|

|

2018-TIOL-NEWS-151 Part 2 | Thursday June 28, 2018

|

|

|

Dear Member,

Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at +91-7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

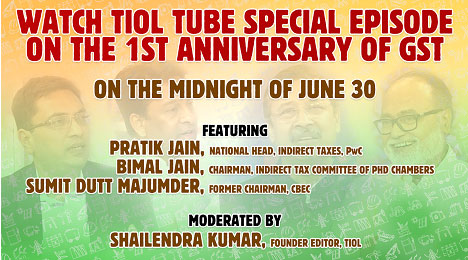

TIOL TUBE VIDEO |

|

|

|

DIRECT TAX |

|

|

|

|

|

|

|

|

|

|

2018-TIOL-1196-HC-MUM-IT

Pr.CIT Vs Engineering Mazdoor Sabha

Whether reopening proceedings deserve to be quashed where initiated without any material showing reasonable belief that income assessable to tax escaped assessment - YES: HC - Revenue's appeal dismissed: BOMABY HIGH COURT

2018-TIOL-971-ITAT-DEL

Moti Adhesives Pvt Ltd Vs ITO

Whether non-production of director in a share-holding company forms basis enough to doubt the genuineness of the receipt of share application money u/s 68 & make additions on this count - NO: ITAT s

Whether the AO can make additions u/s 68 while ignoring its onus to disprove the credibility of documents furnished by the assessee - NO: ITAT - Assessee's appeal allowed: DELHI ITAT

2018-TIOL-960-ITAT-JAIPUR

Rajasthan Fort and Palace Pvt Ltd Vs DCIT

Whether the assessment already completed cannot be disturbed pursuant to search and seizure operation until and unless incriminating material is found - YES : ITAT - Assessee's appeal allowed: JAIPUR ITAT

2018-TIOL-959-ITAT-PUNE

L and T John Deere Pvt Ltd Vs ACIT

Whether penalty proceedings are defective if no specific charges for levy of penalty is clearly mentioned by AO - YES : ITAT - Assessee's appeal allowed: PUNE ITAT

2018-TIOL-958-ITAT-MAD

DCIT Vs Willingdon Charitable Trust

Whether in the absence of any new material, based on existing information, available during original assessment, the Revenue can not reopen the assessment - YES : ITAT

Whether the excess application of income, in a particular year can be adjusted with deficiency in another year by a Trust - YES : ITAT - Revenue's appeal dismissed: CHENNAI ITAT

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

|

SERVICE TAX

2018-TIOL-1992-CESTAT-DEL

Shree Mangalam Vs CCE

ST - The assessee were engaged in providing taxable services - For the period in dispute, the assessee carried out job work for parent company as well as others - The nature of the job work was cutting of HR/MS Sheets - The assessee paid service tax liability on job work under Business Auxiliary Service services - The Revenue opined that tax was short paid and so duty demand was raised on commission & the amount of job charges received but tax not paid -

Held: As regards job work charges during the disputed period, the tax was paid by the assessee on receipt basis - In addition, commission & trade discount pertains to the activity of selling of the product from other entity and not related to job work - Therefore, the matter is remanded to the Revenue for fresh adjudication - The actual receipt of commission and the service tax payable will need to be verified: CESTAT (Para 4, 8, 9, 10) - Matter Remanded: DELHI CESTAT

2018-TIOL-1991-CESTAT-DEL

Ruchi Malls Pvt Ltd Vs CCE

ST - Assessee is a service provider and is duly registered with Service Tax Department for providing taxable services under category of maintenance or repair service, business support service and renting of immovable property service - During disputed period, assessee constructed the retail Mall at Ahmedabad and availed Cenvat credit in respect of service tax paid on various input services used in construction of such Mall - Taking of Cenvat credit was disputed by department on the ground that as per the definition of input service contained in Rule 2(l) of CCR, 2004, disputed services should not be considered as input service.

Held: Rule 3 of CCR, 2004 is the enabling provision, which entitles a service provider to take Cenvat credit of service tax paid on input services for providing output service - Thus a service provider is eligible to take credit of service tax on input services; in terms of Rule 3 of rules - However, in view of embargo created in definition of input service w.e.f. 01.04.2011, Cenvat credit is not permissible on disputed services, from such effective date - The assessee contended that the Cenvat credit was availed prior to 01.04.2011 - Since, assessee has taken the credit prior to 1.4.2011 and the Mall was also completed before 2011, as confirmed by assessee, denial of Cenvat benefit cannot be sustained - Tribunal in case of Navratna S.G. Highway Prop. Pvt. Ltd. 2012-TIOL-1245-CESTAT-AHM has held that the goods and services used for construction of warehouse, which is further used for providing the output service should be available for Cenvat benefit - djudicating authority has held that the Cenvat credit on disputed services has also been taken by assessee after the amendment of definition of input service w.e.f. 01.04.2011 - The assessee that the entire credit was availed prior to such date of amendment - Since, there is dispute about the period of taking Cenvat credit, matter remanded to original authority: CESTAT - Matter remanded: DELHI CESTAT

2018-TIOL-1990-CESTAT-MUM

Rashmi Marketing Vs CCE, C & ST

ST - Demand was made against appellant pursuant to audit objection and same was paid immediately before issuance of SCN - since non-payment was detected from books of account, there is no element of suppression involved - when penalty has not been imposed on portion of demand on the ground that there is no suppression, in that case, it cannot be said that in respect of another portion, there had been suppression - either suppression can be alleged for the whole period or will not exist altogether - appeal allowed with consequential relief: CESTAT [para 4] - Appeal allowed: MUMBAI CESTAT

CENTRAL EXCISE

2018-TIOL-1993-CESTAT-DEL

Ultratech Cement Ltd Vs CCG & ST

CX- The assessee is engaged in manufacture of cement and clinker - The assessee availed subsidy under the Rajasthan Investment Promotion Scheme - Under this scheme the assessee got credit of certain subsidy on account of wages and loans subsidy which was credited to their account with Form VAT 37B challan which was used for discharge of sales tax liability - The Revenue opined that the subsidy availed is additional consideration - Duty demand was raised -

Held: The incentive is in the nature of subsidy which have been received from the State Government and therefore such subsidy cannot be considered as an additional consideration - This follows from the decision of assessee's own case of Ultra Tech Cement Ltd. Vs CCE wherein cenvat credit was allowed relying on the ratio of M/s Shree Cement Ltd. vs. CCE - Therefore, the order-in-original is set aside: CESTAT (Para 1,2, 4, 5) - Appeal Allowed: DELHI CESTAT

CUSTOMS

NOTIFICATION

dgft18pn016

Amendment in the Para 9.03 of the Handbook of Procedures for Chapter 3 Scrips

dgft18pn016

Revised ANF 3B for application under Services Exports From India Scheme (SEIS)

CASE LAWS

2018-TIOL-1989-CESTAT-MUM

Jasu Shipping Company Pvt Ltd Vs CC

Cus - Assessee is in appeal against impugned order wherein Adjudicating authority has denied the benefit of exemption in notfn 21/2002-Cus on import of 'second hand diesel engine with turbocharger' which were confiscated under section 111 (d) of Customs Act, 1962 for having been imported without a license which was considered to be a prerequisite for used goods other than capital goods - The imposition of fine and penalty under section 112 of Customs Act, 1962 is also sought to be quashed - It would appear that exemption claimed by assessee was restricted to 'parts of dredger' and original authority relied upon the note in section XVII (within which chapter 89 of the First Schedule to Customs Tariff Act, 1975 is contained), which excludes coverage of goods falling under heading 8401 to 8479 of First Schedule to CTA, 1975 there from, to deny connection with 'dredgers' to parts classified under heading 8412, of First Schedule to Act, 1975 - The exemption notfn is specifically intended to cover 'parts of dredgers' - The adjudicating authority has held that parts do not find a place in chapter pertaining to dredgers and has taken recourse to rules for classifying such parts, as per note to section referred supra, on merit as authority to exclude coverage as parts in an exemption notification - When parts are, admittedly, not classifiable in same chapter as the main goods and exemption notfn is not related to heading for 'dredger', reliance on the exclusion in notes to the section, which is intended for the sole purpose of classification, to interpret an exemption notification is not legal and proper - The description in exemption notfn must be read in its entirety and harmoniously in accordance with which, all parts of dredgers, including engines, must be accorded the benefit of exemption -Dredging is a service and dredger cannot function without an engine -engines are, therefore, undoubtedly capital goods - There is no requirement of license for import of used capital goods - The confiscation under section 111 (d) of Customs Act, 1962, therefore, fails: CESTAT - Appeal allowed: MUMBAI CESTAT

|

|

|

|

|

|

|

|

|

MISC CASES |

|

|

|

|

|

|

|

|

|

|

2018-TIOL-80-AAR-GST

Inox India Pvt Ltd

AAR - the applicant company manufactured and supplies 'Cryo container', also known as Liquid Nitrogen Containers - These are used for transportation of liquefied nitrogen & storage of semen used in artificial insemination of animals & other purposes - The applicant seeks to know whether Cryo Container is classifiable under HSN 7613 00 19 covering ‘Aluminum container for compressed or liquefied gas' or under HSN 9617 00 12 which covers ‘Vacuum Flask and other vacuum Vessels, Complete with cases parts thereof other than glass inner'.

Held - the product in question is classifiable under HSN 9617 00 12 covering ‘Vacuum Flask and other vacuum Vessels, Complete with cases parts thereof other than glass inner': AAR - Application Disposed Off: AAR

2018-TIOL-81-AAR-GST

ALKA INDUSTRIES

AAR - the applicant company manufactures CI Casting - For this it purchases pig iron, scrap, molasses, coal, foundry minerals & sand - The cast articles are used in various industries - The applicant also manufactures bracket & clamp of cast iron - These are used for hanging wash basin, commodes and urinals - In view of such usage, the applicant sought to know whether the products are classifiable under Chapter Heading 7325 or 7308 or 7326 of the HSN or any other heading.

Held - The articles (brackets and clamps) manufactured by the applicant fall under Chapter Heading 7325, which covers “Other cast articles of iron or steel”: AAR - Application disposed off: AAR

2018-TIOL-79-AAR-GST

National Diary Development Board

GST - the applicant is a statutory body whose functions include promoting dairy and other agriculture based industries - In this regard, it provides technical, financial & managerial assistance - The applicant is also empowered to transfer the whole or part of its functions to any organization - It is also empowered to take up activities entrusted to it by the Central or State governments wherever its expertise is required - Besides, subject to approval of the Central Govt, the applicant can also participate in any organization, financially, managerially, or in any other manner - Hence the applicant sought to know whether in light of such tripartite agreements, any arrangement between itself and Unions would be considered as supply between ‘related persons' in accordance with Schedule 1 of the Central Goods & Service Tax Act, 2017 - If yes, it further sought to know if it would be required to determine value of activities undertaken by it, as per Section 15(5) of CGST Act, 2017 r/w Rule 28 of the CGST Rules, 2017.

Held - The transactions undertaken by the applicant & Unions in accordance with the agreements made by the applicant with State Governments are not to be considered as supply between ‘related persons' as per Schedule I of CGST Act, 2017 CGST Act r/w Section 15 of CGST Act and corresponding provisions under the Gujarat Goods and Services Tax Act, 2017: AAR - Application Disposed Off: AAR | |

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Board :

+91 124-6427300

Fax: + 91 124-6427310

Web: http: //www.taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|