|

|

2022-TIOL-NEWS-129| June 03, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

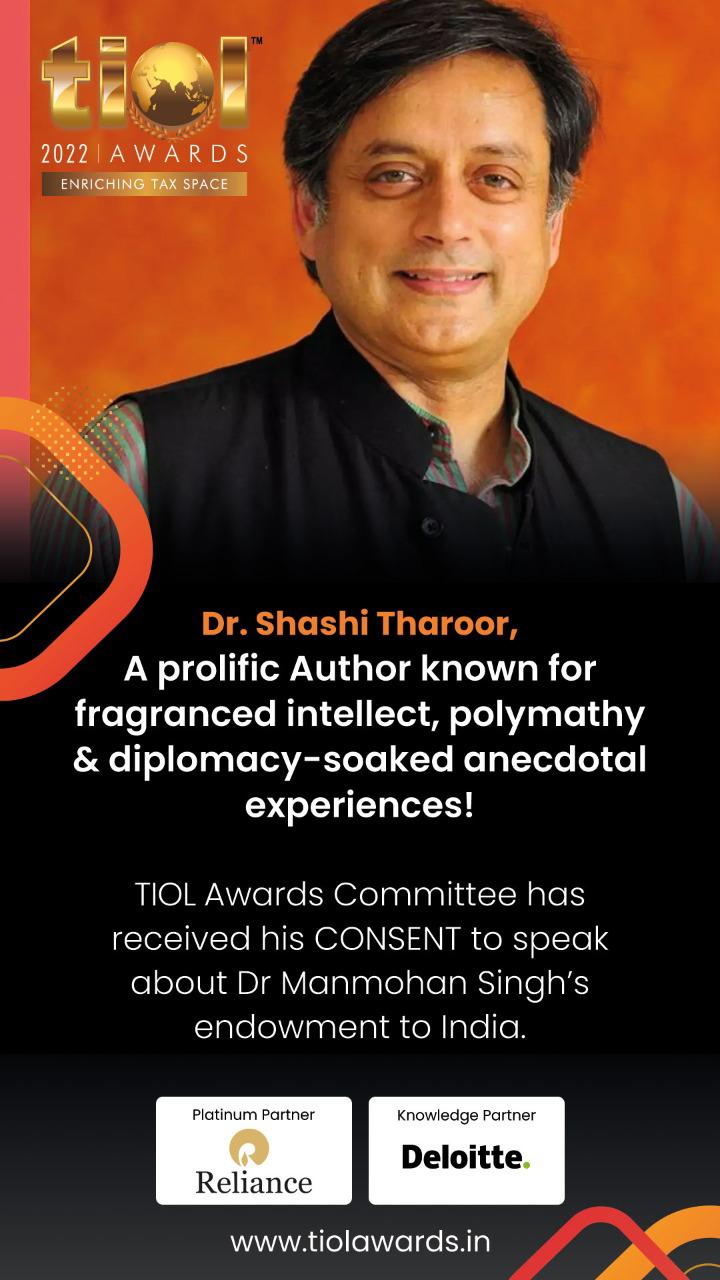

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-791-HC-DEL-IT SKA Infrastructure Pvt Ltd Vs UoI

In writ, the High Court observes that power of compounding of offences is a quasi judicial power, as it definitely entails judicial element/function & discretion in compounding is not unfettered. Hence the assessee is held to be entitled to the benefit of extension of limitation as directed by the Supreme Court in Cognizance for Extension of Limitation Suo Motu Writ Petition. Order rejecting application for compounding of offence is quashed.

- Writ petition allowed: DELHI HIGH COURT

2022-TIOL-790-HC-DEL-IT

Mamta Gupta Vs Additional/Joint/Deputy/Assisstant Commissioner Of Income Tax,Ito National Faceless Assessment Centre Delhi

Whether re-opening of assessment merits being sustained where the sanction for it was rightly granted & where the assessee engaged in a complex web of pre-arranged or artificial transactions leading to escapement of income - YES: HC

- Writ petition dismissed: DELHI HIGH COURT

2022-TIOL-789-HC-RAJ-IT

Rajendra Kumar Vs ACIT

Whether recovery of tax demand for relevant AY by adjusting refund payable in respect of separate AY, without informing assessee & in blatant disregard to relevant judgments and Board Circulars, merits being quashed - YES: HC

- Writ petition allowed: RAJASTHAN HIGH COURT

2022-TIOL-788-HC-KERALA-IT

Muthukoya T Vs CIT

Whether in cases of search & seizure, the Department can seize and retain documents of title, more so where Section 131(3) prescribes a 15-day period for retention of seized documents - NO: HC

- Writ petition allowed: KERALA HIGH COURT |

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

MISC CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-792-HC-MAD-VAT

LG Electronics India Pvt Ltd Vs State of Tamil Nadu

VAT - Section 6 of the TNVAT Act, 2006 is not a charging Section - It only provides for an alternate mode of discharging taxes to the dealers, who voluntarily opt for the compounding scheme to pay taxes at a compounded rate: HC

VAT - TNVAT Act, 2006 - While granting the concession at the point of payment of output tax, it is open to the State to impose any restriction or conditions for availing such concession: HC

VAT - The composition scheme under Section 6 of TNVAT Act, 2006 cannot be treated as provision for levy of tax on purchases or imposing any restriction on purchases from other State or import - The conditions do not alter the rate of tax of goods imported from outside the State - The concession is granted at the point of output tax payable on the transfer of property in goods: HC

VAT - In fiscal or taxing enactments, it is not necessary that every enactment should be backed by objects and reasons - What is relevant is the competence of the State and whether such enactment offends any constitutional rights, which in the instant cases, are held to be negative: HC

VAT - Sections 5 and 6 of TNVAT Act classify works contractors into different categories. Such classification or distinction is not unknown in taxing law. Similarly, Section 8 of the CST Act treats the dealers of the same goods differently, depending upon whether they fall under Section 8(1) or 8(2) of the CST Act. The object that is sought to be achieved is two folds viz., (i) to curb the loss of revenue accrued due to interstate purchase of goods or import; and (ii) to create a level playing field for the local dealers. Therefore, the condition is well found on intelligible differentia and has a nexus to the object that is sought to be achieved. Hence, the challenge to the provision as being arbitrary and in violation of Article 14 is rejected: HC

VAT - The challenge to a provision as being ultra vires to the constitution is available only on limited circumstances, (i) when it is beyond the legislative competence of the State and (ii) when it offends or violates the constitutional guarantees and safeguards. In the present case, the authority of the State to levy tax on sale of goods is traceable to Entry 54 of List II of Seventh Schedule. The authority to impose tax carries with it all the incidental authority to lay down the procedure, to grant exemption or concession and to impose conditions or restrictions for availment of such exemptions and conditions. Therefore, the amendment challenged is well within the legislative competence of the State: HC

VAT - The compounding Scheme under Section 6 is only an option to be exercised voluntarily. There is no compulsion to opt under section 6 and it is open to a works contractor to pay taxes under section 5. The condition contained in section 6 cannot be regarded as giving any preference to one State over another or as discriminatory by levying more tax on the goods brought in from outside the State as because the State by such amendment has not imposed any tax. Therefore, the Amendment does not infringe any of the guarantees or safeguards provided under the Constitution. Accordingly, all the writ petitions challenging the vires of Section 6 of TNVAT Act, 2006, fail and are hence, dismissed: HC

VAT - Insofar as the challenge to the retrospective effect given to the amendment as being violative of Article 19 (1) (g) of the Constitution, the same is rejected as because it is within the authority of the State to bring in such amendments in fiscal statutes by clearly prescribing the date from which it must be given effect. The hardship that is caused to individuals seldom matters as validity of any fiscal enactment ought to be tested on the basis of generality of its operation and not on the basis of few individual cases: HC

VAT - Regarding the co-developers of SEZ are concerned, the provision cannot be read down to exclude the co-developers of SEZ, when the validity has been upheld. Such an exercise would amount to dichotomy in law - The facts, as to whether the activity against which an exemption is claimed, is an authorized activity of the Developer to extend the benefit to the co-developer, as to whether the ownership is transferred to third parties and the interpretation of contracts cannot be adjudicated in this writ petition: HC

Conclusion :Writ petitions challenging the vires of Section 6 of TNVAT, 2006 are dismissed and the writ petitions challenging the notices and assessment orders are disposed of.

- Petitions dismissed: MADRAS HIGH COURT |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-470-CESTAT-BANG

Mineral Enterprises Ltd Vs CC

Cus - The appellant is an exporter of iron ore fines/lumps - During disputed period, appellant entered into a contract with overseas buyers for supply of fines/lumps and one of the conditions of purchase contract between appellant and foreign buyers was that the export consignment was required to be subjected to certain tests to determine iron (Fe) and moisture content and thereafter determine the weight of dry quantity of ore by reducing moisture percentage - Appellant requested for refund - SCNs were issued proposing to reject their refund claim - The exporter shall pay any fine or penalty, which is imposed in adjudication proceedings, if Fe content is more than 63.99% - There is no dispute as regards the Fe content - The liability to pay fine or penalty arises only when the Fe content is more than 63.99% but when it is proved that the Fe content was much below the threshold, naturally the PD bond will have no effect and the same stood cancelled - This is just the starting point, same requires finalization of provisional assessments since the actual duty liability is involved and hence adjudication has to take place to determine the same - The requirement of law is that a provisional assessment, if treated as such, shall be treated as provisional for all practical purposes - Statute mandates the passing of final assessment since a provisional assessment will have to be taken to its logical conclusion, by passing a final assessment order after obtaining necessary information or any report or any other document that the Officer may require, as prescribed under Section 18(1) of Customs Act, 1962 - It is also for the reason that a provisional assessment is in the nature of an interim order, which is not enforceable - Otherwise, granting of time as in Section 18(4) ibid becomes otiose - Other than this, law does not recognize any deeming fiction to treat a provisional assessment as the final one - Hence, a provisional assessment will always remain as a provisional one - There is no shortcut as a deemed finalization since the authorities can only collect the tax/duty as permissible under law - Hence, the non-finalization of provisional assessment has lead to a situation where the duty paid by unsuspecting assessee has been retained in full without following the process of law since it is observed that a provisional assessment will not automatically become final but the same has to be taken to its logical conclusion by passing a final order - Consequently, matter remanded to adjudicating authority with a direction to pass a speaking order finalizing the assessment - Moreover, as both the parties have accepted the Fe content from the report of CRCL, Cochin, the valuation of the goods shall also be carried out adopting the correct value and consequential refund worked out and granted to the appellant: CESTAT

- Matter remanded: BANGALORE CESTAT

2022-TIOL-469-CESTAT-AHM

Space Plan System Vs CST

ST - The appellant seeking relief for setting aside the penalty imposed under Section 78 of Finance Act, 1994 on the ground that they had paid entire Service Tax, interest before issuance of SCN - The only issue to be decided is, that whether the appellant's case could have been concluded under section 73(3) ibid - Appellant has not informed department that they wish to avail the benefit of section 73(3) ibid - Moreover, demand was raised for period 2011-12 to 2014-15 by invoking extended period - This itself shows that appellant has suppressed the fact - Appellant have discharged Service Tax only when the issue was raised by audit party at the end of service recipient M/s Balas Industry - The audit report was issued on 16/09/2014 and on this basis only the appellant has paid the amount on 14/10/2016 and 15/10/2016 - Appellant has neither taken any registration nor paid the Service Tax for the last 5 years - Therefore, there is a clear suppression of fact on the part of appellant - Sub-section (4) of section 73 ibid clearly provides that where nonpayment of Service Tax is due to suppression of fact, misstatement, fraud or collision the case cannot be concluded under section 73(3) ibid - Therefore, appellant have not complied with provision of section 73(3) ibid and suppression of fact is clearly established against appellant - Hence, they are not eligible to avail benefit under section 73(3) - Accordingly, Revenue has rightly issued the SCN and Adjudicating Authority has correctly imposed the penalty under section 78 ibid - Impugned order is upheld: CESTAT

- Appeal dismissed: AHMEDABAD CESTAT

2022-TIOL-468-CESTAT-MAD

India Cements Ltd Vs CGST & CE

CX - On verification of records of appellant, it came to the notice of department that they were availing CENVAT credit on service tax paid on freight charges for outward transportation of finished products upto buyers' premises as well as the dealers - Department was of the view that in terms of definition of "input service", as it stood then, will not apply to outward transportation of goods beyond the place of removal, i.e., up to the premises of customer/dealers and that the credit is not eligible - SCN issued for different periods proposes to disallow the credit and to recover the same along with interest and for imposing penalty - The decision of Supreme Court in case of Vasavadatta Cements Ltd. 2018-TIOL-90-SC-CX and The Andhra Sugars Ltd. 2018-TIOL-45-SC-CX is squarely applicable to the facts of this case - Moreover, the jurisdictional High Court in case of M/s. Bata India Ltd. 2019-TIOL-1861-HC-MAD-CX had occasion to consider the very same issue as to whether credit is eligible on outward transportation of goods upto the customer's premises prior to the period 1.4.2008 and the High Court applied the principle laid down by Supreme court in said cases and held that the credit is eligible - Tribunal have no hesitation to hold that the credit on outward transportation from the place of removal upto the buyers' premises/dealers for period upto 31.03.2008 is eligible - The impugned orders are set aside: CESTAT

- Appeals allowed: CHENNAI CESTAT

2022-TIOL-467-CESTAT-DEL

Takata India Pvt Ltd Vs CCE

CX - The Appellant entered into an agreement with M/s Honda Siel Cars (India) Limited for supply of final products - In terms of agreement, in case of termination of production of any product (vehicle), appellant is required to continue supplying replacement parts for 15 years from date of discontinuation termination of product - SCN was issued proposing to raise demand for Cenvat credit on slow-moving inventory, considering closing balance as on 31.03.2017 under Rule 3(5B) of Cenvat Credit Rules, 2004 - Appellant have only created a general provision for slow-moving inventory and have actually not written off the inventory from inventory or the asset account - In actuality such provision have been made by appropriation in profit and loss account, without writing off any amount from assets/inventory account - Rule 3(5B) ibid is attracted only when the value of assets and/or inventory is written off fully or partially or wherein any specific provision to write off fully or partially has been made in books of account - Appellant have made a general provision, which is not attributable to any particular assets/inventory - Admittedly, Revenue has not been able to identify the details of inventory or asset, for which the general provision has been made - It is further evident that appellant have led evidence that such provision has been varied from year to year by way of writing back, on usage of inventory as required - Situation is revenue neutral as appellant have written off the majority of provision created on utilisation of inventory in manufacturing and clearance of finished goods - Accordingly, impugned order is set aside: CESTAT

- Appeal allowed: DELHI CESTAT |

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|