|

|

2022-TIOL-NEWS-052| March 03, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

|

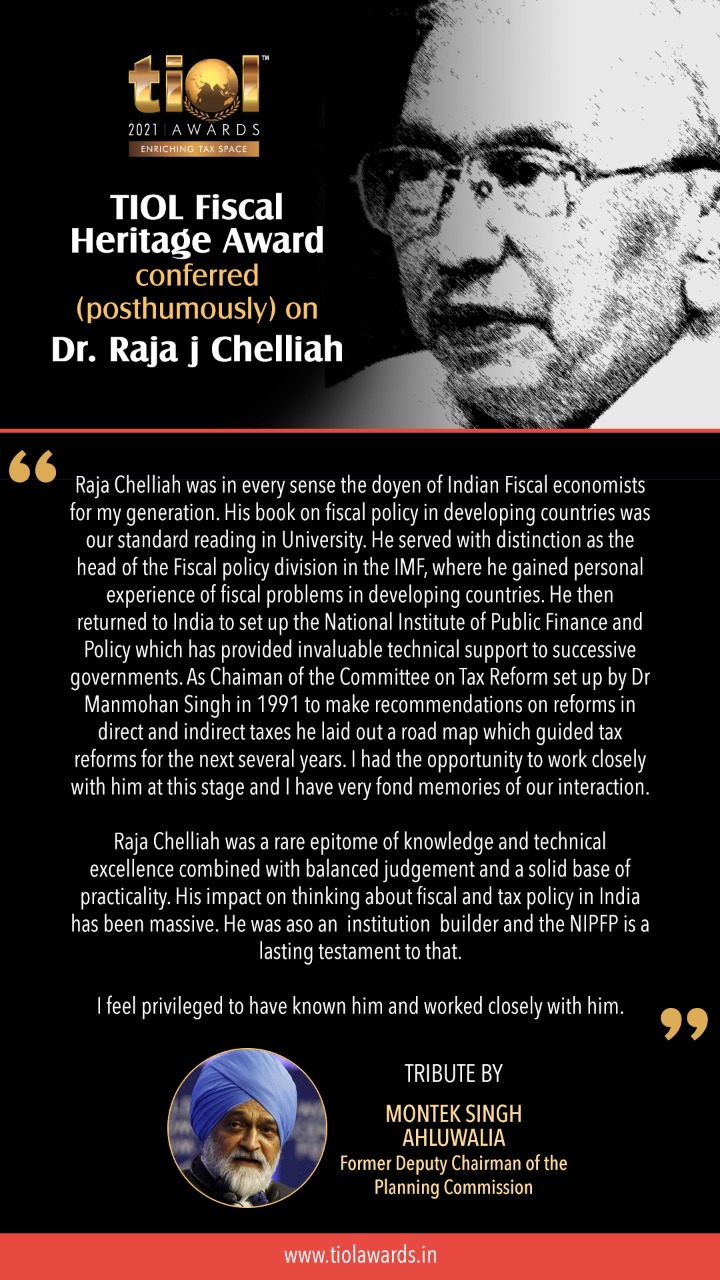

TIOL AWARD |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-223-ITAT-BANG

Fortigo Network Logistics Pvt Ltd Vs ACIT

Whether AO is not entitled to change the method of valuation of shares from DCF method adopted by assessee to NAV method - YES : ITAT

- Matter remanded: BANGALORE ITAT

2022-TIOL-222-ITAT-AHM

Khevana Securities And Finstock Ltd Vs ITO

Whether compensation received for sterilisation of profit-earning source, not in ordinary course of business, is capital receipt not liable to tax in assessee's hands - YES: ITAT

- Matter remanded: AHMEDABAD ITAT

2022-TIOL-221-ITAT-AHM

Morakhia Copper And Alloys Pvt Ltd Vs ACIT

Whether penalty imposed u/s 271(1)(c) is sustainable where assessee is found to have concealed particulars of income in respect of certain purchase transactions made - YES: ITAT

- Assessee's appeal dismissed: AHMEDABAD ITAT

2022-TIOL-220-ITAT-PUNE

Nashik Road Nagari Sahkari Patsanstha Ltd Vs ITO

Whether interest income earned by a cooperative society from investment of surplus money with banks is eligible for exemption u/s 80P(2)(a) - YES: ITAT

- Assessee's appeal allowed: PUNE ITAT

2022-TIOL-219-ITAT-PUNE

Swami Construction Vs ACIT

Whether additions framed are sustainable where based on statements alone & where no discrepancy is found in the valuation of work in progress or genuineness of expenditure is not doubted - NO: ITAT

- Assessee's appeal allowed: PUNE ITAT

| |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-298-HC-MAD-GST

JR Metal Chennai Ltd Vs Deputy State Tax Officer

GST - Petitioner has challenged the Impugned Communication dated 27.01.2022 in Form GST MOV-2 - It is the allegation of the respondent Revenue that the previous movement of goods was not covered by an E-Way bill - Petitioner submits that the goods are imported and customs duty was paid after the goods were assessed at the container freight station (CFS); that for movement of goods from the port to the container freight station no e-way bill is required. Held: It is noticed that at the time of seizure, the goods were accompanied by an E-Way bill - However, the allegation is that no E-Way bill was generated for the previous transport from the port of import to the CFS - It is not clear as to whether for movement of goods from CFS to the petitioner's premises it was accompanied by an E-Way bill and whether it was generated or not - Matter would require a detailed consideration - At the same time, no useful purpose will be served by detaining the goods other than the inflict of financial loss on the petitioner - Petitioner is directed to pay the disputed tax and furnish a bank guarantee for the tax and 25% of the tax amount towards penalty within a period of seven days - Respondent shall release the goods as and when the petitioner complies with the directions and thereafter proceed to pass appropriate orders in merits - Writ petitions stand disposed of: High Court [para 9 to 11]

- Petitions disposed of: MADRAS HIGH COURT

2022-TIOL-297-HC-AHM-GST

Filatex India Ltd Vs UoI

GST - While remitting the matter, the appellate authority recorded a finding that the appellant i.e. writ applicant herein is eligible for refund of the accumulated credit, not on the basis of the formula under Rule 89(4) of the CGST Rules, 2017 as claimed, but under Rule 89(4B) of the Rules - Being dissatisfied with the aforesaid order passed by the appellate authority, the writ applicant is here before this Court with the present writ applications. Held: Principal Commissioner in his affidavit-in-reply has stated that each and every manufacturer / exporter is believed to be aware of the input / output ratio of the inputs / raw materials used in such manufacturing of the exported goods and the ITC availed against such input supplies received; that it is difficult to believe that the manufacturer would not be aware, otherwise the manufacturer would not be in a position to arrive at the costing of the finished goods - Petitioner would submit that now since the principle of input / output ratio is to be applied for the purpose of determining the amount to be refunded, a fresh exercise will have to be undertaken by the Assistant Commissioner - Impugned order dated 19th July 2019 passed by the Joint Commissioner is hereby quashed and set aside - The Assistant Commissioner shall now proceed further in accordance with the directions issued by the Joint Commissioner (Appeals) vide the order dated 13th July 2020 and adjudicate the claim of the writ applicants in accordance with Sub Rule (4B) of Rule 89 of the CGST Rules, but keeping in mind the formula of input / output ratio of the inputs / raw materials used in the manufacturing of the exported goods - Entire exercise is to be undertaken at the earliest and the claim shall be determined and paid accordingly to the writ applicants within a period of eight weeks - Civil Applications stand disposed of: High Court [para 28, 30, 32]

- Petitions disposed of: GUJARAT HIGH COURT

2022-TIOL-295-HC-AHM-GST

Zubair Idrees Dadi Vs Additional Commissioner (Preventive) CGST

GST - It is the case of the writ applicant that he has been wrongly roped into the present litigation - In this regard, he has also addressed a representation to the Commissioner, CGST, Vadodara dated 31st August 2020 - Writ applicant is before the Court with a prayer that the Commissioner, CGST, Vadodara should look into the representation / complaint lodged by him, undertake an inquiry and complete the same at the earliest in accordance with law. Held: Writ application is disposed of by directing the Commissioner, CGST, Vadodara to look into the complaint lodged by the writ applicant dated 31st August 2020 and complete the inquiry within a period of three months - No opinion expressed on the merits of the case: High Court [para 5]

- Petition disposed of: GUJARAT HIGH COURT

2022-TIOL-294-HC-MAD-GST

Haven Infra Projects And Power Ltd Vs State Tax Officer

GST - Petitioner's vehicle was detained and seized on the ground that the E-Way Bill generated on 29.01.2022 had expired on 30.01.2022 at 23.59 p.m., and that the vehicle was moving goods without a valid E-Way bill - Petitioner submits that the total value of the consignment in the vehicle was only Rs.74,000/- and, therefore, no E-way bill is required in terms of Notification No.09/2018, dated 31.05.2018 issued under Rule 138(14)(d) of the Rules; that the driver had encountered technical problem in the vehicle enroute from the factory of consignor to the consignees place; that the consignment of cement in the lorry is prone to get spoilt in view of the inclement weather conditions and, therefore, the goods and the lorry be released. Held: Facts on record indicates that the value of the consignments including tax partially exceeds a sum of Rs.1,00,000/- - The issue as to whether the value would include tax and whether there was a violation has to be determined in the manner known to law by the authority under the Acts - At the same time, no useful purpose will be served by detaining the vehicle or the consignment of goods (cement) as it will only result in the cement getting spoilt - Bench directs the respondents to release the vehicle and the goods if the consignor or consignee or the petitioner, as the owner of the vehicle, furnishes a Bank Guarantee for the tax and proposed penalty within a period of fifteen days - Writ Petition stands disposed of: High Court [para 10, 11]

- Petition disposed of: MADRAS HIGH COURT |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-296-HC-AHM-CX

Five Star Agrico Pvt Ltd Vs UoI

CX - Liability of the revenue to pay interest under Section 11BB of the CE Act commences from the date of expiry of three months from the date of receipt of application for refund under Section 11B(1) of the Act - Both the writ applications succeed and are hereby allowed - Respondent no.3 to calculate interest and complete the exercise within a period of eight weeks: High Court [para 14, 15]

- Applications allowed: GUJARAT HIGH COURT

2022-TIOL-182-CESTAT-DEL

Huhtamaki India Ltd Vs CCGST & CE

CX - The appellant is engaged in manufacturing of packing material - They were availing Cenvat Credit on inputs, capital goods and input services in terms of CCR, 2004 - After an audit of accounts of appellants was conducted, appellants were observed to have taken wrong Cenvat Credits - The only point of adjudication is, whether Rule 8 B of Point of Taxation Rules, 2011 or Rule 7 thereof will be applicable to the facts and circumstances of case - It is rule 7 which shall be applicable as this rule applies to the persons who are required to pay tax as recipients of service i.e. under reverse charge mechanism - This particular perusal is sufficient to hold that Rule 8 has wrongly been applied by adjudicating authorities - It was wrongly been proposed to be applicable in impugned SCN - Further perusal of Rule 7 shows that the Point of Taxation shall be the date on which payment of service tax made - The payment of service tax for six of the invoices under question was made on 30th June, 2017 - The admitted figures are sufficient to show that the appellant has rightly availed input credit of service tax paid by him though under Reverse charge mechanism - Confirmation of demand by Commissioner (A) is hereby set aside: CESTAT

- Appeal allowed: DELHI CESTAT

2022-TIOL-181-CESTAT-DEL

Yug International Pvt Ltd Vs Pr.CC

Cus - Penalty - The SCN was not issued to appellant - It was issued only to five persons including Amit Agarwal, who is the Director of appellant - As the SCN was not issued to appellant, he did not file any reply - The appellant cannot be faulted for not filing a reply since the SCN did not call upon appellant to file a reply - Thus, impugned order in so far as it imposes a penalty on the appellant under section 112(a) of Customs Act, is set aside: CESTAT

- Appeal allowed: DELHI CESTAT

2022-TIOL-180-CESTAT-KOL

Luit Developers Pvt Ltd Vs CCGST & CE

ST - The appellant is in appeal against impugned order, whereby demand of Service Tax (incl Cess) confirmed along with applicable interest and imposed equal penalty - Service tax demand for the period April 2014-September 2014 is beyond the extended period of 5 years - Department has done audit of appellant for February, 2014-15 as per Detailed Manual Scrutiny Report, which includes checking of Form 26AS as clearly mentioned in CBEC Circular 185/4/2015-ST and therefore no suppression can be alleged for this period - As held in Gannon Dunkerley & Co Ltd , since the appellant was filing all ST-3 Returns regularly, Department's stand that it could examine the factual position only on receiving details of Form 26AS cannot be sustained because CBEC Circular 113/7/2009-S.T . and 185/4/2015-ST categorically puts duty on Assessing Officer to effectively scrutinize the returns at preliminary stage - Proviso to Section 73(1) has not been invoked in operative part of SCN and therefore extended period cannot be invoked as held in Satish Kumar and Co 2018-TIOL-1968-CESTAT-MUM - Invoking extended period cannot be sustained for part of tax demand raised on RCM basis by virtue of it being a revenue neutral situation since the appellant is eligible for credit if it had done tax payment as also held in Universal Dredging & Reclamation Corporation Ltd 2020-TIOL-1157-CESTAT-MAD - Appellant is a Pvt Ltd Company and figures in Form 26AS are already included in Revenue from Operations in Profit/Loss Account of Balance Sheet, which is a public document, and therefore no suppression can be alleged as held in Hindalco Industries Ltd 2003-TIOL-330-CESTAT-DEL - Department has not adduced any positive evidence to show malafide intention for evasion of service tax and therefore extended period cannot be invoked as held in Pushpam Pharmaceuticals Limited 2002-TIOL-235-SC-CX - Therefore, the entire demand fails on merits as well as on limitation - Thus, there can be no imposition of Service tax, interest and penalty on the appellant: CESTAT

- Appeal allowed: KOLKATA CESTAT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|