|

|

2022-TIOL-NEWS-203 Part 2 | August 30, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

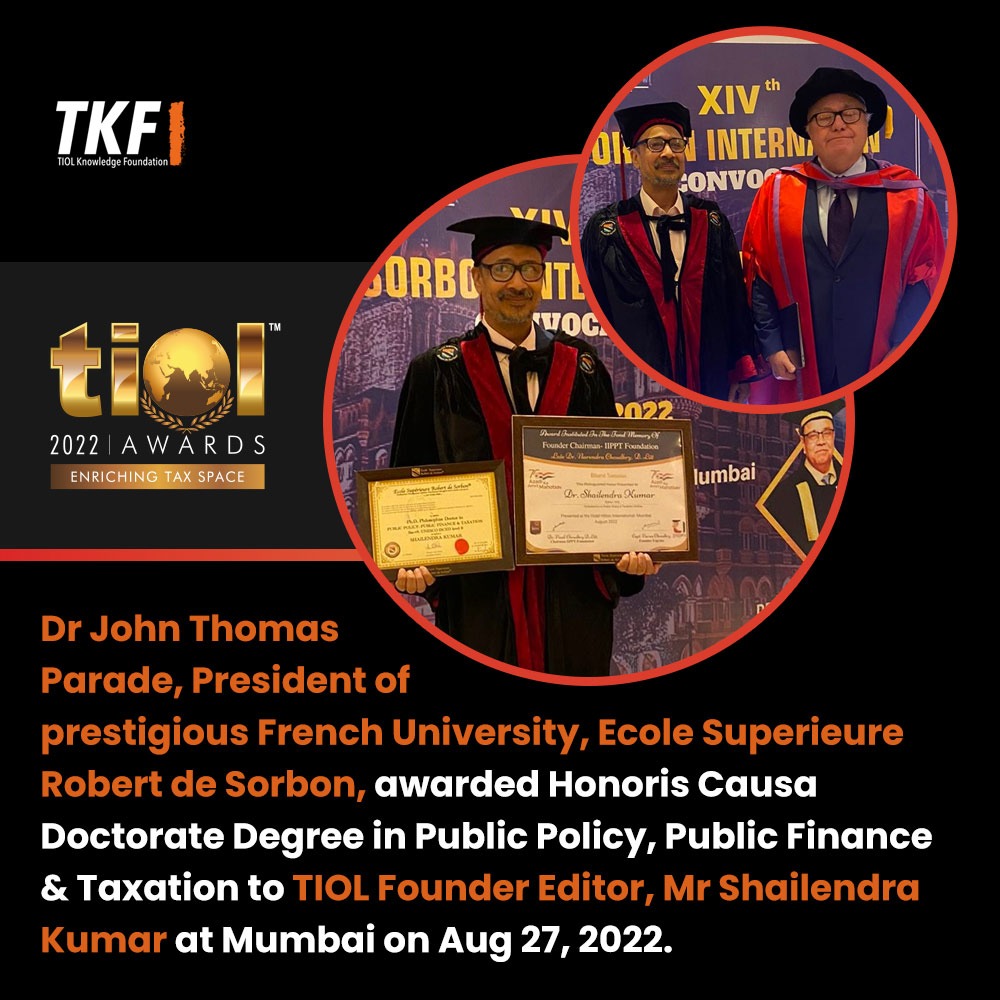

TIOL AWARDS |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-965-ITAT-CHD

Swami Gauraksha Nand Gaushala Vs CIT

Whether PCIT can exercise power u/s 263 and set aside assessment order if AO has failed to make correct application of law - YES : ITAT

- Assessee's appeal dismissed: CHANDIGARH ITAT

2022-TIOL-964-ITAT-AHM

ITO Vs Hemant Hiralal Shah

Whether since purchase of immovable property is duly explained with documentary evidences/additional documents no addition for unexplained investment u/s 69A can be made - YES : ITAT

- Revenue's appeal dismissed: AHMEDABAD ITAT

2022-TIOL-963-ITAT-PUNE

ACIT Vs JK Sugar

Whether merely because credit is outstanding for long time does not lead to conclusion that sundry creditors are not payable - YES : ITAT

Whether burden lies upon Department to establish cessation of liability before invoking provisions of section 41(1) of Act - YES : ITAT

- Revenue's appeal dismissed: PUNE ITAT

|

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

MISC CASE |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-1140-HC-PATNA-GST

G Power Solution Vs State of Bihar

GST - ITC claimed by the petitioner has been denied for having been claimed after expiry of due date u/s 16(4) of the Act - Petitioner seeks quashing of the aforesaid order on the ground that it has been passed without issuance of any SCN - Petitioner also prayed for quashing consequential demand of Rs.20,16,316/- issued in form GST-DRC-07 and GST DRC-13 issued by respondent to banks wherein direction is issued to freeze the bank accounts.

Held: This Court, notwithstanding the statutory remedy, is not precluded from interfering where, ex facie , Bench forms an opinion that the order is bad in law - Inasmuch as the reasons being (a) violation of principles of natural justice; (b) order passed ex parte in nature, does not assign any sufficient reasons even decipherable from the record as to how the officer could determine the amount due and payable by the assessee and the order, ex parte in nature passed in violation of principles of natural justice entails civil consequences - Petition disposed of in mutually agreeable terms viz. orders quashed and set aside; petitioner undertakes to deposit twenty percent of the amount of demand within four weeks; de-freezing/de-attaching of bank accounts; appear before assessing authority; no coercive steps during pendency of the case; to be decided within two months etc. - Petition disposed of: High Court

- Petition disposed of: PATNA HIGH COURT

2022-TIOL-1139-HC-MAD-GST

Pearl And Company Vs CCT

GST - Petition has been filed to quash the order passed by the second respondent and consequently direct the respondents to revoke the cancellation of the petitioner's registration; that due to cancellation of registration they are unable to carry on the business; that their representation to revoke the cancellation of registration was not accepted as it was not filed within the statutory period of 90 days.

Held: Court is of the view that restoring the registration would not cause any harm to the department but on the other hand it would be beneficial for the state to earn revenue - High Court in the case of Suguna Cutpiece Center [ 2022-TIOL-261-HC-MAD-GST ] has held that no useful purpose would be served by keeping the petitioners out of the GST regime as such assessee would still continue to do business and supply goods/services; that not bringing them to the GST fold/regime, would not further the interest of the Revenue - Court is, therefore, inclined to allow the writ petition in terms of the safeguards spelt out in the cited case - Petition allowed: High Court [para 6, 7]

- Petition allowed: MADRAS HIGH COURT

|

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-1141-HC-MAD-ST

Grand Technologies Vs Asstt. CGST & CE

ST - Amount paid as premium for grant of long term lease of industrial plots for a period in excess of 30 years - Service tax paid in the capacity of a service recipient - Exemption notification 41/2016-ST dated 22.09.2016 given retrospective effect by insertion of section 104 in Finance Act, 1994 by Finance Bill, 2017 - Finance Bill, 2017 was assented on 31.03.2017 and the six month period for claiming refund/filing refund claim ended on 30.09.2017 - Petitioner challenges an order that has been passed rejecting the refund claim on the ground of being time barred - Inasmuch as petitioner had made an application on 06.03.2017 to Pondicherry Industrial Promotion Development and Investment Corporation (PIPDIC) but not before the Service tax authorities - PIPDIC rejected the request (on 28.06.2018) as misconceived and the petitioner, thereafter, wrote to the Superintendent, Service tax department on 18.10.2018 - Vide impugned order-in-original dated 28.01.2019, the claim was rejected by the Service Tax authorities, therefore, the present petition - Petitioner submits that the appropriate limitation for processing the refund claim would be a period of three years, since by the very grant of refund, the levy of service tax on the lease premium is rendered unconstitutional - Alternate submission is that the time spent before a wrong forum PIPDIC should be excluded for the purpose of computation of limitation, more so, because the refund claim before PIPDIC was filed in time.

Held:

++ First argument that the provisions relating to levy of service tax on lease premium are rendered unconstitutional or erroneous by virtue of insertion of s.104 in 2017 is misconceived and, therefore, rejected as this is not a case where, by virtue of an amendment, by way of insertion of a provision, the charging provision is rendered unconstitutional - Provisions of s.66/66B insofar as applicable to this issue have not been struck down as unconstitutional or ultra vires but are merely rendered inoperative by virtue of the munificence provided by section 104 - Thus, this is not a case where the assessee becomes entitled to a refund on account of any deficiency or lacunae in the statutory provision itself but on account of a beneficial policy extended by the government - The notification granting such benefit would thus have to be construed strictly and it is solely upon compliance with the conditions set out therein that the assessee would become entitled to refund: High Court [para 18 to 20]

++ As regards alternate submission, section 104 does not stipulate where the claim is to be filed and to this extent, the filing of claim before PIPDIC cannot be said to be in contravention of the provision - After all, the petitioner had been paying the amount of service tax only to PIPDIC and hence its stand that the refund must be sought from the entity to which the payment had been made can well be one legitimate, acceptable interpretation - Application has been filed only on 18.10.2018 before the Service Tax authorities, which is, admittedly, beyond the period of six months as prescribed u/s 104 and to this extent, the impugned order cannot also be said to be erroneous - One cannot expect the authorities to take an expansive view of the matter as urged by the petitioner and consider the application filed before PIPDIC as a refund claim u/s 11B - However, power endowed upon the High Court in terms of Article 226 is substantial and wide, facilitating one to adopt a holistic perspective of all issues in arriving at a decision - Sequence of events reveals that the petitioner is not guilty of any violation, except perhaps, an error in its understanding of s.104 - Since the error is not one of approaching the wrong officer within the same department, the decisions cited by the petitioner are inapplicable - However, the mere fact that the entity approached was PIPDIC and not an officer of department does not persuade the Bench to take a view adverse to the petitioner as such a conclusion would be hyper-technical - Impugned order does not take a plausible view, therefore, it is set aside, invoking and in exercise of powers vested under Article 226 of the Constitution of India - Request of the petitioner shall be processed by the respondents and a decision taken on merits of the refund claim within a period of four weeks - Petition is allowed: High Court [para 22 to 27]

- Petition allowed: MADRAS HIGH COURT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|