|

|

2022-TIOL-NEWS-257| November 03, 2022

|

|

|

Dear Member,

Sending following links. Warm Regards,

TIOL Content Team

TIOL PRIVATE LIMITED.

For assistance please call us at + 91 7838594749 or email us at helpdesk@tiol.in. |

|

|

|

|

|

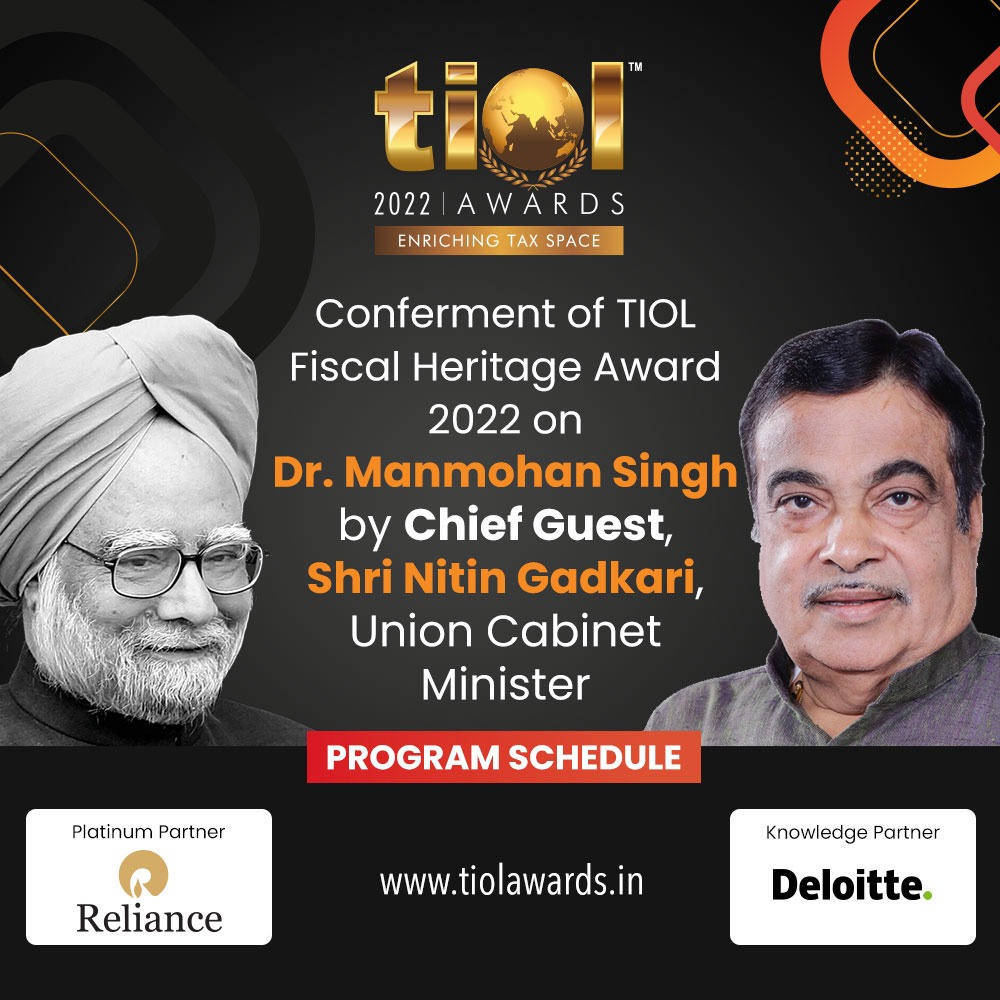

TIOL AWARDS |

|

|

|

|

|

TODAY'S CASE (DIRECT TAX) |

|

|

|

|

|

INCOME TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-1261-ITAT-MUM

ITO Vs Sanika Avadhoot Shilotri

Whether if sale purchase transaction of property is treated as transfer by notionally assigning value then benefit of indexation and benefit of Sec. 54 is to be given to assessee - YES : ITAT

- Revenue's appeal dismissed: MUMBAI ITAT

2022-TIOL-1260-ITAT-DEL

M3M India Holdings Vs ACIT

Whether no addition u/s 69 can be made by in hands of assessee when assessee is not party to transaction - YES : ITAT

- Assessee's appeal allowed: DELHI ITAT

2022-TIOL-1259-ITAT-AHM

Greenwell Orchards Vs Pr.CIT

Whether PCIT without verifying status of appeal proceedings with CIT (A) invoked Revision Proceedings - NO : ITAT

- Assessee's appeal allowed: AHMEDABAD ITAT

2022-TIOL-1258-ITAT-BANG

Ukn Properties Pvt Ltd Vs DCIT

Whether no disallowance u/s 14A can be made when there is no exempt income earned during relevant year - YES : ITAT

- Assessee's appeal partly allowed: BANGALORE ITAT

2022-TIOL-1257-ITAT-HYD

Nekkanti Systems Pvt Ltd Vs ITO

Whether PCIT has rightly exercised power u/s 263 as losses caused to directors in their accounts, has been allowed to be set off against income of assessee company by AO without enquiry - YES : ITAT

- Assessee's appeal dismissed: HYDERABAD ITAT

|

|

|

|

|

|

|

|

|

TODAY'S CASE (INDIRECT TAX) |

|

|

|

|

|

|

|

|

|

PMLA - By handing over money with the intent of giving bribe, such person will be assisting or will knowingly be a party to an activity connected with the proceeds of crime - Offence correctly registered: SC

GST - Merely because petitioner has an option of seeking revocation of cancellation of registration, u/s 30 of the Act, it cannot be said that independent of the said remedy, an appeal would not be maintainable: HC

GST - SCN issued pursuant to audit observation - Petitioner to reply to the same and order to be passed after hearing - no coercive action in the interregnum: HC

GST - Hot hurry on part of authorities sacrificed the right to reply and in the process there was an evident breach of principles of natural justice to the prejudice of the petitioner: HC

CX - In absence of any proceedings with respect to demand of Service Tax, charge of suppression of fact does not exist, for holding that there is a suppression of facts on the part of appellant : CESTAT

Cus - Import of prohibited goods - Penalty levied u/s 114A is not tenable, where no omission or commission of appellant is linked to import of such goods & were confiscated: CESTAT

Cus - Removal of goods from SIIB Custody amount to Theft under IPC, since no Bill of Entry was filed for these goods - Penalty imposed on appellant without indictment is invalid: CESTAT

ST - The mere fact that AVETCS contains computer system does not make it Computers, Computer Systems or Computer Peripherals, appellant is not entitled to benefit of Notfn 20/2003-ST : CESTAT

Cus - Adjudged dues cannot be recovered by department however, issue has to be decided by department and not by Tribunal as there is no provision made in Customs and Central Excise Act to give effect of NCLT proceedings : CESTAT

CX - M/s Parle was justified in distributing credits on input services attributable to final product on a pro-rata basis, proportionate to turnover of each unit between manufacturing plants and its contract manufacturing units under Rule 7(d) of CENVAT Rules : CESTAT |

|

|

|

|

|

|

|

|

GST CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-1379-HC-KAR-GST Shailaja Chandrashekar Vs Addl.CCT

GST - Respondents had passed an order dated 13.04.2020 revoking/cancelling the GST registration of the petitioner - Petitioner submits that due to COVID-19 they could not file an appeal within the prescribed period and subsequently filed an appeal on 30.03.2022 - However, on 22.04.2022, the appellate authority dismissed the appeal on the ground that the appeal was not maintainable inasmuch as the only option available to the petitioner was to approach the respondent no.2 for revocation of the cancellation and restoration of the registration - Petitioner further submits that the entire tax payable up to the date of cancellation and for the subsequent period also a certain amount has been deposited before the appellate authority - Aggrieved, Petitioner is before the High Court by way of the present petition. Held: As against an order passed by the respondent No.3 canceling the registration of GST, the petitioner has a remedy by way of appeal under Section 107 before the respondent No.1-Appellate Authority - It is relevant to state that merely because the petitioner has an option of seeking revocation of the cancellation under Section 30 of the CGST Act, it cannot be said that independent of the said remedy, an appeal would not be maintainable - As such, the impugned order passed by the respondent No.1-Appellate Authority summarily dismissing the appeal on the ground that it is not maintainable in view of availability of the remedy of seeking revocation of the cancellation is clearly contrary to Section 107 and Section 30 of the CGST Act and same deserves to be set aside - Explanation offered by the petitioner in not seeking revocation of the cancellation within a stipulated period of 30 days under Section 30 of the CGST Act is to be held as valid and proper and respondent No.2 is to be directed to reconsider the claim of the petitioner for revocation of the cancellation order in accordance with law subject to payment of outstanding due taxes by the petitioner in accordance with law - Petition is allowed: High Court [para 6, 7, 8]

- Petition allowed: KARNATAKA HIGH COURT

2022-TIOL-1378-HC-KAR-GST

Dilip Kumar S Vs State of Karnataka

GST - An intimation of audit observation dated 21.02.2022 was issued by respondent No.4, which was challenged by the petitioner - However, since there was no interim order passed by this Court, respondent No.4 has proceeded to prepare an audit report subsequent to which a show cause notice dated 26.08.2022 has been issued - It is the grievance of the petitioner that since, there is no interim order was passed in the present petition, the respondents are attempting to proceed further and initiate recovery proceedings. Held: A perusal of the show cause notice dated 26.08.2022 issued by the respondents u/s 73(1) of the Act, 2017 r/w rule 142 of GST Rules, 2017 will clearly indicate that the petitioner has been merely called upon to show cause as to why the amounts, penalty, interest etc. as detailed in the audit report should not be levied upon him - The said SCN also provides an opportunity for personal hearing to the petitioner and who is also be entitled to produce pleadings and documents in support of his claim along with the reply - Without expressing any opinion on the merits/de-merits of the rival contentions, Bench deems it just and appropriate to dispose of the petition reserving liberty in favour of the petitioner to submit his reply/response to the aforesaid show cause notice dated 26.08.2022, along with all relevant documents within a period of one month - Respondent concerned to provide an opportunity of personal hearing and proceed further to pass appropriate speaking orders in accordance with law - Respondents not to take any coercive/precipitative steps against the petitioner in the interregnum - Petition disposed of: High Court [para 5, 6]

- Petition disposed of: KARNATAKA HIGH COURT

2022-TIOL-1377-HC-AHM-GST

Virat Acier Pvt Ltd Vs State of Gujarat

GST - Petitioner has challenged the order dated 07.07.2022 passed in form GST MOV-11 - It is the case of the petitioner that during the course of transit, the lorry carrying Scraped stainless steel was intercepted by respondent no. 3 on 29.06.2022; statement was recorded of the lorry driver and the goods valued at Rs. 36,16,500/- were confiscated and penalty was imposed of Rs. 6,50,970/- and fine of an equal amount. Held: It can be immediately noticed that the impugned order came to be passed in quick succession and that too without permitting the petitioner to file reply - The hot hurry on the part of the authorities sacrificed the right of the petitioner to reply and in the process there was an evident breach of principles of natural justice to the prejudice of the petitioner - A prima facie case is, therefore, made for grant of interim relief - It would be just and proper to direct the respondents to release the goods and conveyance of the petitioner, however, upon imposition of suitable conditions - By way of interim relief, the respondents are directed to release the goods and conveyance of the petitioner on condition that the petitioner deposits with the competent authority an amount of Rs. 13 lakhs and furnishes a bank guarantee of Rs. 36,16,500/- within ten days - Interim relief granted: High Court [para 5, 5.1, 6.3]

- Interim relief granted: GUJARAT HIGH COURT |

|

|

|

|

|

|

|

|

MISC CASE |

|

|

|

|

|

|

|

|

|

2022-TIOL-92-SC-PMLA

Directorate of Enforcement Vs Padmanabhan Kishore

PMLA - Directorate of Enforcement has challenged the order dated 01.03.2021 passed by the Madras High Court - Facts are that the respondent had allegedly handed over a sum of Rs.50,00,000/- to a public servant, which transaction and the surrounding circumstances were projected in FIR dated 29.8.2011, leading to registration of crime under Section 120B, Indian Penal Code, 1860 and Sections 7,12,13(1)(d) read with Section 13(2) of the Prevention of Corruption Act, 1988 - Later, a case was registered by the Enforcement Directorate against the accused including the respondent under Sections 3 and 4 of the PML Act - Respondent had submitted before the Madras High Court that the amount in question, as long as it was in the hands of respondent, could not be said to be tainted money; that it assumed such character only after it was received by the public servant; and as such the respondent could not be said to be connected with proceeds of crime and could not be proceeded against under the provisions of the PML Act - High Court had accepted the submission and allowed the writ petition and quashed the proceedings in PML Act against the respondent, which decision is presently under challenge.

Held: It is true that so long as the amount is in the hands of a bribe giver, and till it does not get impressed with the requisite intent and is actually handed over as a bribe, it would definitely be untainted money - If the money is handed over without such intent, it would be a mere entrustment - If it is thereafter appropriated by the public servant, the offence would be of misappropriation or species thereof but certainly not of bribe - The crucial part, therefore, is the requisite intent to hand over the amount as bribe and normally such intent must necessarily be antecedent or prior to the moment the amount is handed over - Thus, the requisite intent would always be at the core before the amount is handed over - Such intent having been entertained well before the amount is actually handed over, the person concerned would certainly be involved in the process or activity connected with "proceeds of crime" including inter alia , the aspects of possession or acquisition thereof - By handing over money with the intent of giving bribe, such person will be assisting or will knowingly be a party to an activity connected with the proceeds of crime - Without such active participation on part of the person concerned, the money would not assume the character of being proceeds of crime - The relevant expressions from Section 3 of the PML Act are thus wide enough to cover the role played by such person - It is quite clear that the respondent was prima facie involved in the activity connected with the proceeds of crime - View taken by the High Court that the respondent cannot be held liable for the offence under the PML Act is thus completely incorrect - Appeal is allowed by setting aside the judgment and order passed by the High Court: Supreme Court [para 16, 17, 18, 20]

- Appeal allowed: SUPREME COURT OF INDIA |

|

|

|

|

|

|

|

|

INDIRECT TAX |

|

|

|

|

|

|

|

|

|

2022-TIOL-984-CESTAT-AHM

Kkalpana Industries India Ltd Vs CCE & ST

CX - The Cenvat credit was denied by Lower Authorities on the ground that since there is a suppression of fact in terms of Rule 9(1)(bb) of Cenvat Credit Rules, 2004, appellant is not entitled for Cenvat credit and consequential the refund - Though appellant have paid Service Tax on Ocean freight on instruction of audit, but no SCN was issued for demand of such Service Tax - In absence of any proceedings with respect to demand of Service Tax, charge of suppression of fact does not exist, for holding that there is a suppression of facts on the part of appellant - It is necessary that said charge is adjudicated by issuing a SCN and adjudication process, which is absent in present case - Since, there is no suppression of fact, Rule 9(1)(bb) ibid is not applicable, accordingly, appellants are entitled for Cenvat credit - As regard the cash refund of said amount, even though there is no provision under Section 11B but as per special provision under Section 142(3) of CGST Act, appellant is prima facie entitled for cash refund - Moreover, issue of taxability on Ocean freight has now been decided in case of M/s. SAL Steel limited 2020-TIOL-163-HC-AHM-ST - Since this judgment was not available before Lower Authority, issue of taxability is also kept open and appellant has liberty to raise this issue also before Adjudicating Authority - Accordingly, impugned orders are set aside: CESTAT

- Matter remanded: AHMEDABAD CESTAT

2022-TIOL-983-CESTAT-DEL

M B Industries Pvt Ltd Vs CCGST & CE

CX - Issue involved is, whether issuance of Input Service Distributor (ISD) invoice by M/s Parle Biscuits Pvt. Limited to its contract manufacturing unit M/s M.B. Industries Pvt. Ltd., is legal and correct when the contract manufacturing is carried in terms of Notification No. 36/2001-C.E. (N.T.) - Issue herein is squarely covered in favour of appellant by Larger Bench ruling of Tribunal in case of Krishna Food Products 2021-TIOL-294-CESTAT-DEL-LB - Even in terms of provisions of Rules 2(m) and 7 of Cenvat Credit Rules, 2004, as they stood prior to 01.04.2016, appellant company can distribute CENVAT credit in respect of service tax paid on input services to its manufacturing units, including a job worker - Following the said order, impugned orders are set aside: CESTAT

- Appeals allowed: DELHI CESTAT

2022-TIOL-982-CESTAT-MAD

Hari Prabhu Vs CC

Cus - One M/s Universal Exim, (IEC No. 0415019303) had imported goods declared as "Stationery Goods" vide Bill-of-Lading dated 02.01.201 - The consignment was imported in container bearing number TCNU8248262 at M/s. A.S. Shipping Agencies Private Limited,- As on the date of the Demand-cum-Show Cause Notice, the importer had not filed Bill-of-Entry for clearance of the said cargo - Based on specific intelligence, the consignment was taken up for examination wherein it was observed that apart from stationery goods, the consignment also contained cosmetic items of various brands like MAC, HUDA BEAUTY, KYLIE, LAKME, MAYBELLINE, LOREAL, MATRIX, etc. - The consignment consisted of 108 cartons of stationery goods, 445 cartons of cosmetic items of various brands like LAKME, MAYBELLINE, LOREAL, MATRIX, etc., that were registered with the Customs for the purpose of Intellectual Property Rights (IPR) and 303 cartons of non-IPR infringing cosmetic items bearing various brand names like Chanlanya, Glammiere, Huda Beauty, Kylie, Kryolan, etc - The Revenue suspected that there was infringement of Intellectual Property Rights of some of the above brands - The importer had mis-declared the description of the subject goods as "Stationery Goods" by unauthorizedly importing 445 cartons of cosmetic items, as indicated above, in violation of the Trademark Act, 1999, which prompted the authorities to believe that the above goods appeared to be prohibited under Section 11 of the Customs Act, 1962 read with the Intellectual Property (Imported Goods) Enforcement Rules, 2007 and that consequently, the said goods were liable for confiscation under Sections 111(l) and 111(m) ibid - Such findings were sustained on appeal - The Officers of the SIIB, during investigation, summoned various persons and recorded statements under Section 108 and thereafter, penalties were proposed on various persons including penalties under Section 112(b) and Section 114AA ibid on the appellant before this forum. Held - The findings of the AO clearly exonerates this appellant from the penal action under Section 114AA of the Customs Act, 1962, for the reason that there was no material on record to prove that the appellant had submitted the fake gate pass - This, combined with another part of the order holding there to be no evidence other than statement of one Shri R Suresh to suggest the involvement of this appellant in the illegal removal of the subject container, clearly indicates that the appellant has been targeted for no reason whatsoever in this case - Also, there is no material on record as to role of the appellant, omission or commission, that has led to the confiscation of the prohibited goods and it is a matter of record that no goods were confiscated at all in this case on hand - It is also a matter of record that the subject container was very much in the custody of the SIIB Officers since no Bill-of-Entry was ever filed and hence, the alleged removal from the CFS could only attract act of 'theft' under the Indian Penal Code, for which a separate police complaint was lodged and the Revenue has not placed before me the current status of the said complaint - The Revenue has also not placed anything on record as to against whom such complaint has been lodged and if this appellant is one of the accused - Hence, as far as this appellant is concerned, the statement of Shri Chandrasekhar or even that of Shri R. Suresh is clearly insignificant, also for the reason given by the AO in the Order-in-Original and hence, the penalty levied on this appellant is arbitrary and unsustainable: CESTAT + The Revenue appears to have relied on the statement of Shri R. Suresh, Partner of M/s. Saptagiri Logistics, at whose godown it is alleged that the Container No. TCNU 8248262 reached on 20.08.2018, which was referred by his friend Shri Chandrasekhar for the job of shifting the cargo contained in this trailer to other vehicles and hence, both Shri R. Suresh and Shri Chandrasekhar would be the necessary parties who could have revealed the truth. There is nothing on record other than Shri Chandrasekhar informing Shri R. Suresh that the above job was given to him by the appellant before this forum. Surprisingly, this Chandrasekhar, who is alleged to have been assigned the job, is not a party/co-noticee. It is also a matter of record that in his voluntary statement, said Chandrasekhar has denied having known this appellant.

- Appeal allowed: CHENNAI CESTAT

2022-TIOL-981-CESTAT-AHM

Ultratech Nathdwara Cement Ltd Vs CC

Cus - Applicant filed the application in view of NCLT order - NCLT has passed an order by approving resolution plan of company M/s. Binani Cement Limited in favor of M/s. Ultratech Nathdwara Cement Limited, who is resolution applicant - As per resolution plan approved by NCLT and in light of Supreme Court judgment in case of Ghanashyam Mishra & Sons Pvt. Ltd. , it prima facie appears that adjudged dues cannot be recovered by department however, issue has to be decided by department and not by Tribunal - For this reason, that firstly, there is no provision made in Customs and Central Excise Act to give effect of NCLT proceedings - This Tribunal being creature under Customs Act, even though the Insolvency and Bankruptcy Code have over riding effect over all the other Acts in absence of any explicit provision under Customs/Central Excise Act, Tribunal cannot decide finally whether adjudged amount can be recovered by department or otherwise - Appeal became infructuous - Both the sides have liberty that in case of any amicable resolution is not arrived at between the appellant and respondent to approach this Tribunal to revive the present appeal and be decided on merit if required - The assessee against whom IBC proceedings are initiated invariably approach Tribunal through miscellaneous application for disposing of appeals in the light of NCLT's orders - However, in absence of any guideline by CBIC, revenue is unaware as to what stand is to be taken in such cases - Therefore, Central Board of Indirect Taxes & Customs may consider issuing guideline/procedure for dealing with case before this Tribunal wherein, against the assesse's company IBC proceeding has been initiated: CESTAT

- Appeal dismissed: AHMEDABAD CESTAT

2022-TIOL-980-CESTAT-AHM

Chashmita Engineers Pvt Ltd Vs CCE & ST

ST - Assessee is in appeal against demand of Service Tax, interest and imposition of penalties - Assessee is seeking benefit of Notification No. 20/2003-ST in respect of service provided by them in respect of AVETCS system - It is seen that Notification No. 20/2003-S.T. provides exemption only to maintenance or repair of computers, computer systems or computer peripherals - The AVETCS systems can by no means be called computers, computer systems or computer peripherals - The mere fact that AVETCS contains computer system does not make it Computers, Computer Systems or Computer Peripherals - Appellant is not entitled to benefit of said Notfn - The second issue relates to imposition of penalty in respect of payments for period September, 2006 to March, 2007 and April, 2007 to June, 2007 are concerned - Appellant has claimed that payments were made voluntarily - Significant force found in argument given by Commissioner (A) in impugned order consequently, the appeal filed on this count is also dismissed: CESTAT

- Appeal dismissed: AHMEDABAD CESTAT

|

|

|

|

|

|

|

|

|

|

|

|

NEWS FLASH |

|

|

|

|

|

|

|

|

| |

Govt notifies e-waste rules effective from April 1, 2023

No stopping to Fed until Inflation relents; Interest rate further hiked by 75 basis points; RBI to follow suit

5 lions walk out of Australian zoo but officials prevail to bring them back

Ranks of foreign terrorists operating in Kashmir swells: MHA

Canada asks Chinese firms to divest from lithium mines

Netanyahu is back in Israel; wins polls to form next government

COVID - Daily death toll - 200 in America + 100 in France + 73 in Japan & 57 in Taiwan

Ethiopian civil war - Truce brokered

North provokes; South Korea fusillades missiles

RBI to launch retail pilot of digital rupee by Nov-end: RBI Governor

Grain exports - Turkey brokers truce; Russia relents

Govt raises price of ethanol used for blending in petrol

Maruti goes past record 2.5 crore production mark

Editors Guild express concern over searches of ‘The Wire' office premises

India mulling over proposal to allow Chinese firms to set up JVs with local Cos in electronics sector

WhatsApp erases close to 27 lakh accounts in India in Sept month

50 UN members lambast China for tormenting Uyghurs and Turkic population |

|

|

|

|

|

|

|

|

TOP NEWS |

|

|

|

|

|

THE COB(WEB) |

|

|

|

|

|

|

|

TIOL PRIVATE LIMITED.

TIOL HOUSE, 490, Udyog Vihar, Phase - V,

Gurgaon, Haryana - 122001, INDIA

Web: https://taxindiaonline.com

Email: updates@tiol.in

__________________________________

CONFIDENTIALITY/PROPRIETARY NOTE.

The Document accompanying this electronic transmission contains information from TIOL PRIVATE LIMITED., which is confidential, proprietary or copyrighted and is intended solely for the use of the individual or entity named on this transmission. If you are not the intended recipient, you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. This prohibition includes, without limitation, displaying this transmission or any portion thereof, on any public bulletin board. If you are not the intended recipient of this document, please return this document to TIOL PRIVATE LIMITED. immediately |

|

|

|