|

|

2022-TIOL-NEWS-199| August 25, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

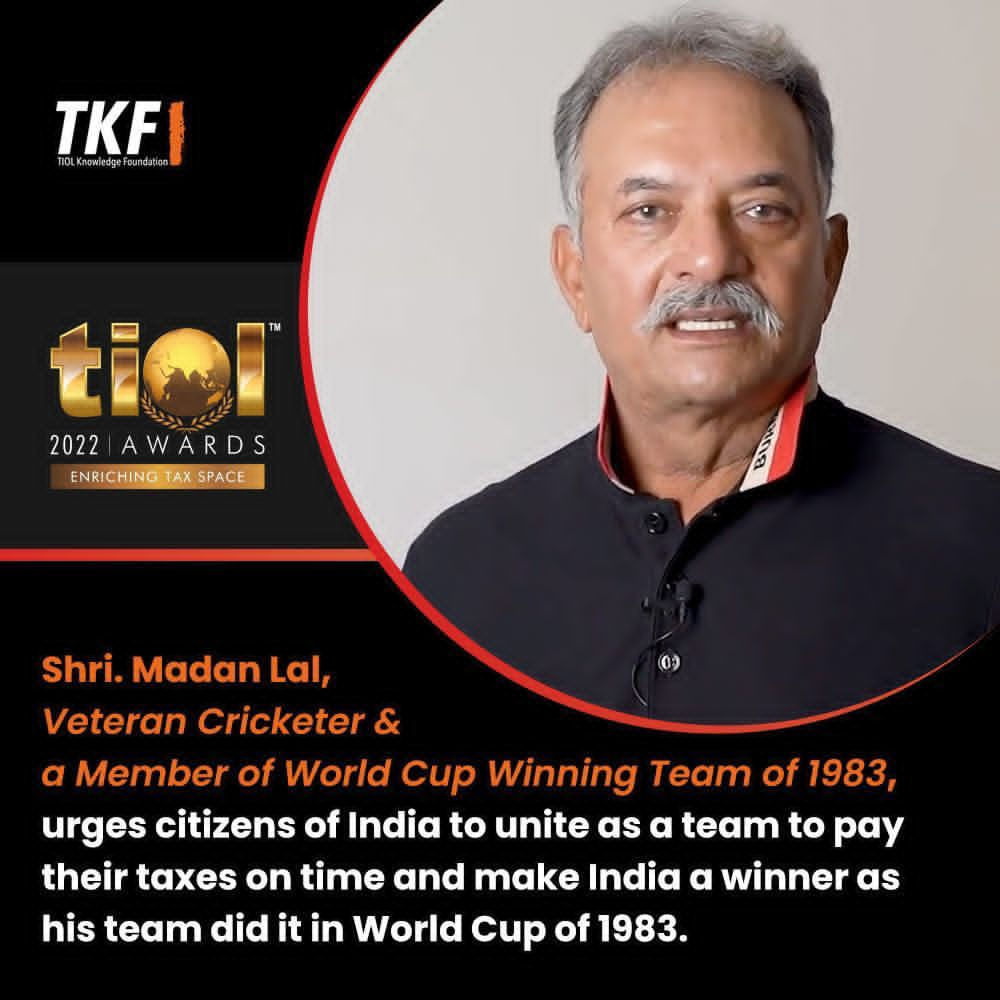

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-941-ITAT-AHM

Corrtech Energy Ltd Vs DCIT

Whether an actual write off of provision for bad debts, would not be hit by clause (i) of Explanation to Section 115 JB - YES: ITAT

- Assessee's appeal partly allowed: AHMEDABAD ITAT

2022-TIOL-940-ITAT-KOL

Combined Merchants Pvt Ltd Vs ITO

Whether when identity & genuineness of transaction is not in dispute, there is no reason to treat alleged share application money as unexplained - YES: ITAT

Whether when assessee has duly discharged its onus by providing necessary material to prove the creditworthiness of the share applicants, no addition is permitted u/s 68 - YES: ITAT

- Assessee's appeal allowed: KOLKATA ITAT

2022-TIOL-939-ITAT-MUM

DCIT Vs V Hotels Ltd

Whether following order passed by coordinate Bench in assessee's own case for previous year, depreciation @ 10% can be allowed on whole of consideration towards FSI - YES : ITAT

- Revenue's appeal dismissed: MUMBAI ITAT

2022-TIOL-938-ITAT-MUM

DCIT Vs Tata Projects Ltd

Whether deduction has been claimed by assessee in respect of tax liability incurred during relevant year even though same has not been routed through P&L Account - YES : ITAT

Whether section 43B is attracted even though assessee has not routed Sales Tax/Works Contract Tax liability through P&L Account but has claimed same - YES : ITAT

- Revenue's appeal dismissed: MUMBAI ITAT

2022-TIOL-937-ITAT-MUM

Hira Technologies Pvt Ltd Vs Pr.CIT

Whether PCIT has erred in assuming revision jurisdiction u/s 263 as it is based on mistaken premise that assessee has not furnished any documents to prove genuineness of transaction - YES : ITAT

- Assessee's appeal allowed: MUMBAI ITAT

|

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-97-AAR-GST

PKS Centre For Learning

GST - Applicant is proposing to submit a bid in response to the tender floated by the Karnataka Secondary Education Examination Board for the printing of question papers and other examination materials - Applicant has, therefore, sought an advance ruling on the following questions viz. Whether the activity proposed to be undertaken by the Applicant, of printing stationery items such as question papers, admit cards, answer booklets, SSLC Pass Certificate, the overprinting of variable data and lamination, fail marks cards, Circulars, ID Cards and other formats used for and during examinations, envelopes for packing answer booklets on contract basis for the Karnataka Secondary Education Examinations Board and utilized for the conduct of examinations, would constitute a supply of service to an "educational institution" as defined in Notification 12/2017 CT(R) and whether services would be subject to Nil rate of tax by being covered against Sr. No. 66 (Heading 9992) of Notification No. 12/2017-Central Tax(Rate) .

Held: Supply of printing (of content supplied by the recipient of supplier) is the principal supply and, therefore, such supplies of printing stationery items such as question papers, admit cards, SSLC Pass Certificate, the overprinting of variable data and lamination, fail marks cards, Circulars, ID Cards on contract basis for the Karnataka Secondary Education Examinations Board and utilized for the conduct of examinations would constitute supply of service falling under Heading 9989 of the scheme of classification of services. (Circular No. 11/11/2017 , dated: 20.10.2017 relied upon) - In view of insertion of clause (iv) in paragraph 3 in the Explanation to notification 12/2017-CTR, by notification 14/2018-CTR dated 26 July 2018, it is evident that Karnataka Secondary Education Examination Board is an educational institution for the limited purpose of providing services by way of conduct of examination to the students - Therefore, services provided by the applicant are exempted as per Entry no. 66 of 12/2017-CTR as amended - However, the applicant is also supplying answer booklets, other formats used for and during examinations and envelopes for packing answer booklets printed with the content supplied by the recipient i.e., KSEEB - Here, the usage of the products gives its essential characteristic while printing (of content supplied by the recipient of supplier) is an ancillary activity and, therefore, such supplies would constitute supply of goods falling under respective Headings of Chapter 48 and 49 of the Customs Tariff - Supply of answer booklets and other formats used for and during examinations falling under the heading 4802 is taxable @12% as per entry No.112 of Schedule II of Notification No.1/2017-Central Tax (Rate), dated 28th June, 2017 and the supply of envelopes for packing answer booklets falling under the heading 4817 @18% is taxable as per entry 152 of Schedule III of Notification No. 1/2017-Central Tax (Rate) : AAR

- Application disposed of: AAR

2022-TIOL-96-AAR-GST

Bhagyam Binding Works

GST - Applicant is proposing to submit a bid in response to the tender floated by the Karnataka Textbook Society (KTBS) for printing of school textbooks as prescribed by the Karnataka State Board - Applicant, therefore, seeks an advance ruling on the following questions viz. whether KTBS can be classified as 'educational institution' for the purposes of applicability of GST on printing services provided to it by the applicant; whether KTBS can be classified as 'State government' and whether the rate of tax being charged at present by printers on printing of text books supplied to KTBS i.e. @12% is correct.

Held: KTBS is a society registered under the Karnataka Societies Act, 1960 and receives grants from the govt. of Karnataka for the supply of textbooks freely to students enrolled in government and aided schools and by sales to private schools affiliated to the Karnataka State Board - Therefore, KTBS is not an institution providing services by way of pre-school or higher secondary education or education as a part of curriculum or as a part of approved vocational course, but is is a society which is only into supply of textbooks to students - Hence KTBS cannot be classified as 'educational institution' and also cannot be considered as 'State government' - Applicant has stated that he provides the materials (physical inputs) and the content is owned by KTBS and the applicant is into printing of content supplied by the recipient and which is a principal supply - Such supplies would constitute supply of service falling under heading 9989 and is taxable in terms of Entry no. 27 of notification 11/2017-CTR as amended @19% and not @12% as claimed: AAR

- Application disposed of: AAR

|

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-763-CESTAT-AHM

Vipul Copper Pvt Ltd Vs CCE

CX - Issue involved is, whether appellant is eligible to Cenvat credit on basis of invoices of dealers which are claimed to have been received along with inputs - In entire investigation the evidences which were relied upon are related to transporters/ RTO check post - On basis of such third party evidences, revenue alleged that goods were not received by appellant in their factory - When statutory records maintained by appellant do not disclose absence of receipt of inputs in factory and there is no cogent evidence of disposal of same goods elsewhere, credit cannot be denied - It is also not the case of department that appellant have procured some unaccounted inputs to cover up quantity of input shown in invoices - There is no allegation by department regarding financial flow back that against invoices for which payments were made through cheque, any cash payment was received by appellant - Merely on the basis of transporter records and RTO check-post reports, it cannot be concluded that inputs were not received by appellant - In absence of any evidence to contrary, denial of Cenvat credit on basis of investigations conducted at third party end cannot be adopted as sole basis for denial of credit - Tribunal in case of M/s. Lloyds Metal Engg. Co. has held that burden to prove non-receipt of inputs is required to be discharged by Revenue by sufficient evidence - Where disputed consignments are entered in RG-23A Part I and Part II in chronological order, allegations of non-receipt of inputs cannot be upheld - Accordingly, allegation of Revenue that appellant have not received the inputs made against appellant are not sustainable and thus, impugned orders are set aside: CESTAT

- Appeals allowed: AHMEDABAD CESTAT

2022-TIOL-762-CESTAT-AHM

Phoenix Project Pvt Ltd Vs CCE & ST

ST - Issue involved is that whether the construction of Market Yard for agriculture produce for APMC is liable to service tax under Commercial and Industrial Construction service - This identical issue has been considered by Tribunal in case of AB Projects 2017-TIOL-3031-CESTAT-MUM and held that construction of Market Yard for APCM is not covered under the Commercial and Industrial Construction service - In view of said decision of Tribunal, issue is no longer res-integra - Accordingly impugned order is set aside: CESTAT

- Appeal allowed: AHMEDABAD CESTAT

2022-TIOL-761-CESTAT-DEL

Maj Shipping Pvt Ltd Vs CC

Cus - Issue involved is whether the penalty of Rs.50,000/- has been rightly imposed under Regulation 18 of CBLR, 2018 on appellant-CHA - The Commissioner has recorded categorical findings exonerating the appellant from all allegations made in SCN - Further, Commissioner has also revoked suspension of appellant, which had been issued earlier - There is no allegation of any mischief either by appellant or by its staff–H Card holder - Simply assisting the customs as a witnesses or otherwise in examination of goods does not amount to misconduct - Accordingly, penalty imposed under Regulation 18 of CBLR, 2018 is uncalled for: CESTAT

- Appeal allowed: DELHI CESTAT

2022-TIOL-760-CESTAT-KOL

Vedanta Ltd Vs CC

Cus - The facts leading to dispute are that the appellant had filed Shipping Bills for exportation of Iron Ore Fines and Iron (Fe) content was declared at more than 62%; that Revenue assessed to duty at Rs. 300/- per MT as was leviable; that appellant requested the Adjudicating Authority/Assistant Commissioner for rectification/correction of error - The Fe content was required to be determined on the basis of guidelines contained in judgement of Apex Court in case of Gangadhar Narsingdas Aggarwal - Same having not been done, it is clear that order of First Appellate Authority is correct - It is the settled position of law that not following the order of High Court or Apex Court would amount to mistake/error which is rectifiable under provisions of Section 154 of Customs Act, 1962 - It is strange that in second round and in impugned order, First Appellate Authority has ignored its own earlier order which has attained finality and thereby sustained a tangential order of lower authority - Further, as claimed by appellant provisional assessments have remained as provisional only, which are required to be assessed finally and hence, impugned order has to be set aside with a direction to lower authority to finalise the assessments adhering to guidelines of Apex Court in case of Gangadhar Narsingdas Aggarwal - Matter remanded to original authority with a direction to pass a speaking order, finalizing the assessments - It is also directed that relief as per Notification No. 62/2007-Cus be given taking into account the test reports; needless to reiterate that consequential benefits, if any, be given to appellant: CESTAT

- Matter remanded: KOLKATA CESTAT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|