|

|

2022-TIOL-NEWS-119 Part 2 | May 23, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

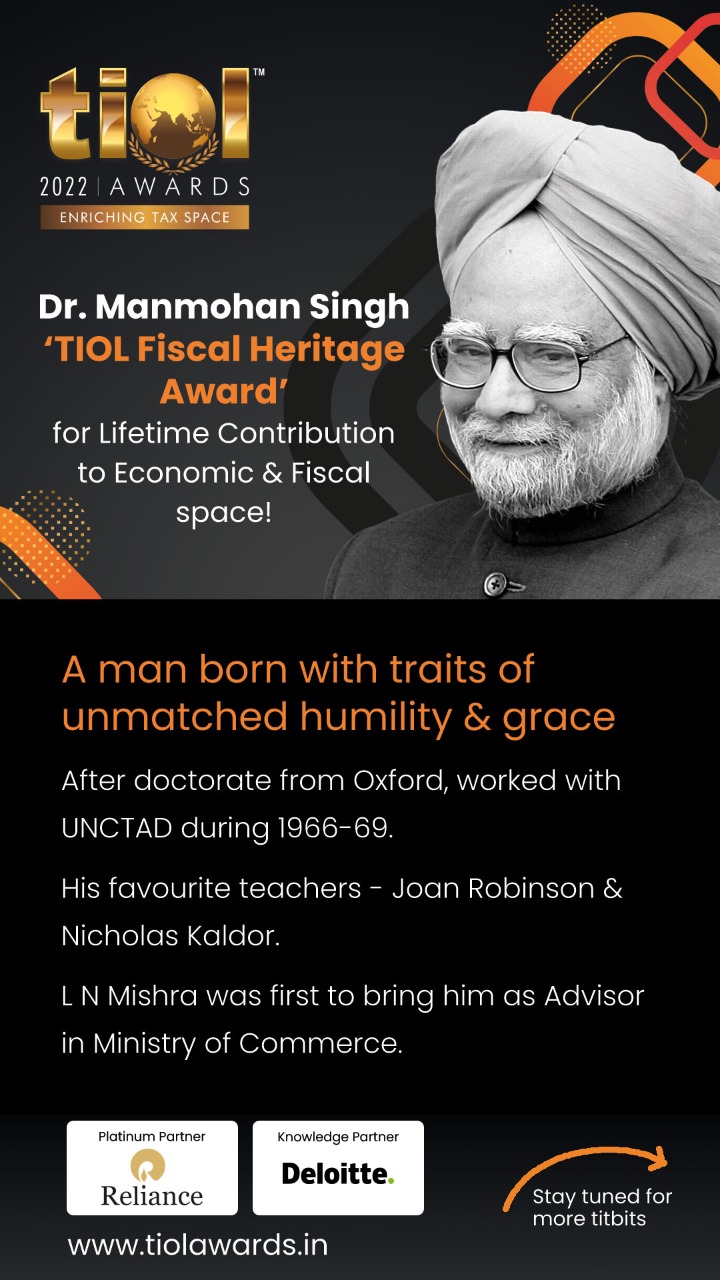

TIOL AWARDS |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-521-ITAT-PUNE Chemetall Rai India Ltd Vs DCIT

Whether rejection of assessee's claim for depreciation is sustainable where such findings were based on a judgment which was subsequently overturned - NO: ITAT

- Appeals allowed: PUNE ITAT

2022-TIOL-520-ITAT-AHM

Deepak Jyotiprasad Chiripal Vs DCIT

Whether where an assessee sells land as agricultural land & where such land is later converted to a non-agricultural purpose by the new owner, then assessee cannot be held liable to pay LTCG - YES: ITAT

- Assessee's appeal allowed: AHMEDABAD ITAT

2022-TIOL-519-ITAT-AHM

DCIT Vs Greenwell Orchard

Whether CIT(A) is right in restricting addition by estimating expenditure incurred by assessee to tune of 5% of teak wood sales instead of 20% estimated by AO - YES : ITAT

- Revenue's appeal dismissed: AHMEDABAD ITAT |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-740-HC-ALL-GST

Gobind Tobacco Manufacturing Company Vs State of UP

GST - Petition has been filed for quashing the seizure order as well as release of goods and vehicle - Expiry of E-way bill - What has been stated in the counter affidavit by Revenue, while replying to the writ petition, is that the petitioners being aware of the COVID-19 pandemic situation, should not have exported the goods and, instead of getting generated the second E-way bill, should have got extended the validity of the e-way bill within 8 hours of its expiry as per the provisions of Rule 138(10) of the CGST/IGST Rules.

Held: From the facts, it is admitted that the goods in question originated from Panipat and were being transported with valid invoice from Panipat to Nepal but due to restriction imposed on account of COVID-19 pandemic, the goods were unloaded at Gorakhpur and after the arrangement of another vehicle was made under prevailing situation of COVID-19 pandemic, the goods were transported to Nepal - Since the time gap was much, therefore, a second e-way bill was generated so that the goods may reach to its destination at Nepal - There is absolutely no dispute that the goods in question were dispatched by the petitioner no.1 from Panipat (Haryana) under valid invoice and valid papers - The goods in question were intercepted and seized by the respondents on hyper-technical ground and assumptions, without there being any allegation of intention to evade payment of tax - The second e-way bill was generated bonafidely and in circumstance beyond control of the petitioners - Since the goods were covered by valid documents, therefore, it could not have been detained or seized and hence the entire proceedings were totally arbitrary, illegal and without jurisdiction - The action of the respondents in seizing the goods in question is evidently an act of harassment to the petitioners, breach of their fundamental rights guaranteed under Article 14 of the Constitution of India and blatant abuse of power by the respondents - Impugned detention order dated 07.03.2022, the release order dated 13.03.2022 and notices dated 22.03.2022 and 28.03.2022, are quashed being totally arbitrary and illegal - The goods and vehicle in question seized by the respondents are directed to be released forthwith - Writ petition is allowed with cost of Rs.50,000/- to each of the petitioners which the respondents shall pay within four weeks: High Court [para 12, 15, 16]

- Petition allowed: ALLAHABAD HIGH COURT |

|

|

|

|

|

|

|

|

MISC CASE |

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|