|

|

2022-TIOL-NEWS-051| March 02, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

|

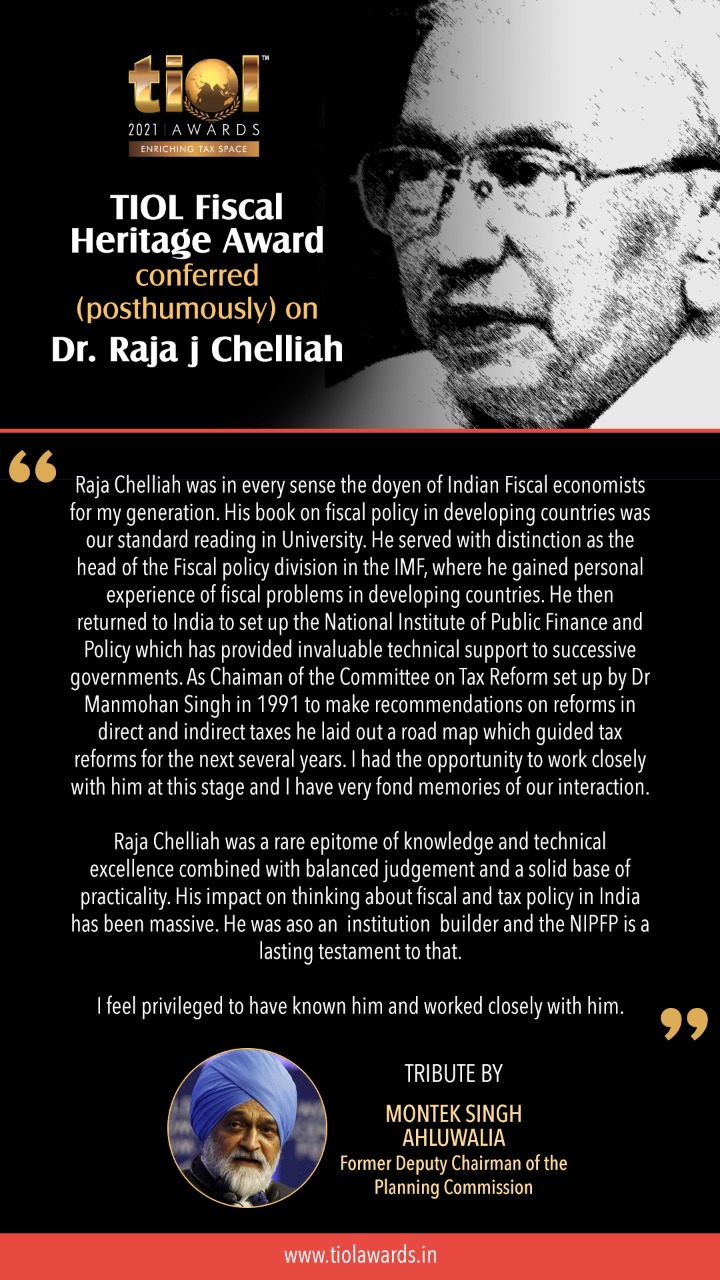

TIOL AWARD |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-293-HC-MAD-IT

CIT Vs Apollo Hospital Enterprises Ltd

On appeal, the High Court finds that the issues in the present appeal are settled in favor of the assessee vide judgment in in TCA.Nos.776 to 778 of 2009. Hence the present appeal is disposed off accordingly.

- Revenue's appeal dismissed: MADRAS HIGH COURT

2022-TIOL-292-HC-AHM-IT

Ranjitsinh Narsinh Vaghela Vs ITO

In writ, the High Court directs the AO to consider the application filed by the assessee and pass orders in respect of the same in two weeks' time. Considering that the CIT(A) has inherent appellate power to pass interim order pending final disposal, the Court directs the CIT(A) to pass such order should application be filed by assessee.

- Assessee's writ petition disposed of: GUJARAT HIGH COURT

2022-TIOL-291-HC-AHM-IT

Yogeshwar Developers Vs UoI

In writ, the High Court observes that considering the date of filing of Settlement application, the same is maintainable and in which case, the SCN issued u/s 143(3) r/w Section 145A is invalidated.

- Writ petition allowed: GUJARAT HIGH COURT

2022-TIOL-215-ITAT-DEL

Priya Diamonds Pvt Ltd Vs ACIT

Whether additions framed u/s 68 are sustainable where based solely on statements of third parties and where assessee does not have opportunity to cross examine the deponent - NO: ITAT

- Assessee's appeal partly allowed: DELHI ITAT

2022-TIOL-214-ITAT-CHD

Retail Quotient Research Pvt Ltd Vs ACIT

Whether CBDT Notification dated 09.08.2019 is applicable to those Startup companies also where addition u/s 56(viib) has been made before 19.02.2019 provided assessee fulfills conditions mentioned in notification - YES : ITAT

- Case Remanded: CHANDIGARH ITAT

| |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-288-HC-JHARKHAND-GST

RK Transport Pvt Ltd Vs UoI

GST - Interest amounting to Rs.83,96,873/- on the alleged ground of delay in furnishing GSTR-3B return for the period July 2017 to December 2019 has been levied by the impugned letter – Petitioner challenges this letter on the ground that without any adjudication proceeding under Section 73 or 74 of the CGST Act which has not been done admittedly in this case, liability cannot be crystallised; that no rules have been prescribed in terms of Section 50 Sub-Section (2) for computation of the interest under Sub-Section (1).

Held: Issue at hand is whether interest liability under Section 50 of the CGST Act can be determined without initiating any adjudication proceeding either under Section 73 or 74 of the CGST Act in the event the assessee disputes its liability towards interest - It is not in dispute that no such proceeding has been initiated in the case of the petitioner, though the liability has been disputed by the petitioner by way of a reply to the notice of recovery under Section 79 of the CGST Act, 2017 – Issue, as on date, stands answered by the decision rendered by the Coordinate Bench of this Court in the case of Mahadeo Construction Company - 2020-TIOL-850-HC-JHARKHAND-GST and wherein while quashing the impugned order and the garnishee notices, liberty was left to the respondent authorities to initiate appropriate adjudication proceedings either under Section 73 or 74 of the CGST Act against the petitioner-assessee and determine the liability of interest, if any, in accordance with law after giving due opportunity of hearing to the petitioner – Earlier, by an order dated 8th May 2020 a Coordinate Bench of this Court had been pleased to grant interim protection from any coercive steps against the petitioner pursuant to the impugned demand - Impugned demand contained in letters dated 28th February 2020 / 2nd March 2020 is quashed and liberty is left to the respondent authorities to initiate appropriate adjudication proceedings and determine the liability of interest - Petition allowed: High Court [para 9, 12, 13, 14]

- Petition allowed: JHARKHAND HIGH COURT

2022-TIOL-31-AAR-GST

Shanmuga Durai

GST - Applicant has sought an advance ruling on the following questions viz. Whether GST liability does arise in respect of property of the partner used by the Partnership Firm to carry out business by the firm at free of rent? If so, what is the relevant section or rule or provision in GST law under which the partner of the firm is required to pay GST on notional rent? Is it mandatory to execute rental deed between partner and Partnership firm, when there is no furtherance of business for that partner? What is the applicable valuation rule, when consideration is not fixed and not received by the Partner?

Held: From the Financial Statements for the assessment year 2018-19, the Statement of Income as an individual reflects an amount of Rs. 7,75,80,000/- as income from House property from the 7 properties which have been rented out to the partnership firm - Income statement for the Assessment year 2019-20 shows the income from House property for the same 7 properties as Rs. 10,34,40,000/- - Therefore, the claim of applicant that a notional rent is charged for the sake of GST is not acceptable as there is a rise in the income from the previous year - Rent so charged cannot be held as notional as the same has been charged in actuality - Thus the rent free accommodation proposed to be provided by the applicant to the partnership firm in which he is major shareholding partner and Managing Partner is a supply without consideration in the course of and furtherance of business and is taxable under Section 7(1)(a) read with Schedule I to the CGST Act, 2017 - In the present situation, the applicant and the firm are related persons, therefore, the value to be adopted is to be arrived at by following the Valuation Rules as per Section 15(5) of the Act - In the instant case, the property being rented and the supplier and recipient being related, Rule 28 of CGST/TNGST Rules, 2017 applies and the value should be arrived at accordingly for the purposes of GST: AAR

- Application disposed of: AAR

2022-TIOL-30-AAR-GST

Rotary District 3231

GST - Membership fees collected by the applicant from their Members is subject to tax as per Section 7(1)(aa) of the GST Act as the activities rendered by the applicant to their Members is a supply - Applicant is liable to be registered: AAR

GST - In respect of the question as to whether specific activities listed and performed by the applicant are liable to tax, it is found that the activities so rendered by the applicant are pertaining to the previous years 2017-18 and 2018-19 and they have been rendered complete - Hence the question is found to be beyond the scope of Section 95(a) of the Act and is not answered: AAR

- Application disposed of: AAR

2022-TIOL-29-AAR-GST

Maanicare System India Pvt Ltd

GST - Section 17(5) of the Act, 2017 had clearly debarred Input Tax Credit on motor vehicles or conveyances used in transport of passengers till the date of the amendment i.e. 01.02.2019 - However with effect from 01.02.2019, Input Tax Credit has been allowed on leasing, renting or hiring of motor vehicles, for transportation of persons, having approved seating capacity of more than thirteen persons (including the driver) - In the instant case, the bus service availed by the Applicant is 49-seater i.e. more than 13 seater - Accordingly, the same is not falling under the blocked credit as provided under section 17(5) of CGST Act 2017 and, therefore, in the instant case, (since the applicant is utilizing the services of renting of motor vehicle for business or furtherance of business), the input tax credit is not restricted to the applicant under the referred Section 17(5) of CGST Act 2017 - Applicant would be eligible for ITC (of GST paid under Reverse charge mechanism @5% for hiring of buses for transportation of employees) but only with effect from 01/02/2019 only: AAR

- Application disposed of: AAR |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-290-HC-MAD-CUS

Bay-Trans Impex Pvt Ltd Vs CC

Cus - Anti-dumping duty - Petitioner has been sending representations from 2012, which has not been evoked any response from the respondent - Considering the fact that the issue appears to be answered by the Supreme Court in the case of G.M. Exports , 2015-TIOL-209-SC-CUS , Bench is inclined to dispose the writ petition by directing the respondent to pass appropriate orders on the representations of the petitioner; to finalize the assessment in the Bills of Entry mentioned in the representations of the petitioner within a period of three months - Petition disposed of : High Court [para 5, 6]

- Petition disposed of: MADRAS HIGH COURT

2022-TIOL-289-HC-AHM-CX

Garden Silk Mills Ltd Vs UoI

CX - Only question that falls for consideration is as to whether the writ application pending adjudication stands infructuous and non- est as well as the respondents claim of Rs.21,41,55,591/- stands extinguished and non-recoverable with the passing of the order dated 19.09.2020 including addendum dated 23.09.2020 passed by the NCLT, Ahmedabad Bench, in case of the writ applicant, declaring the writ applicant company insolvent.

Held: Supreme Court in the case of Ghanshyam Mishra & Sons Pvt. Ltd. vs. Edelweiss Asset Reconstruction Company Ltd. - 2021-TIOLCORP-23-SC-IBC-LB has held that when the resolution plan is approved by NCLT, the claims, which are not part of the resolution plan, shall stand extinguished and the proceedings related thereto shall stand terminated - Bench, therefore, holds that the present writ application is rendered infructuous, non est and is disposed of as abated - Insofar as the issue of extinguishment of claims pending adjudication of the respondent revenue department is concerned, Counsel for Revenue submitted that though the writ petition is being declared as infructuous and abated, liberty may be reserved in favour of the revenue department to invoke Section 61 of the Insolvency and Bankruptcy Code, 2016, if in any eventuality, such question arises for consideration in future - In this regard, the provision itself makes it clear that if in case the revenue is dissatisfied in any manner with the sanctioning of the resolution plan by the National Company Law Tribunal, then the liberty is always reserved in favour of the revenue to prefer an appeal under Section 61 of the Code, 2016 before the National Company Law Appellate Tribunal - Writ application does not survive and is hereby disposed of as abated and infructuous: High Court [para 8 to 11]

- Application disposed of: GUJARAT HIGH COURT

2022-TIOL-179-CESTAT-KOL

Bengal Beverages Pvt Ltd Vs CCGST & CE

CX - The issue arises for consideration is as to whether the assessee is entitled for Cenvat credit, on Sugar Cess under Section 3(4) of Sugar Cess Act, 1982 as the same is not one of the duties allowed for Cenvat credit under Rule 3(1) of CCR, 2004 - In a similar matter, this Bench in the case of Diamond Beverages Private Limited 2020-TIOL-1101-CESTAT-KOL has allowed the Cenvat credit of sugar cess - The First Appellate Authority has rejected the part claim of Cenvat credit on the ground that a demand for recovery of such amount for the period August 2014 to June 2015 is pending adjudication by Commissioner - Issue in said demand notice also relates to eligibility of Cenvat credit on sugar cess and when the same has already been decided in favour of assessee, then the earlier demand notices become infructuous and cannot be sustained in the eyes of law - Further for the same period on the same issue, two demand notices cannot be sustained and hence the order of First Appellate Authority needs to be modified - Thus, the refund claim of assessee needs to be allowed: CESTAT

- Assessee's appeal allowed: KOLKATA CESTAT

2022-TIOL-178-CESTAT-BANG

Ingersoll-Rand International India Ltd Vs CCE & ST

ST - The appellant have filed refund claims - SCNs were issued alleging that appellants are engaged in activity of development of software or computerised engineering drawings in solid models, which are not taxable services; there is no nexus between input services claimed and the output service provided and that the appellants have not submitted requisite documents - SCN was confirmed holding that activity of development of software is appropriately classified as 'ITSS' under Section 65(19) and was not taxable during relevant period; export invoices indicated software or computerised engineering drawings inform of solid models which is also not a taxable service; inputs on which credit is claimed do not qualify under Rule 2(l) of Cenvat Credit Rules and that when a particular service is not taxable, availment of input or input service is not permissible and consequently, question of refund under Rule 5 does not arise - Issue is no longer res integra having been decided in favour of appellant by Tribunal for the past periods and by Department itself in a subsequent period in case of appellant themselves, nothing survives in impugned order: CESTAT

- Appeal allowed: BANGALORE CESTAT

2022-TIOL-177-CESTAT-DEL

Asia Pacific Impex Pvt Ltd Vs Pr.CIT

Cus - The appellant is in appeal against impugned order imposing penalty upon them under section 112(a) of Customs Act, 1962 - It is a fact that the SCN was not issued to appellant - It was issued only to five persons including the Director of appellant - SCN is the basis on which any order can be passed against a person - This is the basic requirement of principles of natural justice - As SCN was not issued to appellant, they did not file any reply - Appellant cannot be faulted for not filing a reply since the SCN did not call upon them to file a reply - Thus, impugned order against appellant is set aside: CESTAT

- Appeal allowed: DELHI CESTAT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|