TIOL-DDT 2113 TIOL-DDT 2113

27.05.2013

Monday

Mr. PG Chacko just retired as Judicial Member, CESTAT (Bangalore Bench) after an illustrious service of nearly 15 years in Delhi, Chennai, Mumbai and Bangalore. Mr.RK Jain is a recognised whistle-blower - recognised by the Supreme Court, an eminent publisher and editor and a crusader against ills of the tax administration. The Supreme Court in Indirect Tax Practitioners Association vs RK Jain - 2010-TIOL-64-SC-CONTEMPT, Observed, "In our view, a person like the respondent can appropriately be described as a whistle blower for the system who has tried to highlight the malfunctioning of an important institution established for dealing with cases involving revenue of the State…" Mr. PG Chacko just retired as Judicial Member, CESTAT (Bangalore Bench) after an illustrious service of nearly 15 years in Delhi, Chennai, Mumbai and Bangalore. Mr.RK Jain is a recognised whistle-blower - recognised by the Supreme Court, an eminent publisher and editor and a crusader against ills of the tax administration. The Supreme Court in Indirect Tax Practitioners Association vs RK Jain - 2010-TIOL-64-SC-CONTEMPT, Observed, "In our view, a person like the respondent can appropriately be described as a whistle blower for the system who has tried to highlight the malfunctioning of an important institution established for dealing with cases involving revenue of the State…"

On 18.6.2012, RK Jain's Excise Law Times (ELT), in a report mentioned, "In the seized records, two entries are learnt to have been found regarding alleged payment of bribes of Rs.30 lakhs and Rs.11 lakhs respectively for seeking favourable orders on stay applications from CESTAT, Mumbai. It is learnt that as per DRI report in both the cases the orders were passed by the CESTAT Bench of Shri P.G. Chacko and Shri K.K. Agarwal.…….."

CESTAT Member (as he then was) PG Chacko was aghast and filed a suit against RK Jain in a Bangalore Civil Court pleading for an injunction commanding the ELT Editor to apologise, an injunction to restrain the editor from publishing any defamatory statement and a damage of Re. 1/-.

On 9.1.2013, the City Civil Judge issued a temporary injunction restraining the ELT editor from publishing any defamatory statement or material calculated to defame the plaintiff - CESTAT Member.

RK Jain took the matter in writ petition to the Karnataka High Court. The High Court observed,

The impugned order, when perused, it is crystal clear that it is bereft of any reason. Trial Judge without reference to any material has assumed that the plaintiff has a prima facie case. He has not touched upon the question where the balance of convenience lies, nor has he dealt with the question, whether the plaintiff would be put to irreparable loss, if no injunction is granted. He has not adverted to the other elements, such as acquiescence and whether the plaintiff has approached the court without any delay and finding recorded, is perverse and capricious. …… In this case, there is not only material irregularity in passing the impugned order, but also perverse approach to the matter.

The High Court quashed the order of the Civil Court and directed it to decide the case afresh.

While deciding the case afresh, the City Civil Court passed an elaborate order running into 38 pages replete with judicial decisions.

The case of the plaintiff is that he is a judicial member of the CESTAT; he has impeccable and unblemished reputation; no person raised any issue on his integrity and honesty.

The case of the defendant is that what he published in his article is true fact based on DRI Report and the defendant is whistle blower and a Public Spirited Person as described by the Supreme Court.

The Court observed, "It is not in dispute that the plaintiff is a person having high image and reputation and good impression in the eye of Public."

The Court granted temporary injunction in favour of plaintiff (PG Chacko) against the defendant (RK Jain) restraining the defendant, its employees, concerns, companies, agents, or any person claiming through or under the defendant from printing, publishing or spreading in any manner whatsoever, whether in Excise Law Times or any other reporter or through any print media or otherwise any defamatory statement or material calculated to defame the plaintiff in any manner until disposal of the suit .

Duty Free Shops - Rule 6 of CCR, 2004 pitches in to promote BRAND INDIA

A netizen writes in -

"On the subject of clearance of excisable goods under exemption for sale in Duty Free Shops at International Airports in India, I am worried about the exemption granted in terms of notification 19/2013-CE dated 23/05/2013 from the perspective of Rule 6 of the CENVAT Credit Rules, 2004.

When the fact of the matter is that these goods would be sold from the DFS against foreign exchange, would this not tantamount to export so as not be brought within the ambit of rule 6 of the CCR, 2004. I would have expected the Board to consider this aspect too while issuing the notifications and not left any scope for the jurisdictional authorities and the CERA to feast on the same.

As for the present, it is clear that when I clear these exempted goods, I would be required to pay 6% of the value of the exempted goods in terms of Rule 6 of the CCR, 2004 as I do not maintain separate records and manufacture both dutiable and exempted goods. In case, I forget to do the same, I would be allowing myself to be visited with recoveries, penalties & interest - all because I fell for Government's idea of promoting Brand India.

There is another issue that bothers me.

The Notification 19/2013-CE mentions that if the value of the goods purchased exceeds the maximum permissible allowance allowed to be cleared duty free, the purchaser is required to pay duty thereon.

In such an eventuality since the goods were already cleared under exemption, how would these goods which were later subjected to Central Excise duty be accounted by the manufacturer? In the context of rule 6 of CCR, 2004, this would be another painful blow.

The Board Circular 970 only discusses the situations of duty payment when the goods cleared from the indigenous manufacturer do not reach the "destination" or are removed after the expiry of the warehousing period but conveniently ignores this.

By the way, I have a simple suggestion - in case the Government is so enthusiastic about promoting Brand India they could have devised a simple procedure like refunding 5% of the bill amount to all the passengers at the airports as they do in London for VAT.

I request DDT to solicit the views of the Netizens on this brand building exercise."

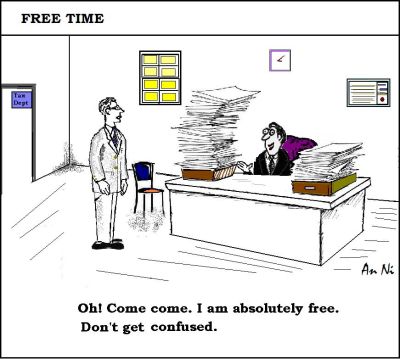

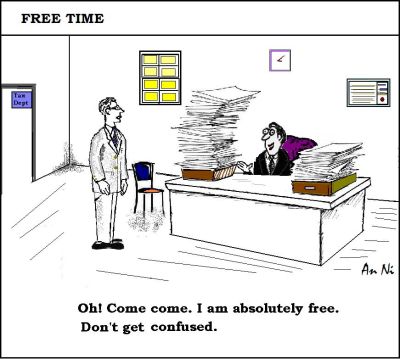

Revenue EH Application not typed in "double space", hence dismissed

YOU have to hand it over to the Revenue - they have found one more reason for getting their appeal/application dismissed by the CESTAT.

In the matter of an appeal filed by the Commissioner of Customs (Imports), Mumbai, the Revenue filed an early hearing application.

The CESTAT Registry issued a show-cause notice to the cure the defects in the application and that is that - the application was not typed in double space as warranted in terms of rule 8 of the CESTAT (Procedure) Rules, 1982.

The defect memo was issued on 2.2.2012, thereafter show-cause notice was issued on 05.02.2012 for listing the matter before the bench on 18.02.2012.

Nothing happened thereafter for almost a year. On 15.02.2013, a reply was submitted by the Revenue stating that application is in double space and, therefore, there is no defect in the application.

The Bench observed -

"3. We have gone through the application and found that the same is not typed in double space. Therefore, the concerned officer was called to be present in the court today. The concerned officer did not appear nor defect has been removed. Therefore application is dismissed as defective."

Hope the Chief Commissioners are reading this if not for the CBEC.

See 2013-TIOL-792-CESTAT-MUM

From the pages of history - Kolkata Custom House

Jurisprudentiol – Tuesday's cases

Customs Customs

Once an appeal is filed by an aggrieved person against original order, it is mandatory requirement under provisions of Customs Act to pay amount ordered by original authority, as condition precedent for taking up appeal - CESTAT after having taken into account all legal principles was lenient in ordering only 20 lakhs as pre-deposit - attitude of petitioner cannot be appreciated - Petition is not sustainable: HC.

IT is to be noted that when once an appeal is filed by an aggrieved person against the original order, it is mandatory requirement under the provisions of the Customs Act to pay the amount ordered by the original authority, as a condition precedent for taking up the appeal. Law is well settled that the capacity of a party to pay the pre-deposit amount had to be noticed and the financial burden and undue hardship for the party to resort to claim waiver of the pre-deposit, have also to be considered. The cardinal principle of consideration of the waiver of pre-deposit is based on undue hardship, prima-facie case, balance of convenience, financial burden and other difficulties expressed by the party before taking the matter on appeal and these factors have to be weighed in relevant circumstances, taking into account all the material factors, which alone can come to the wisdom of the authority to give certain waiver of pre-deposit to the party who is on appeal.

Income Tax

Whether transaction of sale of merchant banking business to an erstwhile global accountancy firm can be considered as colourable device, although payments were made only for transfer of business and contracts - NO: ITAT

THE issues before the Bench are - Whether a transaction of sale of merchant banking business to an erstwhile internationally acclaimed accountancy firm can be considered as a colourable device; Whether only when the document is not bona fide nor intended to be acted upon, but is only used as a cloak to conceal a different transaction, a transaction can be regarded as a sham or colourable; Whether consideration received by the assessee for transfer of its sole merchant banking business, which was discontinued thereafter, is in the nature of capital receipt; Whether any amount is received as compensation or damages for any wrong done which does not affect any capital asset or the capital structure of the assessee's business, but causes injury to the assessee in its trade, will normally constitute a trading receipt - Whether it is beyond the purview of the Revenue to question the adequacy of the consideration involved in a transaction; ………

Service Tax

‘Mithi' is a river and not a storm water drain - from Tender Notice and work awarded to appellant, it is clear that work pertains to Widening and Deepening depth of Mithi river - Thus, the contract awarding authority as well as appellant, the contractor, understood work as pertaining to dredging of river and not as anything else - Demand upheld: CESTAT

DURING the period 05/05/2006 to 31/07/2007, the appellant had undertaken dredging of 'Mithi River ' under a contract entered into with Mumbai Municipal Regional Development Authority (MMRDA, for short). The CCE, Thane-II demanded service tax of Rs.91.23 lakhs from the appellant on the total amount collected from MMRDA for the work of dredging done in 'Mithi River'. But naturally, the appellant had to shift his attention from Mithiriver to the CESTAT. The case of the appellant is that 'Mithi River' is not a river but only a 'storm water drain'. It is submitted that dredging of a drain is not taxable under Chapter V of the FA, 1994 inasmuch as the definition of 'dredging' given under section 65(36a) does not apparently include dredging of any body or stream of water other than river, port, harbour, backwater or estuary.

See our Columns Tuesday for the judgements

Until Tomorrow with more DDT

Have a Nice day.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Mr. PG Chacko just retired as Judicial Member, CESTAT (Bangalore Bench) after an illustrious service of nearly 15 years in Delhi, Chennai, Mumbai and Bangalore. Mr.RK Jain is a recognised whistle-blower - recognised by the Supreme Court, an eminent publisher and editor and a crusader against ills of the tax administration. The Supreme Court in Indirect Tax Practitioners Association vs RK Jain -

Mr. PG Chacko just retired as Judicial Member, CESTAT (Bangalore Bench) after an illustrious service of nearly 15 years in Delhi, Chennai, Mumbai and Bangalore. Mr.RK Jain is a recognised whistle-blower - recognised by the Supreme Court, an eminent publisher and editor and a crusader against ills of the tax administration. The Supreme Court in Indirect Tax Practitioners Association vs RK Jain -

Customs

Customs