|

|

2022-TIOL-NEWS-115 Part 2 | May 18, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

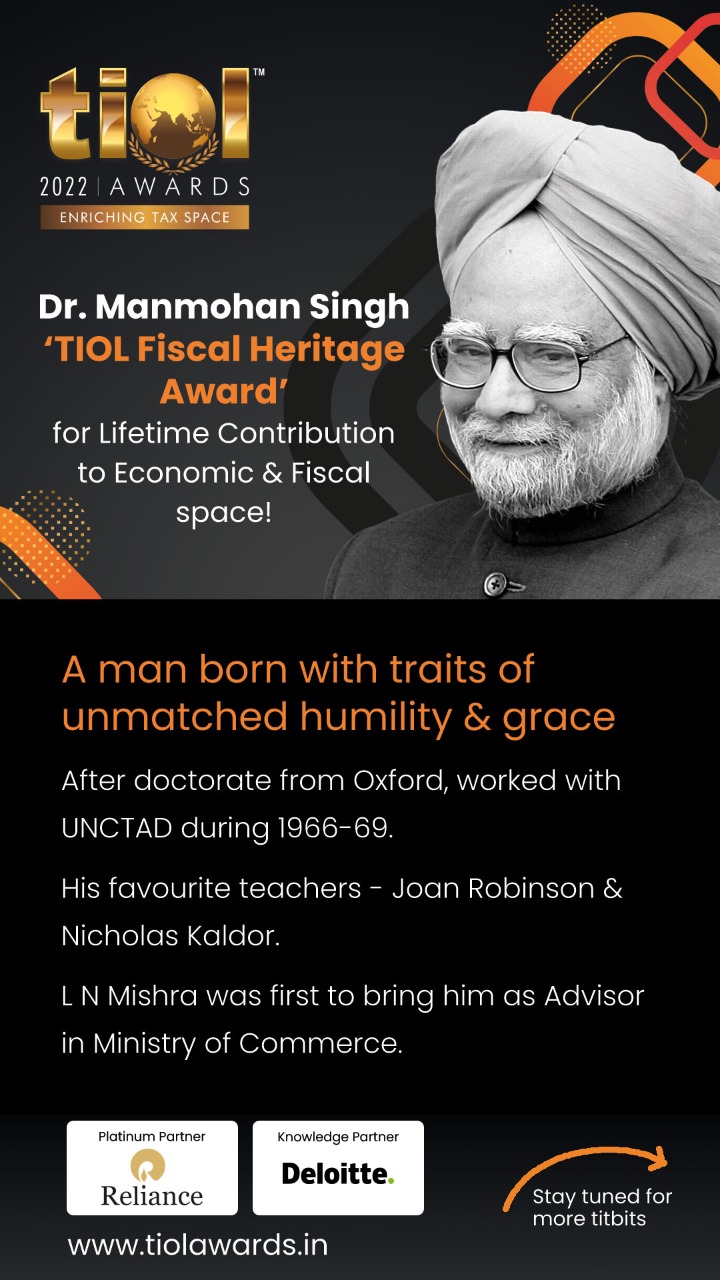

TIOL AWARDS |

|

|

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-501-ITAT-DEL

Kapil Mehta Vs Pr.CIT

Whether conclusions drawn by AO without examining and considering the relevant material falls in the category of cases of lack of inquiry and not inadequate enquiries and hence the such conclusions are erroneous and prejudicial to the interest of revenue - YES: ITAT

- Assessee's appeal dismissed: DELHI ITAT

2022-TIOL-500-ITAT-DEL

Sheela Devi Vs Pr.CIT

Whether notice issued against dead person u/s 148 is null and void and all consequent proceedings/orders being equally tainted are liable to be set aside - YES: ITAT

- Assessee's appeal allowed: DELHI ITAT

2022-TIOL-499-ITAT-CHD

Ganga Acrowools Ltd Vs Pr.CIT

Whether an order of the assessment can be termed as erroneous and prejudicial to the interest of revenue, merely because the CIT is of the view that enquiries conducted by the AO were inadequate - NO: ITAT

- Assessee's appeal allowed: CHANDIGARH ITAT |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-724-HC-KOL-GST

Sanchita Kundu Vs Asstt. Commissioner ST

GST - The petitions have been filed by petitioners being aggrieved by action of revenue concerned denying the benefit of Input Tax Credit (ITC) on purchase of goods in question from suppliers and asking the petitioners to pay penalty and interest under relevant provisions of GST Act, on the ground that registration of suppliers in question has already been cancelled with retrospective effect covering transaction period in question - Case of petitioner is remanded to respondents officer concerned to consider afresh on the issue of their entitlement of benefit of input tax credit in question by considering the documents which the petitioners intend to rely in support of their claim of genuineness of transactions in question and the respondent concerned shall also consider as to whether payments on purchase in question along with GST were actually paid or not to suppliers (RTP) and also to consider as to whether the transactions and purchases were made before or after the cancellation of registration of suppliers and also to consider as to compliance of statutory obligation by petitioners in verification of identity of suppliers (RTP) - The cases of petitioner shall be disposed of by respondents concerned by passing a reasoned and speaking order after giving effective opportunity of hearing to petitioners within eight weeks: HC

- Matter remanded: CALCUTTA HIGH COURT

2022-TIOL-723-HC-AHM-GST

Nikesh Rameshbhai Sarvaiya Vs State of Gujarat

GST - The moot question arises for consideration is, whether authority is entitled to seize and detain goods in transit and the conveyance, more particularly, when it is accompanied by a lawful e-way bill, invoices and without determining and offering applicant opportunity to deposit tax, if any and penalty, authority were justified to distinctly proceed for confiscation proceedings by issuing notice under section 130 of the Act, 2017 - So far as prayer with regard to provisional release as contemplated under sub-clause (3) of section 129 of the Act, is submitted, same will have to be looked into in light of provisions of section 129 read with sub-clause (6) of section 67 of the Act - The Court finds that the additional facts which has emerged on record is that final order in FORM GST MOV-11 has been issued in case of applicant vide order dated 19.01.2022, whereas the amendment has come into effect from 1.1.2022 - Moreover, admittedly applicant is not a registered dealer - Court may not have entertain this petition solely on the ground of availability of efficacious alternative remedy under section 107 of the Act, 2017 - However, since similar question of law has been raised, this matter is directed to be heard with Special Civil Application - Again, on ensuing summer vacation, time is constrain - Hence, rule returnable on 23.06.2022: HC

- Matter listed: GUJARAT HIGH COURT |

|

|

|

|

|

|

|

|

MISC CASE |

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|