|

|

2022-TIOL-NEWS-118| May 21, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

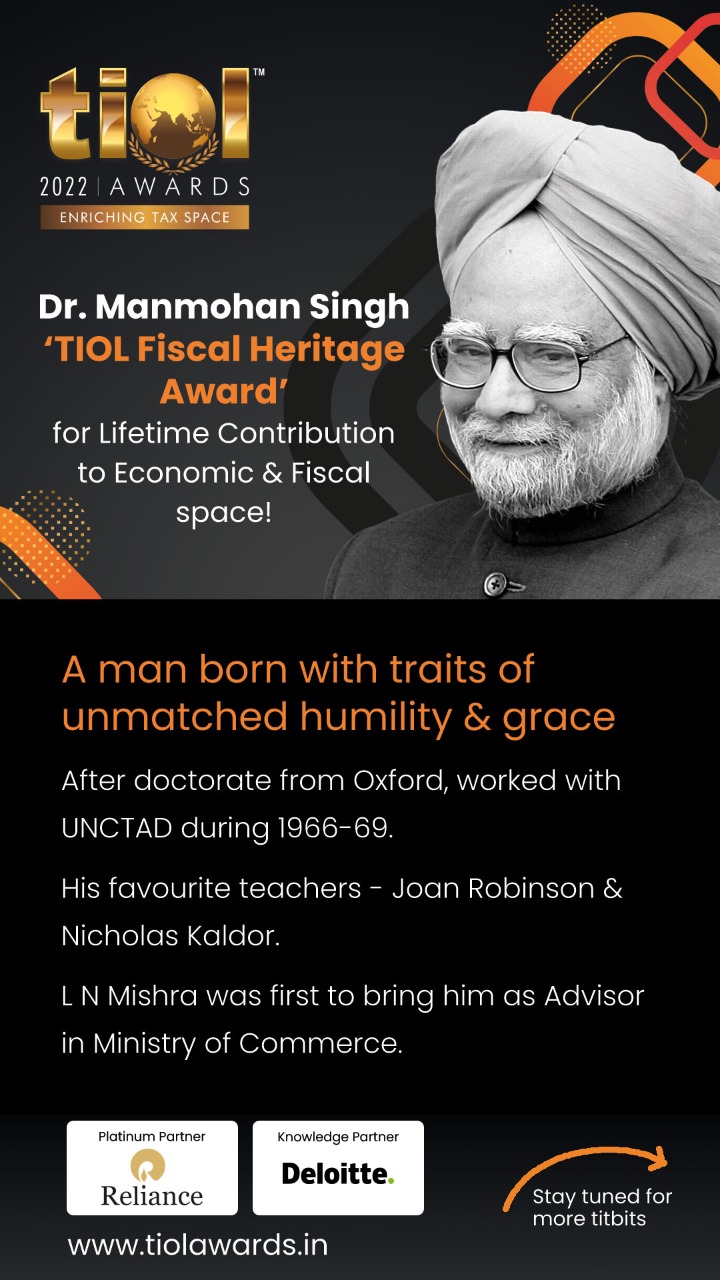

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-518-ITAT-AHM Chandrikaben Harish Shah Vs ITO

Whether CIT rightly passed revision order u/s 263 as no material evidences are available to substantiate claim of cost of improvement, construction, redevelopment expenditure for transaction of sale of immovable property - YES : ITAT

- Assessee's appeal dismissed: AHMEDABAD ITAT

2022-TIOL-517-ITAT-AHM

ITO Vs Gautambhai Babarbhai Patel

Whether reference made by AO to DVO u/s 55A is bad in law and LTCG can be computed on basis of valuation report of Registered Valuer as report representing experts' opinion on technical issue of valuation is available on record - YES : ITAT

- Revenue's appeal dismissed: AHMEDABAD ITAT

2022-TIOL-516-ITAT-KOL

Infinity Infotech Parks Ltd Vs Pr.CIT

Whether PCIT order merely setting aside AO's order without independently dealing with merits of issue is untenable and can be set aside - YES : ITAT

- Assessee's appeal allowed: KOLKATA ITAT |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-15-NAA-GST

DLF Ltd

GST - Anti-Profiteering - s.171 of the CGST Act, 2017 - Shri Sudhir Jain had filed an application alleging profiteering by respondent in respect of flat in respondent's project 'The Sky Court', in DLF Garden City, Sector-86, Gurugram - DGAP has reported that ITC as a percentage of turnover that was available to respondent during pre-GST period (April 2016 to June 2017) was 0.67%, 2.64% and 2.45& and during the post-GST period (July 2017 to November 2020), it was 1.84%, 14.40% and 17.46% for the projects 'The Camellias', The Crest' and 'The Ultima' respectively showing clearly that in post-GST period, the respondent has been benefited from additional ITC to the tune of 1.18%, 11.76% and 15.01% of his turnover

Held : The Authority finds that respondent has profiteered by an amount of Rs 7,23,50,135/-, Rs 12,94,35,170/- and Rs 4,91,23,070/- for the projects 'The Camellias', The Crest' and 'The Ultima' respectively during period of investigation - This authority under Rule 133(3) (a) orders that respondent shall reduce the prices to be realized from the buyers of flats/shops commensurate with benefit of ITC received by him - The profiteering amount for the said projects along with interest @ 18% to customers /flat buyers / recipients shall be paid/passed on by respondent within a period of three months - For the offence committed of violation of s.171(1) the respondent appears to be liable for imposition of penalty u/s 171(3A) - Accordingly, notice be issued to him - The concerned jurisdictional CGST/SGST Commissioner is directed to ensure compliance of this order - In this regard an advertisement of appropriate size may also be published in minimum of two local newspapers/vernacular press in Hindi/English/local language with the details i.e Name of builder (respondent) - M/s DLF Ltd., Project - 'The Camellias', The Crest' and 'The Ultima', Location - Haryana and amount of profiteering so that the concerned homebuyers can claim the benefit of ITC which is not passed on to them - Homebuyers may also be informed that the detailed NAA order is available on Authority's website www.naa.gov.in - Contact details of concerned jurisdictional CGST/SGST Commissioners responsible for compliance of the NAA's order may also be advertised through the said advertisement - Compliance report to be submitted by CGST/SGST Commissioner within four months - Order passed by NAA falls within the limitation prescribed under rule 133(1) of the Rules, 2017 in view of the orders dated 23.03.2020, 10.01.2022 passed by the Apex Court on the aspect of limitation: NAA

- Application disposed of: NAPA

2022-TIOL-12-NAA-GST

Prathima Multiplex Pvt Ltd

GST - Anti-Profiteering - s.171 of CGST Act, 2017 - Applicant has alleged that the respondent has profiteered with respect to supply of 'Services by way of admission to exhibition of cinematography films' - Applicant has contended that respondent did not pass on the benefit of reduction in GST rate on 'Services by way of admission to exhibition of cinematography films' w.e.f 01.01.2019 vide Notfn 27/ 2018- CTR and instead increased the base price to maintain the same cum-tax selling price of admision tickets - DGAP has in its report concluded that the base price of the admission tickets were increased as a result of which the benefit of reduction in GST rate from 28% to 18% and 18% to 12% (w.e.f 01.01.2019) was not passed on to the recipients by way of commensurate reduction in prices charged (including lower GST @ 18% and 12%) - For the period from 01.01.2019 to 30.4.2020, total amount of profiteering was Rs 42,60,104/- - Held: The Authority finds from the documents submitted along with the report that the respondent did not commensurately reduce the price of the tickets despite reduction in the GST rate from 28% to 18% and from 18% to 12% respectively and thus contravened the provisions of s.171(1) of the Act - As per provisions of Rule 133(3)(a), respondent is directed to reduce the price of his tickets, keeping in view the reduction in rate of tax so that the benefit is passed on to recipients - Authority directs the respondents to deposit an amount of Rs.42,60,104/- in Consumer Welfare Fund of the Central and the State government in the ratio of 50:50 as per the provisions of rule 133(3)(c) of the Rules along with interest @18% - Amount is to be deposited within a period of 3 months - Respondent is laible for imposition of penalty under provisions of Section 171(3A) - Accordingly, a notice be issued to him directing him to explain why the penalty should not be imposed on him - Compliance report to be submitted by Commissioners CGST/SGST concerned within a period of four months - Order passed by NAA falls within the limitation prescribed under rule 133(1) of the Rules, 2017 in view of the orders dated 23.03.2020, 10.01.2022 passed by the Apex Court on the aspect of limitation: NAA

- Application disposed of: NAPA

2022-TIOL-11-NAA-GST

Total Environment Habitat Pvt Ltd

GST - Anti Profiteering - Proceedings had been commenced against the Respondent alleging that the Respondent did not pass on benefit of Input Tax Credit by way of commensurate reduction of price in respect of two residential flats developed by the Respondent - Subsequently, the DGAP computed the profiteered amount.

Held - The only issue to be determined is whether there was any net benefit of ITC with the introduction of GST - The NAA finds that the ITC as a percentage of the turnover that was available to the Respondent during the pre-GST period was 1.02% whereas during post GST period was 1.84% - This confirms that in the post GST period the Respondent benefitted from additional ITC to the tune of 0.82% of its turnover and the same is required to be passed on to the recipients of supply, including the Applicant herein - The profiteered amount as computed by the DGAP is based on all relevant information furnished by the Respondent and thus is accepted as being correct - The Respondent is found to have profiteered and that such amount was not passed on u/r 133(1) of the CGST Rules 2017 - The Respondent is directed to reduce prices to be realised from the buyers of the flats commensurate with the benefit of ITC received: NAA

- Application disposed of: NAPA |

|

|

|

|

|

|

|

|

MISC CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-731-HC-DEL-SERVICE

P D Kanunjna Vs CBDT

Service Matter - The petitioner filed the present petition to contest the vires an order passed by the Central Administrative Tribunal (CAT) upholding the issuance of a Charge Memo by the Ministry of Finance, Govt of India - The petitioner claimed that the order in question is erroneous in facts and that the Charge Memo was erroneously issued to him apropos his duties as DCIT, Central Circle-3, New Delhi - The rule governing issuance of Charge Memo to the Officers of Rank of Commissioner is spelt out in Office Order No. 205/2005 dated 19.07.2005, it states that "approval for issuing Charge Memo/sanction prosecution" lies with the Finance Minister - Apropos the authority to issue such Charge Memo, the respondent had so clarified through a RTI reply, that sanction was not granted by the Union Finance Minister. In the said reply, the respondent has admitted that Chairman, CBDT gave approval for initiating penalty proceedings against the petitioner. That being the position, the initiation of the proceedings against the petitioner is without due sanction, against the prescribed rules and would therefore be deemed as non est - The impugned order noted that the Minister of State for Finance (MoSF) is not subordinate to the Union Minister of Finance.

Held - The petitioner is a Group- A officer in the rank of the Joint Commissioner, his Appointing and Disciplinary Authority is the President of India - Therefore, only the Finance Minister would have had the jurisdiction apropos issuance of any Charge Memo or other related proceedings against the said officer - A reference has been made in the impugned order to the dicta of Supreme Court in Union of India and Others vs. B.V. Gopinath (2014) 1 SCC 351 - However, the Government of India has itself clarified that the sole authority to issue Charge Memo or initiate any disciplinary proceedings against a Group - A Officer or an Officer whose appointing authority is the President of India, would lie with the Finance Minister - Hence the Charge Memo is unsustainable: HC

- Application disposed of: DELHI HIGH COURT |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-430-CESTAT-KOL

SSAB Energy And Minerals Ltd Vs CCGST & Excise

CX - The appellant is engaged in manufacture of iron ore concentrates on which applicable Central Excise duty is being paid - They availed the credit as 'Capital Goods' on various steel items like angle, channels, beams and plates for manufacture of goods to be used in manufacture of final products - A SCN was issued to propose disallowance of credit on said items - The principle of "user test" also need to be considered while deciding the entitlement of appellant to avail CENVAT Credit as laid down by Supreme Court in case of Rajasthan Spinning & Weaving Mills Limited 2010-TIOL-51-SC-CX - Following the said decision, Madras High Court in case of Thiru Arooran Sugars , has held that iron and steel items and cement used for erection of foundation and support structures would also come within the ambit of the definition of "input" so long as it satisfies the "user test" - It is not in dispute that various steel items have been used for purpose of setting up of iron ores concentrates plant for manufacture of final products - Therefore, applying the "user test" principle, appellant is entitled to avail credit on steel items: CESTAT

- Appeal allowed: KOLKATA CESTAT

2022-TIOL-429-CESTAT-KOL

Lal Traders And Agencies Pvt Ltd Vs CCE & ST

ST - The only issue involved is, whether the Appellant is entitled for exemption from service tax under Notfn 34/2004- ST - In the given case of appellant, the gross amount charged by transporter per trip is Rs. 150/- which is clearly within the upper limit of exemption of Rs. 1500/ - Said issue is no longer res integra in terms of decision of Tribunal in case of Chhattisgarh Distilleries Ltd. - In the given case also though each trip cost has been determined as Rs.150/trip, however, the total invoice raised by transporter is much higher for all the trips concerned - Thus, Tribunal is inclined to uphold the order of Commissioner (A) and reject the appeal filed by appellant on merits - As regards imposition of penalty, since the issue pertained to interpretation of exemption notification, Tribunal exercise the powers under Section 80 of the Act to set aside the penalties as levied by Commissioner (A) under Section 78 of the Act - As regards to appeal covering the period 2009- 10 to 2012-13, the second SCN was issued on 21/06/2013 invoking extended period of limitation - As per the revenue, some portion of demand is within normal period of limitation and for the limited purpose to verify the same, matter remitted to Adjudicating authority - If any demand is sustainable, same would be payable by appellant with interest - Penalty is set aside: CESTAT

- Appeal partly allowed: KOLKATA CESTAT

2022-TIOL-428-CESTAT-DEL

Abhilasha Impex Pvt Ltd Vs CC

Cus - The issue involved is, whether the Court below have rightly rejected the refund of Anti Dumping duty deposited by appellant for import of PVC Resin (Emulsion) - Admittedly the Anti Dumping notification was valid till 24.06.2015 and the same have admittedly lapsed w.e.f. 25.06.2015, and as such no anti dumping duty was payable by appellant with respect to Bill of Entry filed on 26.06.2015 - Accordingly, Adjudicating Authority is directed to grant refund within a period of 45 days alonwtih interest as per rule: CESTAT

- Appeal allowed: DELHI CESTAT |

|

|

|

|

|

|

|

|

|

|

|

|

NEWS FLASH |

|

|

|

|

|

|

|

|

|

Central Govt slashes Central Excise duty on petrol by Rs 8 per litre and diesel by Rs 6 per litre

Om Prakash Chautala convicted in DA case

High-speed storm & lightning kill 33 in Bihar

Australian PM Scott Morrison likely to lose as counting of votes progresses

NSE racket - CBI conducts searches in many cities

Govt issues Draft rules for E-Waste Management by electrical and electronic sectors

CBIC amends Rules of Origin for India-Japan trade agreement

Definitive anti-dumping duty imposed on Polyurethane Leather from China

Govt amends Companies Incorporation Rules; notifies new Form INC-9 & amends Form INC-32

Law Ministry notifies J&K Delimitation order w.e.f May 20, 2022

Monkeypox cases fox 11 countries; Tally peaks to 3-digit - WHO experts huddle to take note

SC says insurance companies need to avoid being too technical at settling claims

RBI to pay Rs 30300 Crore dividend to Govt for FY 21-22

Jet set to fly again as DGCA releases air operator certificate

Over one crore domestic passengers flew by air in April month

Justice Nageswara Rao retires from SC

Trump deposits fine of USD 1.1 lakh to stall NY tax investigation

Shanghai not yet out of wood - reports close to 900 Omicron cases in last 24 hours

No pause to Bitcoin's slide - Ethereum Co-Founder says he is no longer a billionaire

China turns nose up but US trade chief meets counterpart from Taiwan

US raps UN human rights chief for proposed trip to China's Xinjiang

Govt asks key agencies to keep close eye on monkeypox spread

DRI, Coast Guard seize heroin worth Rs 1500 Cr off coast of Lakshaadweep

CBI books a corruption case against former FM Haseeb Drabu in purchase of J&K bank's BKC complex office

China's BRI project fails to take off in Nepal

Delhi's power demand skyrockets to over 7000 MW

MHA appoints Commissioner & Spl Commissioner for Delhi Municipal Corporation

|

|

|

|

|

|

|

|

|

TOP NEWS |

|

|

|

|

|

GUEST COLUMN |

|

|

|

|

|

ICE CUBE |

|

|

|

|

|

NOTIFICATION |

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|