|

|

2022-TIOL-NEWS-120 Part 2 | May 24, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

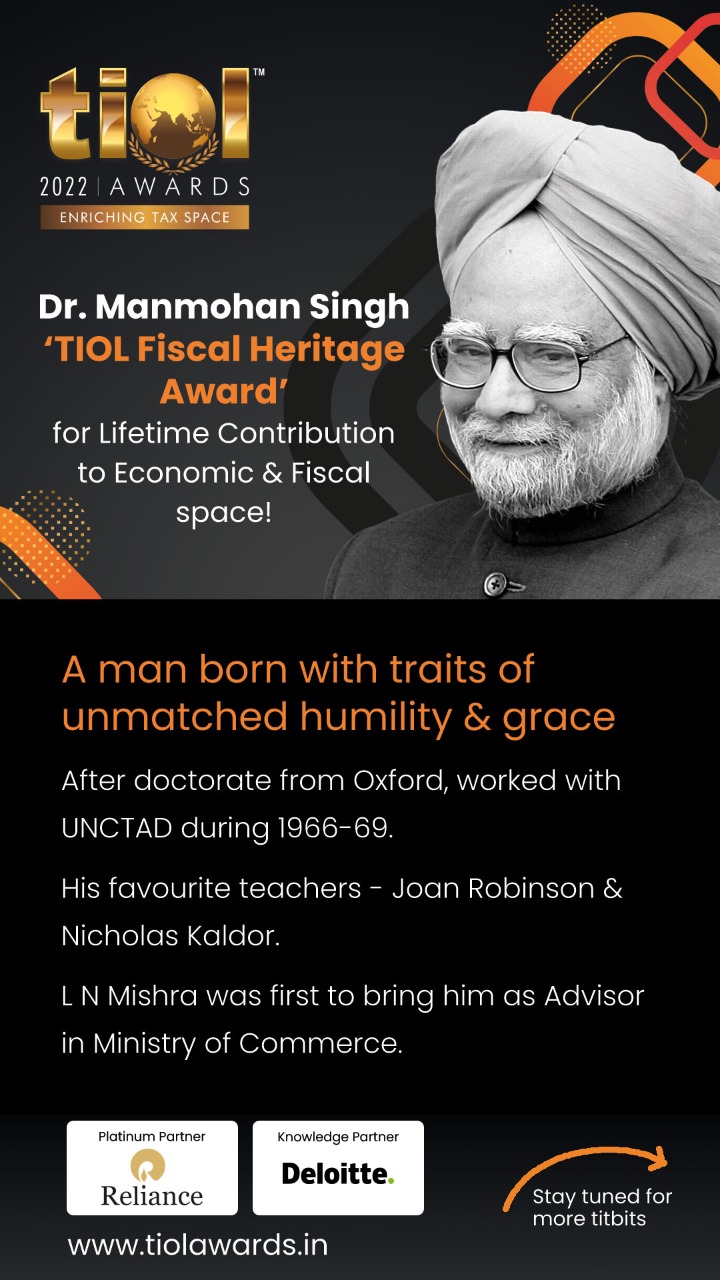

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-747-HC-AP-GST

Godway Furnicrafts Vs State of AP

GST - Section 10(1) of the Act, 2017 - Words ‘preceding financial year' - Court had by its order dated 11.11.2020 - 2021-TIOL-1554-HC-AP-GST declared that insofar as the financial year 2017- 2018 under GST regime is concerned, the preceding financial year would be 2016-2017 under the VAT regime for the purpose of collection of tax under the GST Act, 2017 and held that the petitioner is not entitled for the benefit under the composite scheme and confirmed the findings of the authorities concerned - Bench had negated the plea of the Petitioner holding that the collection of tax under GST Act, 2017 is not in addition to the provisions of the VAT but this being introduced as a substitute to VAT Act to deal with both goods and services, so as to maintain uniformity across the length and breadth of the country and, accordingly, confirmed the order of the 2nd Respondent - Present application seeks review of the Order dated 11.11.2020, passed in W.P. No. 10350 of 2020, wherein this Court dismissed the Writ Petition confirming the Order of the Joint Commissioner (ST), Appellate Authority under GST Act, Vijayawada, who i n turn upheld the Order of the Assistant Commissioner (ST), Circle-II Division, Suryaraopeta, Vijayawada - Counsel for Revenue opposed the application mainly on the ground that, in a review, even if the order is erroneous, the Court cannot review the same unless an error is apparent on record, which is not so in the instant case; that the Bench which heard the Writ Petition dealt with the aspects being now raised and came to a conclusion and if the Petitioner is aggrieved by the same, remedy lies elsewhere but not by way of a Review.

Held: Scope of reviewing an order is very limited - The argument that was advanced at the time of hearing of the Writ Petition was with regard to inclusion of VAT regime for the purpose of deciding the tax to be paid under Section 10(1) of GST Act - In the Review Petition, it is now urged that Section 10 encompasses Section 73 and 74 of GST as well and in the absence of any fraud, the authorities erred in invoking Section 74 of the GST Act and imposing 100% penalty - Averments in the affidavit filed in support of the Writ Petition does not anywhere refer to the plea now taken, though such plea was available at the time of filing of the Writ Petition, more so, when it involves only interpretation of the provisions of GST - Without taking such plea, namely, that 100% penalty can be imposed only when there is fraud or wilful concealment, in the Review Application such a plea is sought to be raised - It is not as if that such a plea was not available at the time filing of the Writ Petition - Even otherwise, in paragraph no.12 of the judgment, the Court held that the option exercised by the Petitioner was self-declaratory, which requires sometime for the authorities to verify and ultimately found it to be incorrect - The order under review would clearly indicate that intentional and wilful non-disclosure of crucial facts can be inferred from the self-declaration made in the web-portal - Viewed from any angle, Bench does not find any grounds to interfere with the order impugned in the review - Review application is dismissed: High Court [para 24 to 26]

- Application dismissed: ANDHRA PRADESH HIGH COURT

2022-TIOL-746-HC-MAD-GST

ABI Technologies Vs Asstt. CC

GST - IGST Refund - Petitioner seeks a Mandamus to direct the respondent to sanction a sum of Rs.24,72,018/- as refund on the exports made by the petitioner during July, 2017, September, 2017 and October, 2017 - It is the specific case of the petitioner that though they had correctly declared the details in the monthly returns in Form GSTR-1 regarding the exports made on payment of tax by debiting the input tax credit, a mistake was committed by the petitioner in GSTR-3B under Rule 61(5) of the Rules, 2017; that the petitioner should have filled the details in Form GSTR-3B in column 3.1(b) but, by mistake, has given the details of the export as outward taxable supply (other than zero rated, nil rated and exempted).

Held: The export incentives have been given to encourage exports, so that there is inward remittance of foreign currency - The procedure prescribed under the aforesaid Rules is not intended to defeat such legitimate export incentives, if indeed on facts there is export on payment of integrated tax under the provisions of IGST Act, 2017 r/w CGST Act, 2017 - Procedures under Rule 96 of CGST Rules, 2017 cannot be applied strictly to deny legitimate export incentives that are available to an exporter - Writ petition is disposed of by directing the respondent to get the data directly from the petitioner and from their counterparts in the customs department and if indeed there was an export and a valid debit of tax by the petitioner on the exports made to foreign buyers, the refund shall be granted: High Court [para 10, 11, 12]

- Petition disposed of: MADRAS HIGH COURT

2022-TIOL-59-AAR-GST

Translog Direct Pvt Ltd

GST - Applicant is incorporated with the aim to streamline and provide services in the marine industry by offering end to end support services to overseas shipping lines/charterers such as crew related activities, documentation support services, administrative functions and other customary activities when entering/exiting the Indian ports to its foreign clients - They will be offering support services to their customers located outside India on a principal-to-principal basis - The customers are in the business of chartering vessels for transportation of goods into India and moving goods outside India and for the provision of aforesaid services, they will render services to vessels/ ship-owners to ensure smooth operations while the vessel/ship is in India - Their main intention is to provide end-to-end solution to their overseas customers in the form of assisting/supporting while the vessel(s) arrive in India - Applicant seeks a validation that such 'support services' are classifiable under SAC Code 9985.

Held: It is seen that the applicant extends vessel related services, supporting the shipper to facilitate the entry/exit of the vessel in the Indian Ports, i.e., the services are more in the nature of 'support services for transport of vessels' and more aptly will be classifiable under SAC 9967 and is liable to CGST @ 9% as per SI. No. 11(ii) of Notification No. 11/2017-C.T. (Rate) , dated 28.06.2017 - It is seen that the services extended are to enable the vessel reach the port; leave the port and undertaking repairs/ requirements of the vessels' crew when such vessel is in the Indian territory - In other words, the proposed services are rendered in respect of the vessels which are physically available in the Indian Territory and, therefore, the proposed services are squarely covered under Section 13(3) of the IGST Act inasmuch as the place of supply of service is the location where the services are actually performed, which is the taxable territory - Condition of the place of supply being outside India is not satisfied in the case at hand and, therefore, the proposed supply is not an 'Export of Service' as per Section 2(6) of IGST Act, 2017: AAR

- Application disposed of: AAR

|

|

|

|

|

|

|

|

|

MISC CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-749-HC-DEL-SERVICE

Yash Rattan Vs UoI

Service - Petitioners were appointed as Inspectors in the Delhi Commissionerate of the respondents in the year 2016 under the direct recruit quota - The private respondents (who were the petitioners before the CAT) were also direct recruits recruited in the year 2011 in various zones outside Delhi - On 31.07.2014, there was a substantial re-structuring in the department, resulting in steep increase in the number of posts of Inspectors in Delhi Zone - On account of the increase in number of vacancies, the private respondents took a transfer to Delhi Commissionerate from their parent cadre and were placed at the bottom of the seniority list - The petitioners who were appointed on direct recruitment basis against the vacancies for the year of 2014, joined cadre only in the year 2016 - On 15th March, 2018, the respondents came out with a seniority list of Inspectors in which the private respondents herein were placed below the petitioners - Main ground of challenge in the OA (filed by private respondents) was that the petitioners who had joined the department after the joining of the private respondents cannot be placed above them in the seniority list - By the said impugned order, OA filed by respondents no.4 to 31 herein (the applicants before the CAT) was allowed and the seniority list dated 15th March, 2018, which was the subject matter of challenge before the CAT, was set aside - Present writ petition impugns the order passed by Central Administrative Tribunal (CAT) - The present petition has been filed by the petitioners, who were the respondents before the CAT.

Held: It is a matter of fact that the seniority position in the present case was not finally settled when the judgment in the case of K. Meghachandra Singh (2020) 5 SCC 689 ) was delivered by the Supreme Court on 13th November, 2019 - The impugned seniority list was issued on 15th March, 2018 and immediately thereafter, various representations were filed on behalf of the private respondents against the said seniority list - Therefore, it is incorrect on the part of the petitioners to say that the seniority position was settled and, therefore, the same has to be protected in terms of the judgment in K. Meghachandra Singh judgment (supra) - Dicta of the Supreme Court that emerges is that the OMs dated 07.02.1986 and 03.07.1986 were not properly construed in the N.R. Parmar - 2012-TIOL-112-SC-SERVICE judgment; Inasmuch as the said OMs made it clear that seniority of direct recruits had to be fixed from the date of appointment and not from the ‘date of initiation of recruitment process'; that persons aspiring to be appointed to a vacant post do not have any vested right and only upon completion of the selection process, a candidate becomes a selected candidate and, therefore, the finding in N.R. Parmar (supra) that the selected candidate cannot be blamed for administrative delay, was not correct; that the decision in N.R. Parmar (supra) case is overruled but the decision would apply prospectively - Therefore, Bench is of the view that CAT has correctly applied the dicta in K. Meghachandra Singh (supra) case in the present case and has proceeded to quash the seniority list to the extent it placed the petitioners above the private respondents - It is also an admitted position that in the present case, requisitions for the appointment of the petitioners were sent to SSC, the recruiting authority on 11th February, 2015, after the private respondents had already joined the Delhi Commissionerate, therefore, even in terms of OM dated 4th March, 2014, the petitioners cannot be placed above the private respondents - Petitions are dismissed: High Court [para 16, 17, 18]

- Petitions dismissed: DELHI HIGH COURT

|

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-748-HC-AHM-ST

Pr. CC Vs Cadila Healthcare Ltd

ST - Principal substantial question of law, involved in all the appeals is whether a Partner (in this case M/s. Cadila Healthcare Ltd.) in the Firm can be said to be rendering services to the Partnership Firm (in this case M/s. Zydus Healthcare) so as to fall within the ambit of services as per the Finance Act, 1994 - CESTAT has in its order dated 27.04.2021 - 2021-TIOL-257-CESTAT-AHM while allowing the assessees appeal held that that the impugned activities of the appellant are undisputedly its obligation as a partner as per partnership deed; that there is no separate contract of services between the appellant and the partnership firm; that, therefore, the remuneration received by the appellant is merely a special share of profits in terms of the partnership deed; that such remuneration cannot be considered as consideration towards any services between two persons, and, hence, not liable to Service Tax - Revenue is in appeal against this order.

Held: Supreme court in the case of Commissioner of Income Tax Vs R.M. Chidambaram Pillai - 2002-TIOL-2675-SC-IT held that a partnership firm has no legal existence separate from the partners, under the Partnership Act - It can, therefore, be said that a partnership firm is not a separate entity than its partners - Section-65(105)( zzb ) applies to service provided to a client by a person in relation to business auxiliary service and hence, two distinct persons are required to attract this levy - The partnership firm, M/s Zydus Healthcare cannot be considered as a 'person' distinct from the Respondent - partner - Therefore, there cannot be a service provider-service recipient relationship between a partner and the partnership firm when a partner discharges his duties as a partner pursuant to deed of partnership - Hence no service tax is payable on the activities performed by the respondent in the capacity of partner to the firm - Any income, salary, bonus, etc. received by a partner for discharge of obligations as per the partnership deed is nothing but a special share in profits of the firm - Partner's capital to a firm can be in the form of cash/asset - It can also be in the form of contribution of skill and labour alone without contribution in cash-"sweat equity" - Remuneration received by a partner by employing his skill and labour as per the partnership deed is also a profit, the profit in such circumstances can be a special share in the profit - All the appeals of the revenue fail - The substantial questions of law are answered in favour of the respondents and against the revenue: High Court [para 16.1, 16.3, 19.1, 19.2, 20, 21, 21.2, 24]

- Appeals dismissed: GUJARAT HIGH COURT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|