TIOL-DDT 2265 TIOL-DDT 2265

03.01.2014

Friday

YESTERDAY, we reported the Notification 16/2013-CE(NT) dated 31/12/2013 in terms of which the Board has found a novel way to pull a manufacturer of goods falling under heading 33.04, who was getting himself excluded from the umbrella of section 4A of the CEA, 1944, back into the MRP valuation by resorting to the provisions of section 3(2) of the CEA, 1944.

It seems that the Board wants to explain the said notification in lucid terms to the field formations and has, therefore, come out with a letter for the departmental officers. It reads -

"Your attention is invited to notification No.16/2013-Central Excise (NT), dated 31.12.2013, prescribing tariff value under section 3(2) of the Central Excise Act, 1944 in respect of goods falling under tariff heading 3304 (beauty or make-up preparations and preparations for the care of the skin, etc.) of the Central Excise Tariff and in respect of which the provisions of section 4A of the Central Excise Act, 1944 do not apply. The tariff value shall be the retail sale price (RSP) less abatement as prescribed for such goods under notification No.49/2008-Central Excise (NT), dated 24.12.2008. Presently, the abatement rate in respect of goods falling under tariff heading 3304 is 35%. Thus, the tariff value under section 3(2) of the CEA, 1944 for such goods shall be 65% of RSP."

Fine, but what happens if the manufacturer fiddles with the retail sale price or does not affix the RSP? What should be done is not forthcoming in the notification.

Perhaps, the TRU would again come out with a notification incorporating or bridging the provisions of section 4A(4) of the CEA, 1944 and the Central Excise (Determination of Retail Sale Price of Excisable Goods) Rules, 2008.

Save your skin, the manufacturer might say!

TRU letter F.No.345/2/2013-TRU, Dated January 02, 2014.

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 3rd January 2014. The US Dollar is 62.35 rupees for imports and 61.35 rupees for exports.

The Exchange rates were last notified on 19 December 2013.

Notification No. 01/2014-Cus (N.T.), Dated: January 02, 2014

Review and Revamp of EOU Scheme

A Committee was constituted by the Government to Review and Revamp of Export Oriented Unit (EOU) Scheme with a mandate to suggest suitable steps to make the scheme more vibrant and attractive for investors, develop a synergy between the EOU scheme and SEZ scheme to make them complementary to each other and aligning the EOUs to make them more globally competitive.

The recommendations of the Committee were subsequently examined in consultation with line ministries. Based on such consultation, the following measures are taken to implement the accepted recommendations:

Validity of the period of Letter of Permission (LOP) issued to EOU: LoP issued to an EOU will have an initial validity for a period of 2 years to enable the Unit to construct the plant and install the machinery. The next extension of one year may be given by the DC for valid reasons to be recorded in writing. Subsequent extension of one year may be given by the UAC subject to condition that two-thirds of activities including construction, relating to the setting up of the Unit are complete and a Chartered Engineer's certificate to this effect is submitted by the Unit. Subsequent extension, if necessary, will be granted by the Board of Approval.

Aligning duration of goods and services in EOU with the term of LOP: At present, capital goods are required to be installed or otherwise used by the EOU, within a fixed period from the date of import or procurement thereof and other goods are to be used in connection with the production or packaging of goods within a period of three years. In case of failure to use within above stated period, extension is required. It has now been decided that the period of usage of goods should be co-terminus with the period of LOP.This would do away with the current practice of obtaining multiple extensions for goods and LOP separately.

Setting up warehousing facilities outside EOU premises and outside the jurisdiction of DC: EOUs which intend to have their warehouses near to the port of export to reduce lead time for delivery of goods overseas and to address unpredictability of supply orders will now be permitted to set up such warehouses subject to the provisions related to export warehousing as given in notification No. 46/2001-Central Excise(N.T.) dated 26.6.2001 and the CBEC Circular No. 581/18/2001-CX dated 29.6.2001 as amended.

Sharing of facilities among EOU/STP/EHTP/SEZ Unit: In order to allow optimal utilization of infrastructure facilities it has been decided that sharing of facilities among EOUs may be considered by the UAC on case-to-case basis and the recommendations be sent to the BoA for final approval. While accepting such proposals, the NFE obligations of the Units shall not be altered. However, sharing of facilities between EOUs and SEZs Units should not be permitted.

Inter-Unit transfer (IUT) of goods & services: In order to facilitate a group of EoUs which sources inputs centrally to obtain bulk discount, reduce cost of transportation and other logistics cost and to maintain effective supply chain, IUT of goods and services will be permitted on a case to case basis by the UAC. Further, the procedure for Inter-Unit Transfer (IUT) of finished goods will be clarified by CBEC in order to bring uniformity in the practices and procedure adopted by various field offices.

Self-warehousing and self-certification of goods imported/procured by EOUs: The scheme of self-warehousing and self-certification was introduced vide Circular No. 19/2007 - Cus. dated 3.5.2007 dispensing with the requirement for physical verification of imported/indigenously, procured duty-free goods before issuing re-warehousing certificate by the proper officer in respect of Units set up under EOU /EHTP /STP /BTP scheme having physical export turnover of Rs.15 Crore and above in the preceding financial year and having a clean track record. In order to extend self-warehousing and self-certification facility to more Units, it has been decided to reduce the limit of physical turnover from Rs 15 Crore to Rs 10 Crore.

Rationalization of reports/ returns to be filed by EOUs: EOUs submit Quarterly Performance Report (QPR) and Annual Performance Report (APR) to the Development Commissioners and monthly return ER-2 to Central Excise. In order to reduce multiplicity of these reports, a common return to DoC and DoR would reduce paperwork for the EOUs. It has, therefore, been decided that a single common report/return may be devised which may serve the purpose for DoC as well as DoR. A joint group of DoC and DoR including Director General of Systems, CBEC will be formed to devise a proforma exhaustively capturing all the data and figures relating to export, import, DTA sale, deemed export sale, IUT, sale of goods as such, destruction, payment of duty etc. and devise simplified records to be maintained by EOUs.

Extension of time for submitting shipping bill for export made under self-sealing/self certification: It has been decided to increase the mandatory requirement to submit Shipping Bill within 24 hrs to 48 hrs as it is sometimes difficult to reach jurisdictional Central Excise office within 24 hrs from the port of export.

Will the CBEC come out with its own Circular soon? None of the above measures can be implemented without the approval of the CBEC.

Dept. of Commerce Office Memorandum No.1/10/2010-EOU, Dated: January 02, 2014

Stakeholder consultations by Tax Administration Reform Commission (TARC)

GOVERNMENT has set up Tax Administration Reform Commission with a view to reviewing the application of Tax Policies and Tax Laws in India in the context of global best practices. The Commission will work as an advisory body to the Ministry of Finance and recommend measures for reforms required in Tax Administration to enhance its effectiveness and efficiency.

The Commission has identified the following four points in its Terms of Reference to be included in its first report, which is to be submitted to Government within six months:

a. To review the existing organizational structure and recommend appropriate enhancements with special reference to deployment of workforce commensurate with functional requirements, capacity building, vigilance administration, responsibility and accountability of human resources, key performances indicators, staff assessment, grading and promotion systems, and structures to promote quality decision-making at high policy level.

b. To review the existing business processes of tax administration including the use of information and communication technology and recommend measures best suited to the Indian context.

c. To review the existing mechanism of dispute resolution, time involved for resolution, and compliance cost and recommends measures for strengthening the process. This includes domestic and international taxation.

d. To review existing mechanism and recommend measures for improved taxpayer services and taxpayers education programme. This includes mechanism for grievance redressal, simplified and timely disbursal of duty drawback, export incentives, rectification procedures and refunds.

Tax Administration Reform Commission Letter F.No.TARC/Meeting/1/2013-14,Dated: December 24, 2013

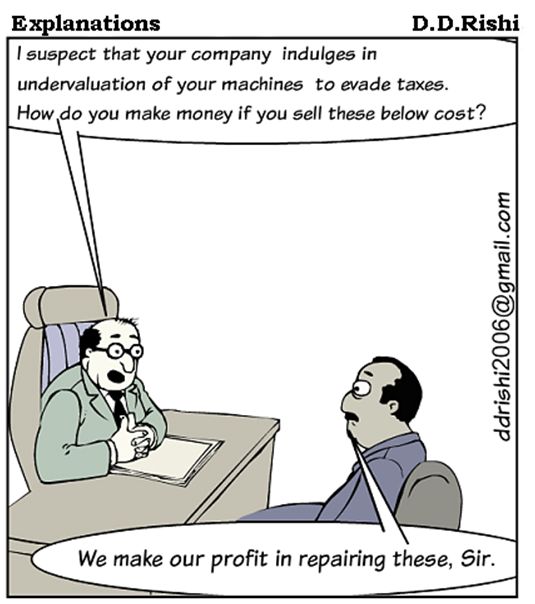

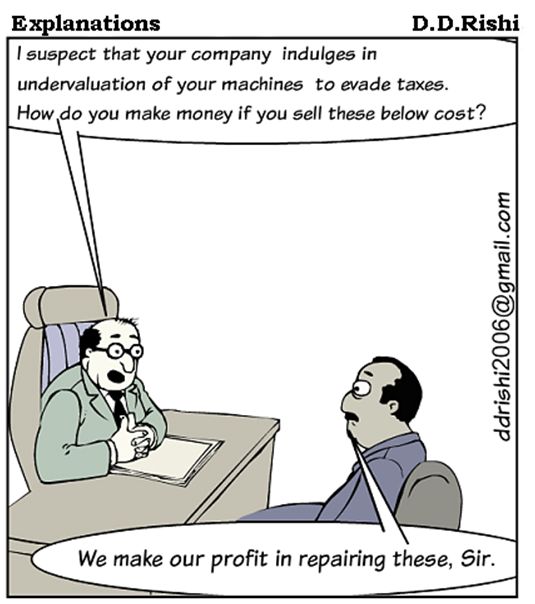

DDT Cartoon

Jurisprudentiol – Monday's cases

Central Excise Central Excise

Cutting and slitting of Jumbo rolls of Al film - respondent paying duty by taking CENVAT credit of duty paid on Jumbo Rolls - Revenue alleging that since activity does not amount to manufacture credit cannot be availed - in view of notfn. 24/2012-CE(NT) issued u/s 5B of CEA, 1944 appellant not required to reverse CENVAT credit: CESTAT

THE respondents are engaged in the manufacture of HG Capsules and they have packing films division and capsules division in their factory, where they undertake cutting and slitting of jumbo rolls of aluminium foil rolls into smaller rolls. Under the bonafide belief that cutting and slitting of jumbo rolls amounts to manufacture, the respondent discharged excise duty liability thereon and also availed CENVAT Credit of the CVD paid on jumbo rolls.

On the ground that the activity of cutting and slitting of Jumbo rolls into smaller rolls did not amount to manufacture, a demand notice was issued to the appellant requiring reversal of CENVAT Credit amounting to Rs.1,54,33,170/-. The proceedings were dropped by the Commissioner holding that the activity amounts to manufacture and, therefore, the appellant has rightly availed the CENVAT Credit.

Income Tax

Whether activity of blending and mixing of reactive dyes amounts to manufacture and same is eligible for Sec 80IC benefits - YES: ITAT

THE assessee is engaged in the business of manufacturing of reactive dyes in notified industrial area in the state of Sikkim. Assessee claimed exempt u/s 80IC. AO noticed that assessee achieved a huge turnover within a very short time of two and half months and the turnover was out of the production of two machineries which was used for mixing and grinding of materials. Assessee had shown G.P of 71.38% and N.P. of 70.42%, which according to him was not possible in normal course of business.

The issues before the Bench is - Whether the activity of blending and mixing of reactive dyes amounts to manufacture and the same is eligible for Sec 80IC benefits. And the answer of the Tribunal is YES.

Service Tax

Tax saving bond is Government security - Logic contained in Board Circular dated 10/08/2010 clarifying that there is no ST liability on underwriting fee/commission received by dealers for dealing in Govt. securities would apply in respect of brokerage received for sale of tax savings bonds: CESTAT

THE appellant undertook sale of Bonds issued by the RBI, notified as Issuance of 6.5% Savings Bond, 2003 (Non-taxable) vide Notification No. F.4/(9)-W&M/2003 dated 13/03/2003. These bonds were to be purchased by individuals and HUF and the bonds were exempted from income tax and wealth tax issued at par. The RBI authorised the appellant bank to sell these bonds and paid a brokerage @ 0.50 paisa per Rs.100/- in terms of Notification dated 13/03/2003 issued by the Government of India, Ministry of Finance and Company Affairs (Department of Economic Affairs).

For the service rendered, the appellant bank received brokerage from the RBI and it is on this amount the Service Tax demand of Rs.1.53crores has been confirmed with penalties and interest by CCE, Belapur holding that the said services rendered comes under the category of Banking and Financial Services.

See our Columns Monday for the judgements

Until Monday with more DDT

Have a nice weekend.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Central Excise

Central Excise