SERVICE TAX

2018-TIOL-1988-CESTAT-MUM + Case Story

Indorama Synthetics India Ltd Vs CCE & ST

ST - Tax paid on reverse charge basis under mistaken belief that the same was payable and credit availed thereof would not cause any loss of Revenue - impugned order denying credit and imposing penalty set aside and appeal allowed: CESTAT [para 6, 7] - Appeal allowed: MUMBAI CESTAT

2018-TIOL-1983-CESTAT-DEL

CST Vs Melange Developers Pvt Ltd

ST - Assessee engaged in construction activities and have executed various contracts for private and Government agencies - They are registered for payment of Service tax under CICS as well as WCS - Dispute pertains to period 01.07.2007 to 31.03.2012 - The Department observed that assessee, in respect of three contracts, did not pay Service tax under category of WCS - The dispute is regarding liability for payment of Service tax, on the part of sub-contractor who has executed certain works for the main contractor - On the activities provided as sub-contractor, the main contractor has already discharged Service tax liability - Adjudicating Authority has referred to Circular 96/07/2007-ST and dropped the demand for Service tax by observing that if the assessee is to pay tax on gross amount received by them as sub-contractor, it would amount to double taxation which is totally against the provision of Service tax law - Revenue, on the other hand, has challenged these findings by taking the view that the activity performed by assessee/ sub-contractor is a taxable service and hence is required to discharge Service tax - Since there are two streams of decisions by various Tribunal Benches, taking opposing views on same issue, matter needs to be considered by a Larger Bench - Registry is therefore directed to place the matter before President for constituting Larger Bench to decide the issue: CESTAT - Case deferred: DELHI CESTAT

2018-TIOL-1982-CESTAT-DEL

Oberoi Rajvilas Vs CCE

ST- The assessee is engaged in providing restaurant and short term accommodation services - It is claiming abatement under Notification No. 1/2006-ST @ 50% (for short term accommodation services) and 70% (on restaurant services) - The abatement was available on non-availment of credit on inputs or input services or capital goods - It claimed abatement however, the Revenue denied benefit under the notification and demanded payment of service tax on grounds that the assessee was availing cenvat credit on certain input services -

Held: With respect to claim for abatement a part of the input services is exclusively used for provision of taxable services for which service tax is payable - Therefore, the cenvat credit has been used only for payment of service tax on taxable service - Hence, the claim is allowable - With respect to claim for common input services, the assessee has followed the proportionate method for availment of credit on common input services - It cannot be said that the assessee has availed any credit on input services used in providing exempted service (restaurant service) - The reversal of credit by assessee satisfies the requirement of non availment of credit laid down in the Notification No. 1/2006-ST - Rule 6 (3) of CCR is satisfied by means of proportionate reversal of credit - Hence, the benefit of abatement cannot be denied and demand is set aside - Further, in regard to payment of service tax on income from open air restaurant - While section 65 (105)(zzzzv) lays down the mandatory condition of airconditioning for taxability of restaurant services - In the present case open air restaurants do not fall under service - In addition, the CBEC Circular No. 139/8/2011-TRU clarifies that within the same entity, if there are more than one restaurants, which are clearly demarcated the one with A/C alone will be liable to service tax - Therefore, the demand is set aside: CESTAT (Para 2, 7, 8, 11, 12, 13, 14) - Appeal Allowed: DELHI CESTAT

2018-TIOL-1981-CESTAT-MAD

Toll India Logistics Pvt Ltd Vs CCE

ST - The assessee is providing C&F as well as GTA service to HUL - It entered into two separate contracts with HUL for providing these services - Duty demand was raised on grounds that the assessee did not include loading, unloading & halting charges while discharging the service tax under C&F agency service - Even though the assessee produced necessary documents to show that service tax on GTA service has been paid - The Original Authority confirmed the demand with interest for the period in dispute.

Held: The issue at hand is whether the service rendered by the assessee is a composite service under C&F Agency Service - The consignment note for GTA services shows that service tax will be discharged by the consignee (in the present case, HUL) - Therefore, the service tax has been paid & ancillary charges of loading and unloading as well as halting charges which are part and parcel of GTA service cannot be included in C&F Agency service - The very same charges cannot be subject to levy under C&F Agency Service - Hence, the demand is set aside: CESTAT (Para 1, 5) - Appeal Allowed: CHENNAI CESTAT

CENTRAL EXCISE

2018-TIOL-1987-CESTAT-MUM

Bilt Graphic Paper Products Ltd Vs CCE

CX -Appellants are sending Coating Base Map-litho paper reels for coating purpose to job worker and for clearance thereof on payment of duty from job-worker's premises after completion of required process - job worker purchased certain chemicals and other inputs to be used in the said processing in their own name and subsequently prepared fresh invoice in favour of appellant so as to pass on CENVAT credit - SCN issued proposing denial of CENVAT credit taken on the invoices issued by the job worker - demand confirmed and upheld by Commissioner(A) by concluding that credit can be availed only on the inputs which are received in the factory of manufacturer and not those which have been received by the job worker - appeal to CESTAT.

Held: Upon a reading of rule 3(1) of the CCR, 2004, it can be seen that the CENVAT credit is allowed not only on the inputs received in the factory of the manufacturer of final product but also on the input used in the manufacture of intermediate product by the job worker availing exemption in terms of notification 214/86-CE - Identical matter has been decided in favour of appellant in their own case reported as 2017-TIOL-1785-CESTAT-MUM - CENVAT credit availed is in order and is clearly admissible - impugned order set aside and appeals allowed: CESTAT [para 4, 5] - Appeals allowed: MUMBAI CESTAT

2018-TIOL-1986-CESTAT-MUM

Vako Seals Pvt Ltd Vs CCE

CX - Notification 42/2001-CX(NT) - Scope of the expression 'twelve calendar months', according to lower authorities, would restrict the validity of 'undertaking' against which exports were effected to the period up to 31 st December of the year of issue, whereas, according to appellant, it would be effective till twelve months have elapsed.

Held: Expression used in the prescribed procedure is 'twelve calendar months', a 'calendar year' which, by definition would be coterminous with the twelve months ending in December - Such an interpretation would restrict the validity to part of such year if issued after the first day of January - similarly, the expression 'twelve calendar months' would encompass exactly twelve months with any part of month computed as a month - such a viewpoint would divorce the purpose of such procedure from the outcome - goods cleared under ARE-1 between 1st January 2013 and 16th January 2013 had been exported - intent of the procedure is to ensure that goods are not diverted under the guise of exports - to that end, possession of a valid undertaking would permit business activity without permanent oversight or scrutiny - facilitation procedure should not be used to the detriment of the genuine exporter - demand of duty and consequential detriment is not tenable - impugned order set aside and appeal allowed: CESTAT [para5 to 7] - Appeal allowed: MUMBAI CESTAT

2018-TIOL-1985-CESTAT-ALL

Swadeshi Polytex Ltd Vs CCE & ST

CX - During period from 14.5.1986 to 30.6.1990, assessee paid duty on crimped uncut waste and cut and process waste under protest through letter of protest dated 6.5.1986 which was acknowledged by central excise authorities on 14.5.1986 - Assessee submitted on 7.4.1997 an application for refund of duty paid under protest for said period - Said refund application was rejected by original authority - During relevant time, if duty was paid under protest limitation was not applicable as per first proviso to sub-section 1 to section 11B of CEA, 1944 - Tribunal is also satisfied through documents that duty was borne by assessee whereas there was no mention of duty in invoices and this is how the duty was not recovered from customers - Therefore, application for refund is not hit by limitation - Assessee has proved that duty burden was not passed on to customers relying on ruling of Supreme Court in case of Allied photographics India Ltd 2004-TIOL-27-SC-CX - Revenue is directed to pay the refund along with applicable rate of interest within a period of 90(ninety) days: CESTAT - Appeal allowed: ALLAHABAD CESTAT

2018-TIOL-1984-CESTAT-MUM

Wockhardt Ltd Vs CCE, C & ST

CX - Recombinant Erythropoietin (r-EPO) classified by lower authorities under heading no. 2937 as 'hormones' instead of the claimed classification as 'other blood fractions', heading 3002 - demand of CE duty confirmed with penalty - appeal to CESTAT.

Held: Classification sought by appellant does not appear to be tenable - A 'blood fraction' is a constituent of human blood that has been subject to a process of disaggregation with intention to introduce in the body of the recipient as therapy - Hormones are glandular secretions of a particular organ of the human body - Erythropoietin does not fall within the three categories of hormones - for long it was presumed in medical circles that 'Erythropoietin' is secreted by the kidneys but current research posits that these are produced in the brain too, therefore, this runs counter to the general understanding of 'hormone' - lower authorities, therefore, had incorrectly and in the absence of a valid and acceptable alternative after discarding its classification as a 'blood fraction', the consequent recovery ordered by the original authority and upheld by the Commissioner(A) fails to meet the test of law and must be set aside - there is also no evidence of deliberate intent of evading duty and the ample scope for confusion also precludes invoking of the extended period - impugned order set aside and appeal allowed: CESTAT [para 9 to 12] - Appeal allowed: MUMBAI CESTAT

CUSTOMS

2018-TIOL-1980-CESTAT-MUM

Bharathi Rubber Lining and Allied Services Pvt Ltd Vs CC

Cus - Import of Zinc Ash - Declared Assessable value rejected and demand of Customs duty confirmed along with imposition of interest and penalty and redemption fine - appeal to CESTAT.

Held: Director, in his statement, which has not been retracted, has agreed that the invoices received by DRI showed real price of the goods and he also agreed that the amount of differential value was given in cash to the Indian representative of foreign supplier, therefore, it cannot be claimed that statement was obtained by coercion - furthermore, case of revenue is not merely based on rejection of transaction value in terms of rule 10A of Valuation Rules, 2007 - Since the real transaction value i.e. the amount transferred through legal channels and amount paid to the local representative of the foreign supplier is available, same becomes transaction value and duty can be demanded by taking the same as AV - since goods are not available for confiscation, no confiscation can be ordered and no redemption fine can be imposed - appeal partly allowed: CESTAT [para 6, 7] - Appeal partly allowed: MUMBAI CESTAT

|

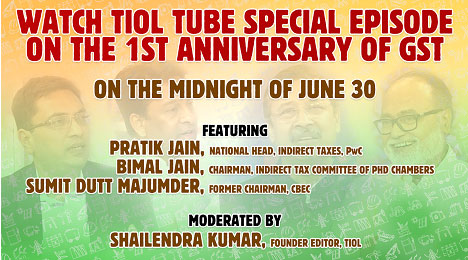

by Shailendera Kumar

by Shailendera Kumar