TIOL-DDT 2292 TIOL-DDT 2292

12.02.2014

Wednesday

IN a big blow to the Construction Industry and property buyers, the Haryana Taxation Commissioner has clarified on 10th February 2014 that under the composition scheme, the tax has to be paid on the total valuable consideration receivable for the execution of the contract and no deduction will be allowed on any count - even for the land.

This is exactly opposite to the clarification given by the Commissioner just nine months ago. In his Memo. No. 952/ST-1 dated 7-5-2013, in para 3.1, he had clarified as:

"3.1 Where a builder or developer has opted for payment of tax on his turnover relating to transfer of property in goods involved in execution of works contract under the composition scheme as provided under Section 9 of the HVAT Act, the total consideration on which such dealer is liable to tax would not include the amount received from the customers towards their undivided share in land . However, as explained earlier, in the case of joint development projects this exclusion would not be applicable."

Now, by the latest Memo No. 259/ST-1 dated 10.2.2014 the para 3.1 (reproduced above) is substituted with a new para as:-

"3.1 Where a builder or developer has opted for payment of tax on his turnover relating to transfer of property in goods involved in the execution of works contract under the composition scheme as provided under Section 9 of the HVAT Act, read with rule 49 of HVAT rules, he would be liable to pay a lump sum tax calculated at the rate provided therein (presently at the rate of 4%) on the total valuable consideration receivable for the execution of the contract. This would be applicable to all types of agreements and there cannot be allowed any deduction from the total valuable consideration on any count even for the land. It is further made clear that in the light of the provisions contained in section 2(w)(input tax) and 2(zs) (vat dealer) such a composition dealer cannot claim the benefit of any input tax paid on purchase of goods used in the execution of work contract."

This clarification is bound to travel to other States and ultimately the Centre and will influence Service Tax and GST, if any.

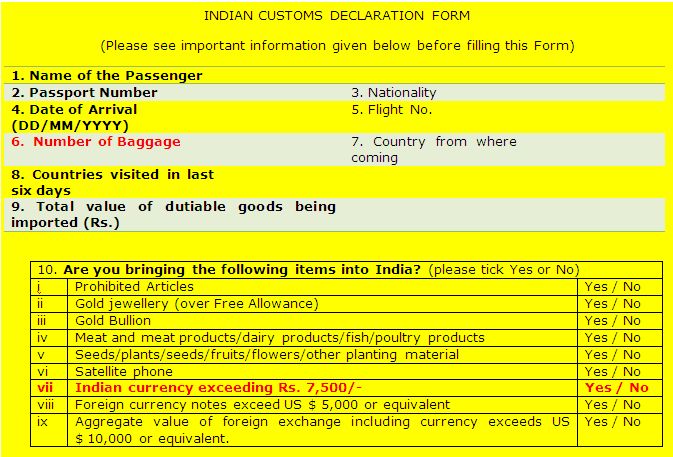

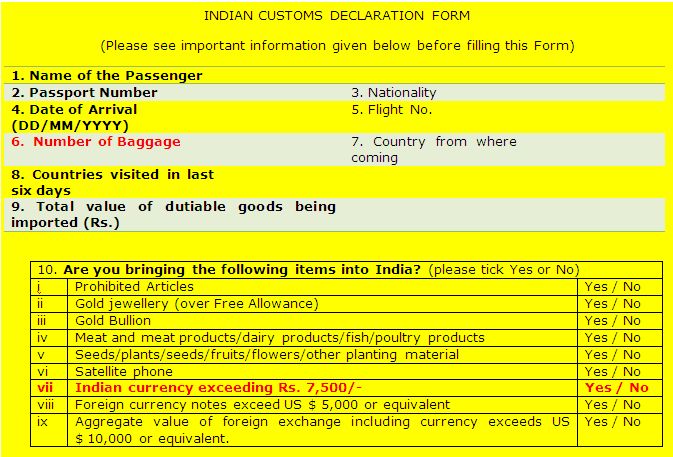

CBEC amends Customs Baggage Declaration Regulations 2013 - Hand baggage to be included and Indian Currency enhanced to Rs. 10,000

PASSENGERS coming to India are to declare their accompanied baggage in the following form with effect from 1st March 2014.

Now in Sl. No. 6 above for the words "Number of Baggage", the words and brackets, "Number of Baggages (including hand baggages)" are substituted.

In Sl. no 10, in item (vii), for the figures "7,500", the figures "10,000" are substituted.

A passenger was allowed to bring Rs. 7,500 of Indian currency. This was enhanced to Rs. 10,000 by the Reserve Bank of India vide Circular No. 39 dated 06.09.2013. It took CBEC five months to know about this change. Fortunately no damage is done, as this form is effective from 1st March 2014 only.

Notification No. 10/2014-Customs (N.T.), Dated: February 10, 2014

Income Tax - Vodafone v GOI - Tax by Talks fails Government to demand over 20,000 Crores

THE Demand against Vodafone with accumulated interest and penalty, by now would be more than Rs. 20,000 Crores. Now it seems that the talks have failed and the Government has decided to withdraw its conciliation proposal and decided to proceed with collection of the tax arrears. The finance ministry will seek cabinet approval to withdraw the conciliation proceedings. DS Malik, the Finance Ministry spokesman is reported to have told Reuters that the cabinet will take a final decision, while declining to share specifics of the proposal.

Bad times ahead for Vodafone or do they have some plan to see them through. 20,000 Crores is a lot of money even for Vodafone!

Strike by Central Government Employees - Government to be tough

THE Confederation of Central Government Employees and Workers have given notice that the members of the affiliates of the Confederation will go on strike on 12th and 13th February, 2014 in pursuance of their Charter of Demands.

DOPT in a letter to all Secretaries have informed them that Government Servants are prohibited from participating in any form of strike including mass casual leave, go-slow etc. or any action that abet any form of strike. There is no statutory provision empowering the employees to go on strike. The Supreme Court has also agreed in several judgments that going on a strike is a grave misconduct under the Conduct Rules and that misconduct by the Government employees is required to be dealt with in accordance with the law. Any employee going on strike in any form would face the consequences, which besides deduction of wages, may also include appropriate disciplinary action.

DOPT wants the Secretaries to inform this to the employees and dissuade them from resorting to strike in any form.

DOPT Office Memorandum No. 33011/1(s)/2014-Estt-B(I), Dated: February 10, 2014

CBEC Communicates the DOPT OM

CBEC has communicated the above O.M to all the Chief Commissioners for information and compliance. Superintendents of Central Excise have embarked on a two-day Satyagraha during the same period. Are they not participating in the strike? The Superintendents have a 32-Point Charter of Demands, top among them being cadre review and five promotions. Their Satyagraha is during lunch break.

Is there a Government ready to listen to the woes of the employees at this point of time or is it a hope for an election sop?

CBEC File No.B.12017/01/2014-Ad.IV.A, Dated: February 11, 2014

Their Lordships differ - Penalty under which Section? - Too many cases go to the Third Member in CESTAT

IN a recent case before the CESTAT, alleging misdeclaration of imported goods, the Adjudicating Authority imposed a penalty of Rs. 1.50 Lakhs without any reference to the section of the Customs Act under which such penalty was being imposed.

In the Tribunal, the Member (J) set aside the penalty, but Member (T) did not agree with her. He held that Penalty was imposed as per the provisions of Section 114, which warrants such imposition. He then extracted Section 114 of the Customs Act in his order.

Because of difference of opinion, the matter went to the Third Member with the following question:

"whether there was deliberatemis-declaration of classification and description as well as value inviting penal provisions under Section 114 of Customs Act, 1962 as held by Member (Technical) or the penalty is to be set aside as held by Member (Judicial)".

The Third member who was also a Technical Member observed, "Though the order of learned Member (Technical) mentions imposition of penalty under section 114, this section is not attracted in this case, as section 114 is for imposition of penalty for attempt to export goods improperly, while this is a case of improperly imported goods to which the provisions of section 111 and 112 apply."

So, he held that penalty was imposable under Section 112(a) of Customs Act, 1962 (not under Section 114 as mentioned in the order of Hon'ble Member (Technical) as this is not a case of improper export). And so penalty is upheld by majority. As far as the assessee is concerned, it makes no difference as to the Section under the Customs Act, which makes him pay the penalty!

Please see 2014-TIOL-221-CESTAT-DEL

Third Member not an appellate authority: In another case, we are reporting today, in a Third Member case, the Hon'ble Third Member while deciding a reference made a caustic remark about the two Hon'ble Members who had a difference of opinion. He said, "While both the members have recorded factual aspects, none has recorded the consideration on which interim order should base."

Now there was unanimity between the two Members that the comments of the Third Member are not proper. They unanimously declared, "Before the recording of the Final Order, we would like to observe that learned third Member, in para 18 of his order has observed that both the Members have recorded factual aspects but none has recorded consideration on which the interim order should pass. Both the Members feel that such type of comments by the third Member are not appropriate and proper inasmuch as the third Member is not deciding the matter in an appellate capacity and as such, is not in a position to comment upon the orders recorded by his co-brothers."

Please see Breaking News today for this case.

Of late, it has become a common practice in the CESTAT for Members in a Division Bench to have a difference of opinion and the matter is referred to a Third Member. In 2013, we reported 42 CESTAT cases in which the matters were referred to Third Members. May be we should have all Division Benches consisting of three Members so that invariably there is a majority decision and the trouble of referring too many cases to Third Members can be avoided. And maybe Larger Benches should consist of five Members.

Jurisprudentiol - Thursday's cases

Customs Customs

Reassessment - Customs directed to pass reasoned order on importer's application for re-assessment: High Court

THE petitioner cleared the goods under protest and paid Rs. 2.94 crores on 04.04.2012. Soon thereafter on 09.04.2012 it sought for reassessment in terms of Section 17(5) of Customs Act. It is stated that till date no order has been made. The petitioner concurrently had applied for refund on 17.05.2012. A show-cause notice was issued which was eventually confirmed on 12.11.2013. Direction issued to the Customs Authority to pass a reasoned order on the petitioner's application for reassessment.

Income Tax

Whether when assessee, engaged in exports, outsources preparation of food items and does not supply any controlled raw materials to its jobworkers, it can even then claim Sec 10B benefits - NO: High Court

THE assessee company is engaged in the business of manufacturing and exporting of food items such as mathia, chorafali, paratha and other tandoor items. It had claimed benefit u/s 10B. The Revenue contested the claim on various grounds including that the assessee cannot be stated to be manufacturing or producing an article or thing. On appeal, Tribunal split the issue in two parts. Insofar as the majority of the claims of the assessee for deduction was concerned, the plea was accepted holding that the assessee had a manufacturing unit in Kandla Special Economic Zone which was a 100% EOU. The food items manufactured by the assessee thus would qualify for such deduction. The Tribunal held that the assessee was an industrial undertaking and was engaged in manufacturing or producing article or thing when it produced different food preparations.

The issue before the Bench is - Whether when the assessee, engaged in exports, outsources the preparation of food items and does not supply any controlled raw materials to its jobworkers, it can even then claim Sec 10B benefits. And the verdict goes against the assessee.

Central Excise

Classification - ATM Rolls, Printed lottery ticket rolls and printed bus ticket rolls are 'Products of Printing industry' and classifiable under CETH 4901 of CET attracting Nil rate of duty : CESTAT

THE respondents are manufacturers of various excisable goods on which they pay CE duty. They also manufacture printed ATM Rolls, printed lottery ticket rolls and printed bus ticket rolls which were classified by them under CETH 49019900 of CET attracting nil rate of duty, as being the product as "products of the printing industry".

The assessee availed CENVAT Credit on inputs used in the manufacture of both dutiable and exempted products but did not maintain separate accounts and, therefore, at the time of clearance of the said products, the appellant paid an amount of @10%/8% of the value of the exempted goods.

The department harboured a view that the impugned goods merit classification under heading 48234000 as "rolls, sheets and dials, printed for self-recording apparatus" and are chargeable to appropriate rate of duty. Accordingly, a SCN dated January 2010 was issued demanding excise duty of Rs. 14,12,26,755/- for the clearances made during December 2005 to October 2010.

See our Columns Tomorrow for the judgements

Until Tomorrow with more DDT

Have a nice day.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Customs

Customs