|

|

2022-TIOL-NEWS-056 Part 2 | March 09, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

|

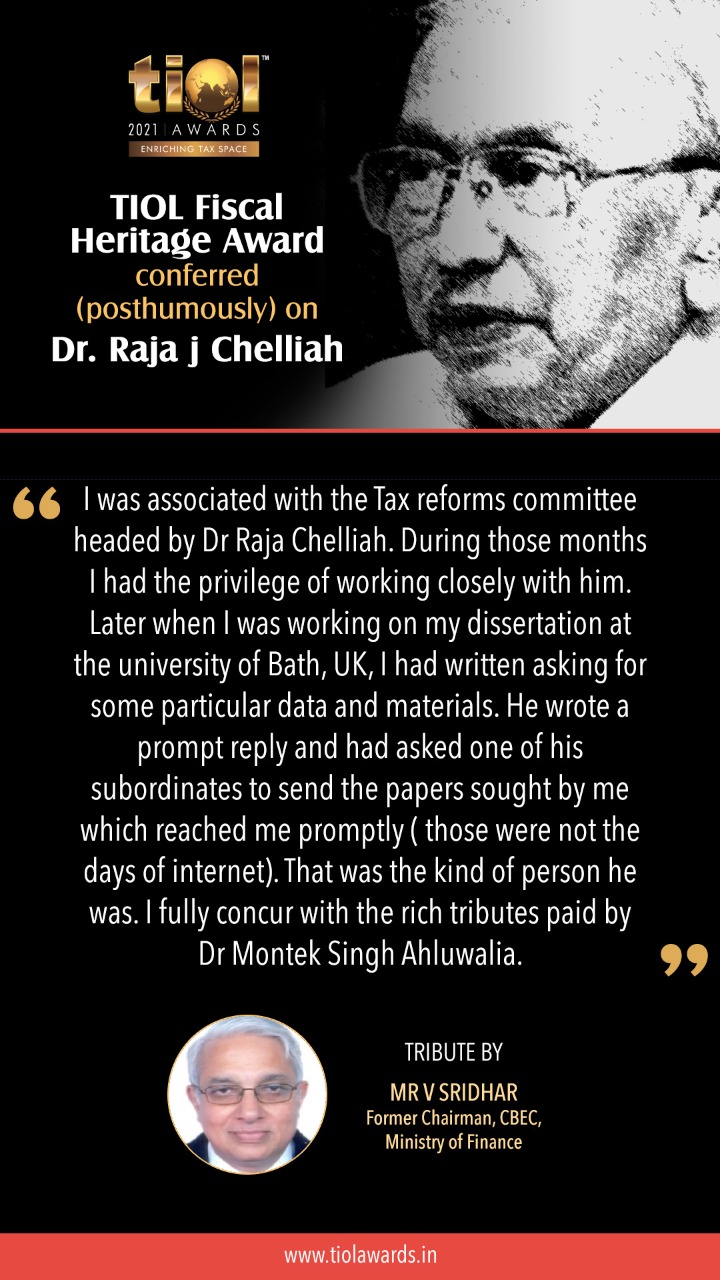

TIOL AWARD |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-249-ITAT-DEL

Crafts India Vs ACIT

Whether provision of section 68 is inapplicable on assessee who has no sum credited in books in relevant FY - YES : ITAT

- Assessee's appeal allowed: DELHI ITAT

2022-TIOL-248-ITAT-DEL

Pavel Garg Vs ACIT

Whether case can be remanded back for reconsideration as ab hoc addition of notional annual value of house property is not correct - YES : ITAT

- Matter remanded: DELHI ITAT

2022-TIOL-247-ITAT-DEL

NHPC Ltd Vs DCIT

Whether in absence of contrary proved by Revenue and following order passed by Co-ordinate bench of ITAT on identical facts in earlier years, claim made u/s 80IA can be allowed - YES : ITAT

- Assessee's appeal allowed: DELHI ITAT

| |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-324-HC-SHILLONG-CX

Vansha Fragrances Pvt Ltd Vs CCGST & Excise

CX - The appellant manufactures soya chunks under the brand name of Gulab - Upon the appellant being informed that they were liable to pay excise duty on soya chunks manufactured by it, by February 27, 2007 an amount of money was deposited by appellant and it was represented by them to the department that the entirety of excise duty leviable, together with interest thereon, had been deposited - However, a subsequent demand was raised by excise authorities for duty payable for goods in respect of financial years 2003-04, 2004-05 and 2005-06 - The first issue that arises is as to whether such demand could have been made at all, particularly in respect of period more than a year prior to the date of demand - The second aspect of matter on which there is no discussion in order of Appellate Tribunal pertains to disqualification of appellant to be entitled to exemption on the ground that appellant manufactured the product under the brand name of another - When a person claims a benefit under any government scheme and the authorities seek to deny eligibility of such person to obtain such benefit, the onus is on authorities to demonstrate why the person would not be entitled to the benefit - The third issue that requires to be looked into and answered is related to the appellant being entitled to exemption or not - Initial turnover in 2003-04 was extremely low and same picked up only in 2004-05 - In the event the appellant was entitled to exemption as claimed, it requires to be ascertained when the appellant's manufacturing unit exceeded the turnover of Rs.1 crore for the excise duty to be claimed only thereafter - The three key aspects of the matter have not been addressed in order of Appellate Tribunal - These issues cannot be conveniently addressed in present proceedings which are conducted on summary basis on affidavit evidence - Further, as to whether a person is entitled to an exemption or not based on the geographical location of manufacturing unit, is essentially question of fact that has to be ascertained - Accordingly, matter is remanded to Appellate Tribunal with a request to render the opinion on the three key aspects indicated herein and on any other issue that may be relevant for the purpose of adjudication: HC

- Matter remanded: SHILLONG HIGH COURT

2022-TIOL-323-HC-KOL-CUS

Emami Agrotech Ltd Vs UoI

Cus - This intra-court appeal is directed against impugned order wherein their petition was dismissed on the ground of availability of an alternative remedy - The question would be whether the appellant should be directed to avail alternative remedy or whether the writ Court can exercise jurisdiction despite availability of alternative remedy under the statute - Seldom the appeals filed by revenue before this Court are not being filed within the period of limitation - Invariably the appeals are delayed for nerely a year and the revenue will endeavour to seek umbrage under the order passed by Supreme Court extending the period of limitation though the order may not apply to the appeals - The time limit for issuance of SCN under Customs Act has been extended by placing reliance on the decision of Supreme Court and the ordinance issued by Central Government - Thus, appellant has pleaded a genuine difficulty that its consultant being tested positive for Covid-19 and unable to appear - Such request has to be accommodated unless it is shown to be absolutely false - The order impugned is unsustainable in law and in violation of principles of natural justice apart from having passed by misinterpreting the order passed in earlier writ petition - Therefore, impugned order is set aside - Department is directed to release the goods in question within 48 hours - The bank guarantee furnished by appellant shall be kept alive till the order is passed by concerned authority: HC

- Writ petition allowed: CALCUTTA HIGH COURT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|