|

|

2022-TIOL-NEWS-051 Part 2 | March 02, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

|

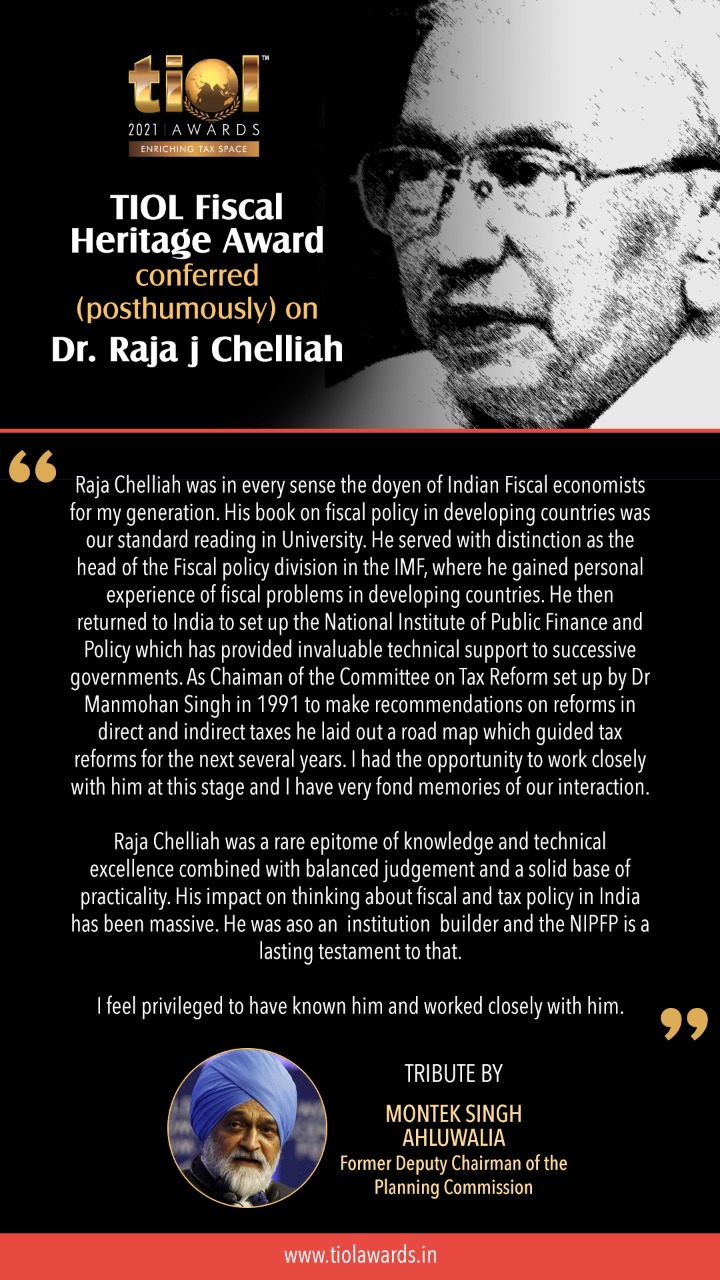

TIOL AWARD |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-218-ITAT-BANG

Sri Yeruva Prasad Vs Asstt/DCIT

Whether amendment by Finance Act, 2021, to section 36(1)(va) and 43B is not clarificatory - YES : ITAT

Whether employees' contribution paid by assessee before due date of filing of return of income u/s 139(1) is an allowable deduction - YES : ITAT

- Assessee's appeal allowed: BANGALORE ITAT

2022-TIOL-217-ITAT-PUNE

Shergil Harjit Vs Pr.CIT

Whether power of revision u/s 263 can be exercised where the order passed by the AO is plausible enough - NO: ITAT

- Assessee's appeal allowed: PUNE ITAT

2022-TIOL-216-ITAT-KOL

Alankar Commodeal Pvt Ltd Vs ITO

Whether reopening of assessment on basis of invalid approval is bad in law - YES : ITAT

- Assessee's appeal allowed: KOLKATA ITAT

| |

|

|

|

|

|

|

|

|

|

GST CASE |

|

|

|

|

|

MISC CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-300-HC-AHM-CT

Saint Gobain India Pvt Ltd Vs UoI

CST - Applicant is seeking direction to respondents to forthwith grant the refund of the amount collected from them by seller of natural gas and deposited with respondent authorities under the Central Sales Tax Act, 1956 - Despite the fact that natural gas continued to come within the ambit of CST Act, after 1.7.2017, authorities in State of Rajasthan refused to issue "C" Form declarations of purchase of natural gas at concessional rate on the ground that after introduction of GST regime, registration certificates of dealers such as applicant, automatically stood cancelled and they were not eligible for making purchases of natural gas against C form declarations - In view of such stand taken by authorities of State of Rajasthan, the seller - IOCL started raising invoice charging full tax @ 20% on sales of natural gas to the applicant - Since the authorities of State of Rajasthan were not heeding to request of applicant as well as other similarly situated dealers, applicant approached the Rajasthan High Court seeking a direction to authorities of Rajasthan under CST Act to issue C form declarations in respect of natural gas required for use in manufacturing of glass and consequential relief for tax deposited at higher rate in absence of C form being issued by authorities of State of Rajasthan - The Rajasthan High Court passed appropriate orders directing the CST Authorities at Rajasthan to issue "C" Form declarations in respect of transactions in question - The respondents do not dispute the fact that against "C" Form declarations, tax collected from applicant and deposited by IOCL is required to be refunded - However, the stance of respondents is that such refund can be made to seller, i.e. the IOCL after its assessment for period in question and not to the applicant who is not registered as dealer in State of Gujarat - Issue is squarely covered by decision of Coordinate Bench of this Court in case of J.KI. Cement Ltd. wherein t he respondents are directed to forthwith process the refund claims of respective petitioners and grant refund of tax amount collected from the petitioners and deposited by seller - In view of aforesaid, respondents are directed to forthwith process the refund claim of applicant and grant the refund of tax amount collected from applicant and deposited by seller (IOCL) in accordance with law within a period of eight weeks: HC

- Writ application allowed: GUJARAT HIGH COURT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|