TIOL-DDT 2212

18.10.2013

Friday

THE Karnataka High Court had in 2013-TIOL-264-HC-KAR-CX observed, "the parties submit that there are any number of Benches of CESTAT up north, while down south, more appropriately for the 3 states, [Karnataka, Andhra Pradesh, Kerala], there is only one Bench and large number of matters are pending consideration. If that is so, then the Union Government must wake up to the clarion call and constitute any number of Benches as may be required for speedy disposal of the appeals. Though no relief is sought for in the petition for a writ of mandamus to direct the 1st respondent - Union of India to constitute additional Benches of CESTAT for the southern states, it is appropriate to issue necessary directions."

The High Court issued a direction to the Union of India by way of a writ of mandamus to constitute and establish as many number of Benches of CESTAT for the 3 southern states of Karnataka, Andhra Pradesh and Kerala forthwith and file a report with the Registrar General of the High Court by way of compliance, on or before 3/6/2013, failing which the matter would be taken seriously.

Of course nothing happened by 3.6.2013. It seems the Government asked for some more time and the High Court granted six months.

Addressing a meeting in Hyderabad on 8.6.2013, Justice Goda Raghuram, the CESTAT President said that the proposal to start a CESTAT Bench at Hyderabad is seven months pregnant but he was not sure of a safe delivery in nine months. [DDT 2123 - 10.06.2013]

Yesterday the Union Cabinet approved setting up of six additional benches of CESTAT - three at the existing locations of New Delhi, Mumbai and Chennai and three new Benches at Chandigarh, Allahabad and Hyderabad. At present, CESTAT has three benches each in Delhi and Mumbai and one bench each at Kolkata, Chennai, Bangalore and Ahmedabad.

The creation of additional/new Benches of the CESTAT would cost a one time expenditure of Rs. 3.45 crore while the recurring expenditure would be Rs. 10 crore per annum. Was it for this paltry sum of 13.45 Crores that new benches were not set up all these years?

The cabinet approval does not mean that the new Benches will start functioning from tomorrow - the most difficult job is to get Members for the Tribunal. We need 12 new Members (apart from the existing vacancies) - 6 Technical and six Judicial Members for the six Benches. Appointment of Judicial Members is a long drawn out process. As for Technical Members, it is very difficult to find willing and good Commissioner and above level officers from the department to become Technical Members in the Tribunal as there is tremendous drudgery in the job without commensurate perks.

Anyway it is great news that the proposal to set up more CESTAT benches is moving forward. There is urgent need for more benches as nearly a lakh of cases are pending in CESTAT.

CESTAT needs better facilities

AFTER all it doesn't cost much - rather it costs only a fraction of the money that you spend on the officers who clog the CESTAT with litigation. Even after thirty years, CESTAT does not have its own buildings. The judges sit in rooms that are smaller than the ones that Assistant Commissioners in the field have - Many of the rooms do not have attached toilets. The Technical Members are former Commissioners or Chief Commissioners in the Department. As bosses in the department they enjoy tremendous powers and privileges and an army of subordinates to do all their work. When they come to the Tribunal, they find more of work and absolutely no facilities. Even Additional Commissioners in the department have Superintendents and Inspectors to write their orders - judges have no such privilege.

The least the Government can do is providing a little better infrastructure - we need better court rooms. Even small courts have a horseshoe type table where lawyers can keep their books and browse their appeal books, but the court rooms in the CESTAT are like class rooms. We need better rooms for the bar, we need better libraries, we need a massive computerisation and better use of technology.

And why should the CESTAT be under the Revenue Department of the Finance Ministry?

The website of the Finance Ministry [http://dor.gov.in/org setup] informs the world that CESTAT is a subordinate/attached office of the Revenue Department. Strange that you establish a high-powered Tribunal with a High Court judge at its head and make it a subordinate office of the Revenue Department which is one of the litigants in every case before the Tribunal. There were strong protests and demands to attach the Tribunal to the Law Ministry and in initial days it was told that after the Revenue Department completes the formalities of initial setting up, the Tribunal would be transferred to the Law Ministry. We have waited for 31 years and so far nothing has happened.

Please Also See : Tribunalisation of justice - CESTAT - Kal Aaaj Aur Kal! and Strengthen the CESTAT - give their Lordships some facilities

FTP - Mono cartons to be treated as primary level packaging of export consignment of pharmaceuticals and drugs

DGFT had by Public Notice No.21 dated 10.01.2011 prescribed Procedure relating to tracing and tracking of export consignment of pharmaceuticals and drugs.

Para 3 a. of the Public Notice read as:

3. Exporter of Pharmaceutical products will build track and trace capability for their exported medicines using barcode technology as per GS 1 global standards. The same will need to be done at primary, secondary and tertiary level packaging labels as per details below:-

a. Primary Level packaging:

Incorporation of 2D (GS 1 Data matrix) barcodes on medicines at strip/vial/bottle level encoding unique product identification code (GTIN), Batch Number, Expiry Date and Serial Number of the Primary pack.

Now this sentence is added at the end - "Mono cartons containing stripes/vials/bottle shall be treated as part of primary level packaging".

DGFT Public Notice No. 31 (RE-2013)/2009-2014,Dated: October 17, 2013

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 18th October 2013. The US Dollar is 62.20 rupees for imports and 61.20 for exports.

Notification No. 105/2013-Cus (NT), Dated: October 17, 2013

CAG's Advice on Good Writing - Style Guide 2013

CAG does things other than finding fault with departments of the Government - it has released a Style Guide 2013 developed mainly in the context of the English language used in the Audit Reports. However, these are equally relevant to other official reports and communications in the Indian Audit and Accounts Department, including the Inspection Reports.

The Style Guide consists of advice on good writing, guidance on drafting, list of conventions, common errors and care in use of words and phrases. The provisions in the Style Guide are aimed at securing corporate consistency in the reports and at obviating the need for repeated redrafting, quite often guided by the individual styles.

General advice on good writing :

1. Clear writing depends on clear thinking. To draft well a writer must know just what meaning he wishes to convey.

2. You can usually say what you want in short everyday words. This is especially important if you are writing about a complex subject. Readers will need all their attention to grasp what they are being told. They don't want to spend time grappling with obscure language as well.

3. Never use a long word when a short word will do; if it is possible to cut out a word, always cut it out;

4. Never use a foreign phrase, a scientific word or a jargon word if you can think of a straightforward English equivalent. Use the language of everyday speech, not that of accountants, computer experts, bureaucrats and lawyers;

5. Avoid a desire to impress. Your job is to help readers understand you readily and precisely and not to show them how clever you are;

6. Do your best to be lucid. Simple sentences and short paragraphs help to break down slabs of text into manageable chunks. Avoid complicated constructions and gimmicks.

7. For writers, long sentences are difficult to construct well. The longer they get the more risk there is of ideas becoming confused. For readers, long sentences are hard work.

The Style Guide contains chapters on Drafting reports, The IA&AD style of report writing, IA&AD conventions, A to Z of common errors and weaknesses, Words and phrases to be used with care, Correct spellings of words that are commonly mis-spelt, ‘Official words' and alternatives worth considering, and many tips on good writing.

What I liked best were:

Write 'officer concerned'/'department concerned' instead of 'concerned officer' 'concerned department'.

Disinterested - Means impartial and not uninterested. 'Uninterested' means unconcerned or indifferent.

Does it mean the concerned officers of CAG will remain uninterested while reporting objections?

Perhaps the Revenue Department should also publish such a guide for its officers.

Cochin Gold Smuggling Case - Yet another officer arrested

AFTER the sensational 20 kgs gold seizure by Cochin Air Customs, it seems more Customs officers than smugglersare getting arrested. It is learnt that CBI arrested an Assistant Commissioner yesterday. Already a Deputy Commissioner and a Preventive Officer are under arrest.

Meanwhile it seems the kingpin in the smuggling racket, who is well connected, has filed a complaint against some Customs officers alleging custodial torture and the Police have registered a case against some Customs officers.

CBI Case against Birla and Parakh - 'Capable and Highly Regarded officers and business leaders cannot be made scapegoats of mere suspicion and misconstrued actions' - FICCI Chief

"THE key to sustaining economic growth and promoting development is good governance and quality decision making. In the recent past, we have been witness to some very unfortunate developments. We find that cases are being registered against top bureaucrats and industry icons. It goes without saying that such developments dent the national psyche and also dampen investor confidence; both domestic and foreign. There is also a feeling that with repeated episodes of a trust deficit between Industry and Government, the business sentiment and the investment environment would be vitiated and India could slip further from the growth trajectory that is so necessary for us to maintain.", said Naina Lal Kidwai, President FICCI.

She added, "we also need to bring back a regime of courageous decision making. Decisions made in the interest of progress, when made in a transparent manner with no personal gains and without malafide interest are critical for growth. Capable and highly regarded officers and business leaders cannot be made scapegoats of mere suspicion and misconstrued actions".

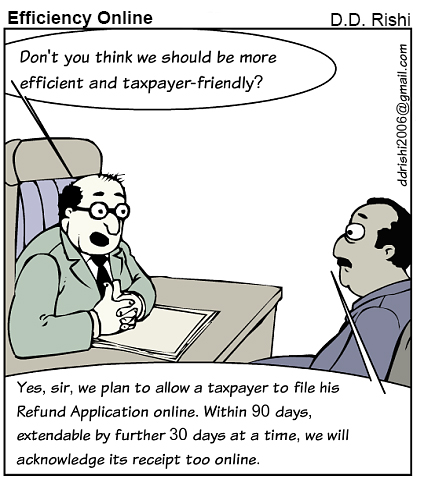

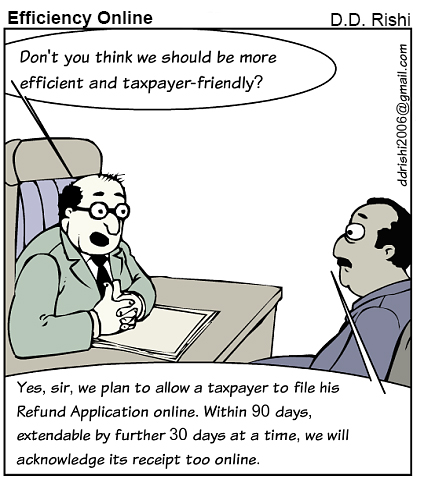

DDT Cartoon

Jurisprudentiol – Monday's cases

Central Excise Central Excise

Assistant Director, CEI, has no locus standi to challenge order of Settlement Commission: Adjudication or settlement - Minority decision upheld: HC

SETTLEMENT or Adjudication?: a case involving complexity of issues both of facts and law and disputed questions of fact for which detailed enquiry is necessary ought to be referred to the adjudicating officer by the Settlement Commission, to be taken up from the stage at which the matter was before the adjudicating officer, which is before the filing of applications before the Settlement Commission.

Income Tax

Whether in case manufacturing activity is performed by third party, assessee can claim deduction u/s 80I in respect of such manufactured items: HC

THE issues before the Bench are - Whether service charges received from Department of Atomic Energy can be considered as profit derived from the industrial undertaking to qualify for deduction u/s 80I; Whether crane hire charges would also be covered under equipment hire charges; Whether transportation activities can be a part of manufacturing process, hence eligible for deduction u/s 80I and Whether in case manufacturing activity is performed by a third party, assessee can claim deduction u/s 80I in respect of such manufactured items also. And the answers to all the questions go against the Revenue.

Customs

Refund of SAD - there is mismatch between goods imported and that sold in domestic market - no documentary evidence in support that goods sold on payment of VAT in domestic market are same as those imported - refund rightly denied - Appeal dismissed: CESTAT

THE appellant imported "Assorted Thickness Cold Rolled Steel Coils" of size viz.0.60mm, 1.0mm, 1.8mm and 2.0mm by paying Customs duty including SAD.

There after, they filed a refund claim towards the SAD paid of Rs.11,98,080/-. The claim was rejected by the Assistant Commissioner of Customs on the ground that as per the invoices produced by the appellant the goods sold in the domestic market did not match with the imported goods. The lower appellate authority also came to the conclusion that the goods on which VAT has been paid do not match in description with the goods imported and, therefore, the appellant has not satisfied the department that goods sold and goods imported are one of the same and VAT liability has been discharged on the goods imported.

See our Columns Monday for the judgements

Until Monday with more DDT

Have a Nice Weekend.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Central Excise

Central Excise