See we are already seven months into GST and heavens are yet to fall - they will not.

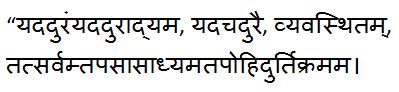

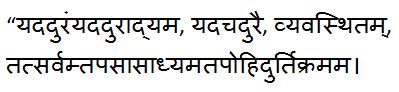

And remember the Prime Minister had warned us. In the launch ceremony, he had said,

Chanakya's words summarize the whole GST process. Even if something is very difficult to be achieved, one can obtain it with penance and hard work.

Yeah! It only requires a little penance and hard work.

The Government is very responsive, rates are being reduced, vibhuti is being exempted, notifications and circulars are being issued, all that you need is a little patience to read a few thousands of pages and have a little more IQ than Einstein to understand them.

There was a meeting of the omniscient GST Council last week which had decided to make GST much simpler and easier and those resolutions of the Council will be translated into legal language by our concerned babus, which we will try to translate into English for you.

Law by corrigendum: The Government had by Circular No. 28/02/2018-GST, dated 08.01.2018, issued a clarification on the taxability and rate of GST on services by a college hostel mess. The clarification was:

The educational institutions have mess facility for providing food to their students and staff. Such facility is either run by the institution/ students themselves or is outsourced to a third person. Supply of food or drink provided by a mess or canteen is taxable at 5% without Input Tax Credit [Serial No. 7(i) of notification No. 11/2017-CT (Rate) as amended vide notification No. 46/2017-CT (Rate) dated 14.11.2017 refers]. It is immaterial whether the service is provided by the educational institution itself or the institution outsources the activity to an outside contractor.

Ten days later by a corrigendum dated 18.01.2018, the Government clarifies that:

If the catering services is one of the services provided by an educational institution to its students, faculty and staff and the said educational institution is covered by the definition given under para 2(y) of notification No. 12/2017-Central Tax (Rate), then the same is exempt. [Sl. No. 66(a) of notification No. 12/2017-Central Tax (Rate) refers]

If the catering services, i.e., supply of food or drink in a mess or canteen, is provided by anyone other than the educational institution, then it is a supply of service at entry 7(i) of notification No. 11/2017-CT (Rate) [as amended vide notification No. 46/2017-CT (Rate) dated 14.11.2017] to the concerned educational institution and attracts GST of 5% provided that credit of input tax charged on goods and services used in supplying the service has not been taken, effective from 15.11.2017.

Don't blame the government for creating confusion, didn't they issue a corrigendum? Just to make it simple for you!

Please also see Correction By Corrigendum - Unfair Legislative Practice.

And incidentally this Circular is numbered as 28 of 2018. Did they issue 28 circulars in 2018? No, they are continuing with the numbering of 2017. How long will this serial run? Will we have a circular number 12846 in the near future? We are in the seventh month of GST and they have already issued 28 circulars in CGST. Quite an impressive figure! Nothing much has changed. This numbering methodology probably owes its origin to this Board Circular of 1994.

The Government, it is understood, is soon going to give a clarification that elephant/camel joy rides are not classified as transportation services and attract GST @ 18% with threshold exemption to small services providers.

Before parting, I cannot resist the temptation of another quote -

"This agglomeration of statutes and regulations dealing with similar matters is neither convenient for the public nor conducive to well organized administration. Moreover, under this disjunctive arrangement, we have not and cannot readily construct a comprehensive code of standing instructions for the governance of the excise staff… The Act… Will then form a complete Central Excise Code, which will simplify the administration of this branch of the revenue system…"

Can you guess from where the quote is extracted? This is from the Gazette of India dated 10.1.1943, Statement of Objects and Reasons for the Central Excise Act, 1944. Seventy Four years have passed and simplification continues… |

Download PDF

Download PDF