|

|

2022-TIOL-NEWS-119| May 23, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

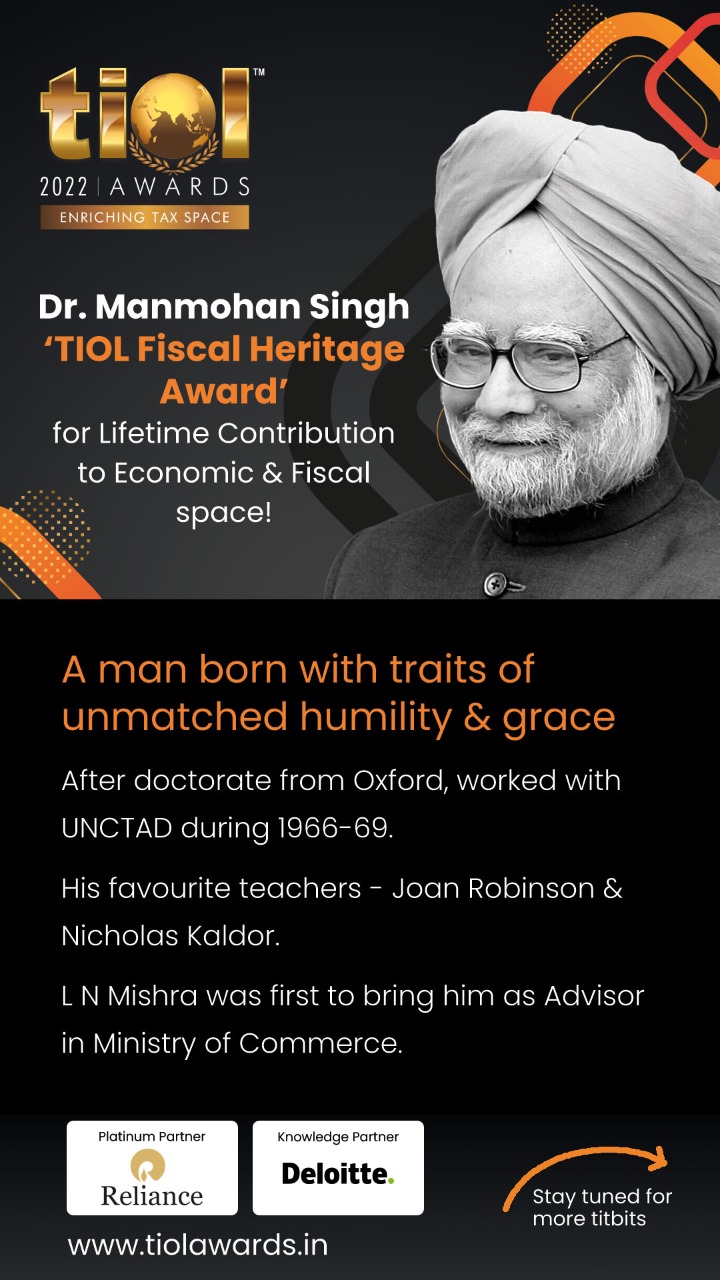

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-735-HC-DEL-IT DCM Shriram Ltd Vs ACIT

Whether re-opening of assessment can be initiated when assessment proceedings for the relevant AY are still on-going - NO: HC

- Writ petition allowed: DELHI HIGH COURT

2022-TIOL-734-HC-AHM-IT

Pushpa Uttamchand Mehta Vs ITO

Whether re-opening of assessment is valid where the AO applies mind while recording reasons for re-assessment & where the AO conducts own investigation after receiving inputs from the Investigation Wing - YES: HC

- Writ petition dismissed: GUJARAT HIGH COURT

2022-TIOL-733-HC-AHM-IT

Sardar Vallabhbhai Patel Education Society Vs ITO

Whether re-assessment proceedings are sustainable when there is no income escaping assessment, considering that the Revenue itself assessed income of the assessee for the relevant AYs - NO: HC

- Writ petition allowed: GUJARAT HIGH COURT

2022-TIOL-732-HC-AHM-IT

Shree Maharaja Agrasen Seva Sansthan Vs CIT

Whether where any statute leads to some hardships, the Revenue is obliged to construe these provisions in a reasonable manner - YES: HC

- Assessee's writ petition allowed: GUJARAT HIGH COURT |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-433-CESTAT-DEL

Allied Chemicals And Pharmaceuticals Pvt Ltd Vs CCE & CGST

CX - The dispute is, whether the appellant is entitled to interest on amount of pre-deposit under Section 35FF of Central Excise Act, - Claim of interest has been rejected on the observation that the refund have been given within three months from the date of application for refund and accordingly it was held that they are not entitled to interest - Under similar facts and circumstances, Division Bench of Tribunal in case of Parle Agro Pvt. Limited 2021-TIOL-306-CESTAT-ALL held that an assessee is entitled to interest on such pre-deposit on being successful in appeal, from the date of deposit till the date of refund @ 12% p.a., following the ruling of Supreme Court in case of Sandvik Asia Ltd. 2006-TIOL-07-SC-IT - Accordingly, appellant is entitled to interest @ 12% p.a., from the date of deposit till the date of grant of refund - Adjudicating Authority is directed to disburse the amount of interest within a period of 45 days: CESTAT

- Appeal allowed: DELHI CESTAT

2022-TIOL-432-CESTAT-CHD

Secon Logistics Pvt Ltd Vs CC

Cus - Early hearing - Applicant is customs broker and his license has been suspended rendering him and his employees jobless - Irrespective of merits of case as far as application for early hearing is concerned the same needs to be allowed - Continuance of suspension of license without examining necessity of same impinges on fundamental right to work of applicant - Tribunal is not going into the merits of case and the nature of offence committed as the same needs to be examined when appeal is heard and not at this stage where only the application of early hearing is being examined - The appeal of applicant may be listed in next available Division Bench in Chandigarh: CESTAT

- Application allowed: CHANDIGARH CESTAT

2022-TIOL-431-CESTAT-AHM

Tops Security Ltd Vs CCE & ST

ST - The investigation against appellant was initiated by department on the ground that appellant charging and collecting service tax from their clients but the same is not deposited properly and timely - The case of department is that appellant out of total service tax of Rs. 1,24,96,001/- produced the evidences of deposit of service tax of Rs. 75,31,939/- only, thus failed to deposit service tax of Rs. 49,64,062/- - Appellant neither provided any evidences before Adjudicating Authority/Commissioner (Appeals) nor before this Tribunal to show that they have paid disputed service tax - Therefore, demand of Service Tax is legally correct - As regard the cenvat credit demand, appellant could not produce any evidence or documents on the basis of which credit was taken - Accordingly, the demand is sustainable - No infirmity found with impugned order, same is upheld: CESTAT

- Appeal dismissed: AHMEDABAD CESTAT |

|

|

|

|

|

|

|

|

|

|

|

|

NEWS FLASH |

|

|

|

|

|

|

|

|

|

Oxfam at Davos: COVID spawned a billionaire every 30 hours

Monkeypox - Formidable days ahead, says WHO

Mitali Express to link New Jalpaiguri to Dhaka railway station from June 1

UNHCR says over 100 mn people ejected out of homes - war is one of major reasons

Anthony Albanese assumes office as New Australian PM; to meet Modi in Japan

Downplaying climate change risk - HSBC puts top Executive on ‘back burner'

US receives first shipment of baby food from Europe

High-intensity storms kill 8 in Canada; 8 lakh population goes without electricity

India detects first case of Omicron BA.4 & BA.5 cases in TN & Telangana

India delivers humanitarian consignment of rice, milk powder and drugs to Lanka

PM says world closely watching India's startups as the future

ACC appoints Vivek Kumar, IFS of 2004 Batch, as PS to Prime Minister in JS-rank

|

|

|

|

|

|

|

|

|

TIOL EDIT

|

|

|

|

|

|

NOTIFICATION |

|

|

|

|

|

|

|

|

|

ctariff22_025

Road & Infrastructure Cess reduced on petrol & diesel ctariff22_026 PCI coal, Coking coal - Duty relief granted

ctariff22_027

Seeks to further amend notification No. 11/2021- Customs dated 1 st February, 2021 to reduce duty on Anthracite/Coking Coal ctariff22_028

Seeks to amend Second Schedule of the Customs Tariff Act, 1975 to increase and levy Export duty ctariff22_029 Seeks to amend notification No. 27/2011 dated 1 st March, 2011 to increase export duty on certain goods

etariff22_02

Road & Infrastructure Cess reduced on petrol & diesel |

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|