|

|

2022-TIOL-NEWS-114 Part 2 | May 17, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

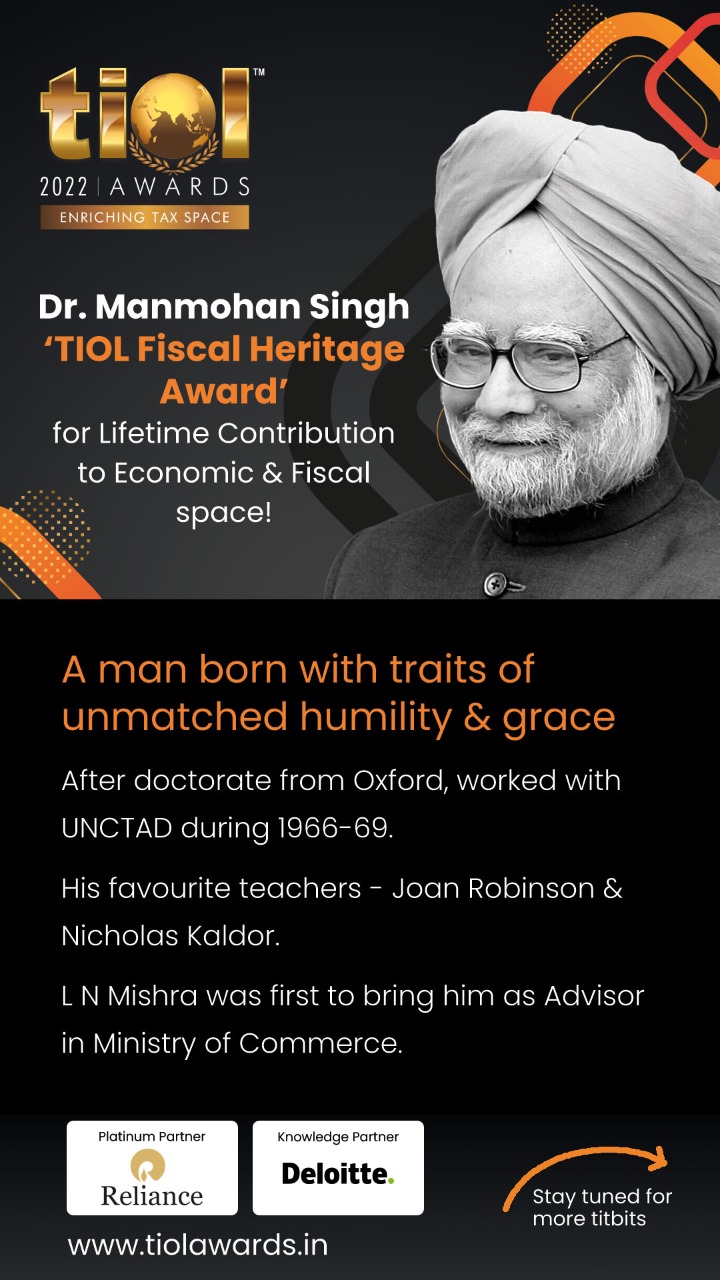

TIOL AWARDS |

|

|

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-493-ITAT-BANG

Divyashree Infrastructure Vs DCIT

Whether disallowance of depreciation on bogus/inflated URD purchases without making addition of alleged purchases is wrong - YES : ITAT

- Assessee's appeal partly allowed: BANGALORE ITAT

2022-TIOL-492-ITAT-BANG

DCIT Vs Chaitanya Properties Pvt Ltd

Whether no addition in assessment completed u/s 153C can be made without material found in course of search if unabated assessments is already completed prior to search - YES : ITAT

- Revenue's appeal dismissed: BANGALORE ITAT

2022-TIOL-491-ITAT-PUNE

Great Fortune Investments and Infrastructure Pvt Ltd Vs ACIT

Whether Municipal Ratable Value of property or actual rent offered in return of income, whichever is higher, is to be adopted as fair rent u/s 23(1)(a) - YES : ITAT

Whether places where Rent Control Act is not applicable, the Annual Value decided by Municipal Authorities can be a rational yardstick - YES : ITAT

- Assessee's appeal allowed: PUNE ITAT |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-719-HC-HP-GST

Hi Tec Point Technologies Pvt Ltd Vs UoI

GST - The petitioner opted the SVLDR Scheme, 2019 and declared an amount under category of ‘arrears-appeal not filed or appeal having attained finality' in respect of order issued by Joint Commissioner - The Designated Committee after verification of aforesaid declaration issued Form SVLDRS-3 to petitioner whereby petitioner was required to pay an amount of Rs.68,19,084.60/- - However, petitioner failed to pay aforesaid amount within 30 days from the date of issue of notice and further did not pay the same within extended due date - The Range Officer initiated action for recovery of arrears and petition was filed after more than 1 year and 3 months from the last date of payment of determined amount of tax under SVLDRS, 2019 - The Scheme cannot be made operational by Court going beyond the period for which it was formulated only for one person or to relax any of conditions enumerated in Scheme - The prayers made in petition cannot be granted for consideration of case of petitioner for paying service tax under the Scheme as Court cannot make operational SVLDRS, 2019, especially when the petitioner has approached this Court belatedly after 1 year and 3 months from the last date of payment of determined amount of tax under SVLDRS, 2019: HC

- Writ petition dismissed: HIMACHAL PRADESH HIGH COURT

2022-TIOL-718-HC-DEL-GST

Shakti Oil And Chemical Company Vs Commissioner of DGST Delhi

GST - The principal grievance of petitioner is that its premises lie sealed - According to petitioner, powers to seal under Section 67(4) of Delhi Goods and Services Tax Act, 2017 /Central Goods and Service Tax, 2017 are confined to the fact and situation adverted to in said provision - Revenue on the other hand, says that in case the petitioner produces the relevant documents, they will have no objection to subject premises being de-sealed - It is directed that authorized representative of petitioner will present himself/herself with relevant documents before concerned officer and revenue will de-seal the subject premises - In case the documents produced by petitioner are found to be deficient, appropriate steps, in accordance with the law, will be taken - However, sealing will not continue, beyond the timeframe indicated herein: HC

- Writ petition disposed of: DELHI HIGH COURT |

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|