|

|

2022-TIOL-NEWS-204| August 31, 2022

|

|

|

Dear Member,

,Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

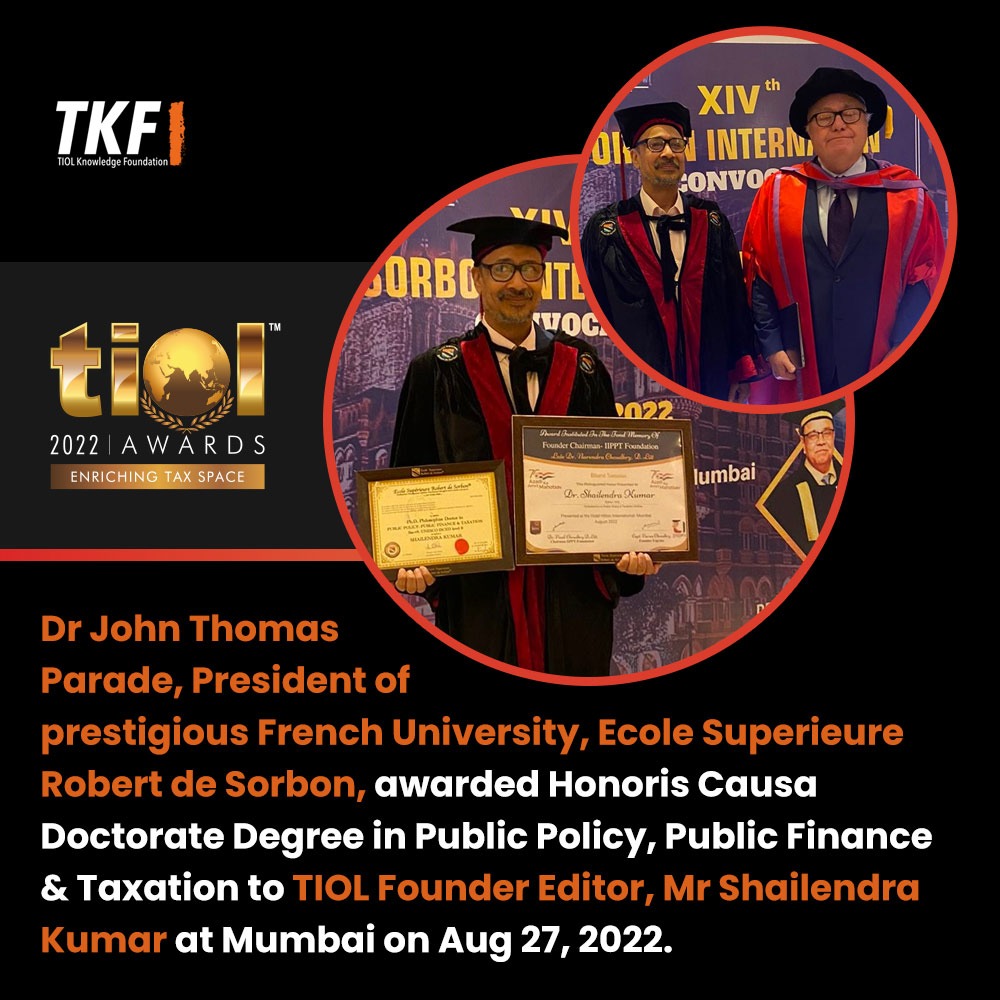

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-970-ITAT-MUM

DCIT Vs Unique Land Realty Pvt Ltd

Whether valuation of preference shares under discounted free cash flow method is one of recognized methods - YES : ITAT Whether assessee has discharged initial onus placed upon it u/s 68 and AO has failed to disprove onus discharged by assessee - YES : ITAT

- Revenue's appeal dismissed: MUMBAI ITAT

2022-TIOL-969-ITAT-JAIPUR

Manglam Land Bank Company Vs Pr.CIT

Whether order of PCIT u/s 263 can be upheld when assessee fails to demonstrate on merits that view taken by AO before passing assessment order is plausible view - YES : ITAT

- Assessee's appeal dismissed: JAIPUR ITAT

2022-TIOL-968-ITAT-AHM

Texraj Realty Pvt Ltd Vs Pr.CIT

Whether issue of land vacation compensation charges is duly examined by AO by making necessary inquiries and is partly allowed by AO by applying his mind - YES : ITAT

- Assessee's appeal partly allowed: AHMEDABAD ITAT

2022-TIOL-967-ITAT-CHD

DCIT Vs Rajinder Pal Garg

Whether Agriculture land is not 'asset' for purposes of levying capital gain - YES: ITAT Whether Ghasni land is an agricultural land which is outside the purview of capital asset u/s 2(14)(b), as it was situated in the State - YES: ITAT

- Revenue's appeal dismissed: CHANDIGARH ITAT

2022-TIOL-966-ITAT-CHD

Valco Industries Ltd Vs ACIT

Whether assessee's claim once allowed cannot be revisited, without establishing that there has been some fraud or misrepresentation on part of assessee - YES: ITAT

- Assessee's appeal partly allowed: CHANDIGARH ITAT

|

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-1146-HC-J&K-GST

Lupin Ltd Vs UoI

GST - Petitioner alleges that he was entitled to tax exemption up to year 2023 and, therefore, under new tax regime, respondents are liable to extend budgetary support up to that period - Accordingly, petitioner applied for grant of budgetary support for period January to March, 2020 for a sum of Rs. 93,29,509/- - Respondent accepted the claim for grant of Rs. 68,67,539/- but rejected the claim for budgetary support for balance amount of Rs. 24,61,920/- - No reason has been assigned anywhere as to why claim in respect of balance amount has been rejected - Ineligibility of petitioner to receive budgetary support has been decided on basis of office memorandum - The said office memorandum was not in existence on the date on which impugned order was passed i.e. on 26.08.2020 - Therefore, it is misconceived to allege that petitioner was denied benefit of budgetary support on account of ineligibility - It is well settled that validity of an order has to be adjudged on the basis of reasoning contained therein and not otherwise - Impugned order is unsustainable in law and that respondents fell clearly in error in declining budgetary support for part of amount for the period January to March, 2020 - Court has not adjudicated about eligibility of petitioner for benefits of budgetary support and the period for which the same is available to petitioner: HC

- Writ petition disposed of: JAMMU AND KASHMIR HIGH COURT

2022-TIOL-1145-HC-DEL-GST

Grahil Enterprises LLP Vs UoI

GST - Petitioner says that Integrated Goods and Services Tax (IGST) against 11 shipping bills has been blocked - According to him, IGST had to be refunded to petitioner, as these were zero rated supplies - According to petitioner, IGST refund should be ordered along with interest @ 9% per annum - Petitioner also seeks amounts towards duty drawback - In prayer clause of petition, amount claimed towards IGST is Rs. 99,11,273/-, and likewise, towards duty drawback, amount claimed is Rs. 6,96,027/- - Counter-affidavit(s) will be filed within next four weeks - Amended memo of parties will be filed within next ten days: HC

- Matter listed: DELHI HIGH COURT

2022-TIOL-1144-HC-DEL-GST

Grahil Enterprises LLP Vs UoI

GST - Revenue has instructions to convey to the Court that compliance has been made qua the order dated 25.05.2022 - Petitioner says that they have no such instructions - In case compliance is not made, concerned officer shall remain present in the Court on next date of hearing: HC

- Matter listed: DELHI HIGH COURT

2022-TIOL-1143-HC-DEL-GST

Grahil Enterprises LLP Vs UoI

GST - A copy of compilation of documents has been furnished, which seem to suggest that grievance of petitioner has been redressed - Since the grievance of petitioner stands redressed, petition and pending application are closed: HC

- Writ petition closed: DELHI HIGH COURT |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-781-CESTAT-CHD

Tej Ram Dharam Paul Vs CCGST

CX - Issue relates to classification of goods manufactured by appellant as to whether that product is chewing tobacco classifiable under heading 24039910 as claimed by appellants or it is jarda scented tobacco classifiable under Tariff Item 2403 99 30 of Central Excise Tariff as claimed by revenue - Admittedly Chapter 24 of Central Excise Tariff which relates 'Tobacco and Manufactured Tobacco substitutes' has not defined Chewing Tobacco and Jarda Scented Tobacco - In same way section / chapter heading notes in chapter 24 of HSN are silent on this issue - Department rests its case only on basis of Test Reports under Test Memo of CRCL - Since the CRCL report which has been relied upon by revenue is not as per BIS specification, reliance placed on it by revenue as well as by adjudicating authority for changing the classification is totally misplaced - Neither in SCN nor before adjudicating authority or before Tribunal, it is the case that appellant have used 'jarda scent' in their product - Even statements relied upon by department nowhere mention that 'jarda scent' has been used by appellant in their product - Commissioner mistook the pleasant odour as mentioned in CRCL test report as scent which is totally different from 'jarda scent', an essential ingredient for manufacturing jarda scented tobacco - The classification given by appellant is proper and hence impugned order is set aside: CESTAT

- Appeal allowed: CHANDIGARH CESTAT

2022-TIOL-780-CESTAT-AHM

Piyush S Viramgama Vs CC

Cus - Appeal filed against impugned order whereby Commissioner imposed penalties upon appellants under Section 112(a) of Customs Act, 1962 and under Section 114AA ibid for their alleged involvement of forged/fake VKGUY/DEPPB license and imports there under - In appellant's matter, Commissioner has decided matter ex-parte - He has sought for cross–examination but same was also not considered by Commissioner - It is basic principle of Natural justice that no one can be condemned unheard - Natural Justice is an un codified law purely based on principle of substantial justice and judicial spirit - Principles of Natural Justice are cardinal principles, which must be followed in every judicial and quasi judicial proceeding - Therefore, ex-parte order passed by Adjudicating Authority will not sustain - Matter remanded to Adjudicating Authority for passing a fresh order after granting sufficient personal hearing: CESTAT

- Matter remanded: AHMEDABAD CESTAT

2022-TIOL-779-CESTAT-KOL

Global Castings Pvt Ltd Vs CCGST & CE

ST - The original refund claim was filed on 22.07.2015 for the period 2014-15 - Under clause (g) to proviso appended to Notification No. 41/2012-S.T., it has been provided that claim for rebate of Service Tax paid on specified services used for export of goods filed on 21.07.2015 covered the period from April, 2014 and so as advised by Department, appellant requested to return the claim - Thereafter after several correspondences, claim was filed - Adjudicating authority rejected the claim on the ground of limitation and such order was upheld by Commissioner (A) - It is observed that initial date of filing of rebate claim i.e. 22.07.2015 is relevant date as per Section 11B of CEA, 1944 - Hence, rebate claims are not barred by limitation - Technical deviations or procedural lapses are to be condoned, if there is sufficient evidence regarding export of duty paid goods - Refund claim is within the prescribed time limit and accordingly, matter is remanded to adjudicating authority to consider and dispose the refund claim in accordance with law: CESTAT

- Matter remanded: KOLKATA CESTAT

2022-TIOL-778-CESTAT-KOL

Balajee Machinery Vs CCGST & CE

ST - Assessee is in appeal against impugned order whereby Commissioner has confirmed demand of Service Tax along with interest and penalty - The very basis of impugned demand is figures appearing in Income Tax Portal and Profit and Loss account - Since the records have been duly audited, demand cannot be raised for same period on account of change in opinion - Appellant had duly submitted VAT Returns which have been recorded by Commissioner in impugned order - In VAT Return for Financial Year 2015-16, appellant has duly disclosed sales turnover of Rs. 8,13,46,124/- on which VAT has been duly paid, whereas impugned demand has been raised considering the value of taxable services to be Rs. 8,28,06,929/- by taking higher of amount appearing in profit and loss account and Income Tax Return - Similarly, for Financial Year 2016-17, value of taxable services have been considered to be Rs. 8,96,52,728/- whereas appellant has duly disclosed sales turnover of Rs. 8,79,88,828/- in its VAT Return on which VAT has been paid at applicable rate - It appears that major demand has been computed on sales turnover - In so far as issue of limitation is concerned, no ingredient of fraud or suppression found with an intent to evade payment of tax - Demand raised for period up to March 2015 is completely barred by limitation and accordingly same is set aside - Further, since there is no element of fraud or suppression, entire penalty amount is liable to be set aside - In so far as demand pertaining to Financial Year 2015-16 and 2016-17 is concerned, by considering reconciliation statements and Chartered Accountant Certificate submitted by appellant before Adjudicating Authority, as well as VAT returns, there is no occasion to sustain demand as raised in impugned order: CESTAT

- Appeal allowed: KOLKATA CESTAT

|

|

|

|

|

|

|

|

|

|

|

|

|

NEWS FLASH |

|

|

|

|

|

|

|

|

| |

ACC appoints two new Members for CBIC - Mr Alok Shukla & Rama Mathew

Manufacturing in Covid-walloped China further cramps in August month

Omicron - Daily death count - 248 in Japan; 242 in US & 196 in Brazil

Taiwan's China Airlines buying 16 Boeing 787s for USS 4.6 bn

Google Play shows door to Trump's Truth Social

Singapore eyeing Hong Kong HNIs by easing visa rules

Mikhail Gorbachev, who ended Cold War, passes away at 91

SC widens definition of ‘family' by extending it to same-sex couples and other households

Saudi woman put in jail for 45 years for social media posts

CCP to re-elect Xi Jinping for 3rd term on Oct 16

Portugal Health Minister puts in papers after pregnant tourist dies after being turned away by hospital

NASA to make second bid to launch Moon Rocket on Saturday

Google, Amazon chide Microsoft for cloud computing changes snarling switch by customers

Govt keen to promote 10K start-ups in next 5 years

FBI alerts investors against DeFi platforms

Govt again bans export of wheat, atta & maida |

|

|

|

|

|

|

|

|

TOP NEWS |

|

|

|

|

|

JEST GST |

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|