TIOL-DDT 2227 TIOL-DDT 2227

08.11.2013

Friday

CBI Quashed

The very creation of CBI illegal

CBI Investigation, arrest, charge sheet, prosecution conviction quashed

CBI has no legal existence

The Caged Parrot - there was neither a cage nor a parrot

When people fear government, there is tyranny

THE CBI - the very name that sends a chill down the spine of even the most honest Government Servant and many a politician - has been in existence for the last 50 years - ILLEGALLY. The very creation of CBI was illegal and unconstitutional and CBI never had the power to arrest and prosecute all those angels of Indian Society, whom it had sent to jail.

The CBI was created by a Union Home Ministry Resolution dated 1.4.1963, which is now struck down by the Guwahati High Court.

The High Court started its judgement with a quote from Thomas Jefferson, “When the people fear the government, there is tyranny. When the government fears the people, there is liberty.”

Article 21 is one of the most cherished provisions in our Constitution, which prohibits the State from depriving a person of his life and liberty except according to the procedure established by law. However, what happens if by the State's action, which has been neither sanctioned by a legislation nor has been taken in valid exercise of its executive powers, the ineffaceable mandate of Article 21 gets smudged. This is precisely the issue, which the appellant has been, for almost a decade of litigation, urging the court to decide. Some of the prominent questions, which have arisen for determination, in this appeal, are:

(i) Whether ‘Central Bureau of Investigation', popularly called CBI, is a constitutionally valid police force empowered to ‘investigate' crimes?

(ii) Could a ‘police force', empowered to ‘investigate' crimes, have been created and constituted by a mere Resolution of Ministry of Home Affairs, Government of India, in purported exercise of its executive powers?

(iii) Could a ‘police force', constituted by a Home Ministry Resolution, arrest a person accused of committing an offence, conduct search and seizure, submit charge-sheet and/or prosecute alleged offender?

(iv) Whether CBI is a ‘police force' constituted under the Union's Legislative powers conferred by List I Entry 8?

(v) Do Entry 1 and 2 of the Concurrent List empower the Union Government to raise a ‘police force' and that, too, by way of Executive instructions of Union Home Ministry?

(vi) Whether Delhi Special Police Establishment Act, 1946, empowers the Union Home Ministry to establish a ‘police force' in the name of CBI?

(vii) Above all, is it permissible for the Executive to create a ‘police force' with power to ‘investigate' crimes in exercise of its executive powers, when exercise of such a power adversely affects or infringes fundamental rights embodied in Part III of the Constitution, particularly, Article 21?

SUBMISSIONS ON BEHALF OF THE PETITIONER :

It is submitted by the counsel for the appellant that the CBI is a non-statutory body inasmuch as it has been constituted by way of an Executive Order/Resolution, dated 01.04.1963, issued by the Ministry of Home Affairs, Government of India, and not by making any legislation.

In the absence of any law laying the birth of the CBI, the exercise of powers of police, by the said organization, such as, registration of First Information Reports, arrests of persons, ‘investigation' of crimes, filing of charge sheets and prosecution of the offenders cannot be permitted, for, allowing the CBI to do so would offend the fundamental rights guaranteed under Article 21 of the Constitution of India, which expressly provides that no person shall be deprived of his life and liberty except according to the procedure established by law.

SUBMISSIONS OF THE CBI

A) That the CBI derives its power to ‘investigate', like a police force, as contemplated by the Cr.PC, from the DSPE Act, 1946;

B) That the CBI is only a change of the name of the DSPE and the CBI is, therefore, not an organization independent of the DSPE;

C) That as per Section 5 of the DSPE Act, the Central Government may extend the powers and jurisdiction of the members of Delhi Police Establishment to investigate an offence beyond the territorial limits of Delhi and as per Section 6 of the DSPE Act, 1946, the members of the Delhi Police Establishment can exercise powers and jurisdiction in any area of any other State with the consent of the Government of that State;

QUERIES RAISED BY THE COURT

1) If a Pre-constitutional law was made on a subject, which is, now, covered by State List, whether the law will be valid after the Constitution has come into force bearing in mind Article 372?

2) Whether a law can be made by Parliament, on a subject covered by the State List, in respect of a Union Territory, after the Constitution has come into force?

3) The Executive power of the State is co-extensive with its legislative power. Is it, therefore, possible to constitute an investigating agency by a State taking recourse to State's executive Power?

4) Delhi was a Part-C State under the Govt. of India Act. On coming into force of the Constitution, it was made a Union Territory and it has, now, the status of a State, but some of its powers, under the State List, are exercised by Parliament. The Court wants to know details of the legislative history of the present status of Delhi, as a State, and its legislation making process.

5) The points, which, now, falls for determination, is: whether CBI is established under the DSPE Act, 1946, or is an organ of the Delhi Special Police Establishment Act and, if not, whether a force, with the object of investigation of crimes preparatory to filing of charge-sheet for prosecution of offender, can be created by the Central Government by way of an Executive order/Resolution and whether the CBI can be said to be validly created by the Central Government by way of an Executive order/Resolution.

WHETHER CBI IS A NON-STATUTORY BODY?

The Court Observed:

A statutory body, as the name suggests, is a body, which has a legislative sanction. In other words, a body or agency can be termed as statutory only when it is created by a statute to carry out certain functions.

There is no dispute that CBI came into existence with the issuance of Resolution, dated 01.04.63. If CBI is an integral part of the DSPE, then, such a resolution ought to have been issued by the Central Government in exercise of powers vested in the Central Government by the DSPE Act, 1946. In other words, had the CBI been constituted under the DSPE Act, 1946, by the Central Government, the CBI could have been treated as having been created by way of delegated legislation. There is, however, nothing, either in the DSPE Act, 1946, or in the impugned Resolution, dated 01.04.1963, to show that the CBI is a creation of a delegated piece of legislation. In order to exercise powers under delegated legislation, it is necessary that the Statute itself empowers the Executive to issue notification/resolution to meet the exigencies of time; whereas no such power is vested in the Central Government by the DSPE Act, 1946.

The source of power to create CBI as an investigating agency cannot be traced to, or be said to be located in, Entry 8 of List I (Union List). This apart, from the fact that while the law existing, prior to the coming into force of the Constitution of India, is protected in terms of the mechanism introduced by Article 372 and Article 372A of the Constitution of India, no amendment to any such law, if made after the Constitution of India has already come into force, be saved or protected by taking resort to Article 372 and 372A if the provisions, embodied in the Constitution, run counter to the scheme of our Constitution.

So far as constitution of police force is concerned, Union and the State, both have legislative competence to enact laws on ‘police'. However, so far as law, enacted by Parliament, is concerned, it can operate only in the ‘Union territories' and not in any ‘State', because ‘police' is a subject falling under State List.

The question, now, is: whether the impugned Resolution, dated 01.04.1963, is an executive action and, therefore ‘law' within the meaning of Article 13 (3)(a) and/or Article 21 of the Constitution of India?

It is seen that CBI has been investigating offences and prosecuting alleged offenders in the garb of being an organization under the DSPE Act, 1946. The impugned Resolution, dated 01.04.1963, is not, strictly speaking, an executive action of the Union within the meaning of Article 73 inasmuch as the executive instructions, embodied in the impugned Resolution, were not the decision of the Union Cabinet nor were these executive instructions assented to by the President. Therefore, the impugned Resolution, dated 01.04.1963, can, at best, be regarded as departmental instructions, which cannot be termed as ‘law' within the meaning of Article 13(3) (a) nor can the executive instructions, embodied in the impugned Resolution, dated 01.04.1963, be regarded to fall within the expression, "procedure established by law", as envisaged by Article 21 of the Constitution.

Situated thus, the actions of the CBI, in registering a case, arresting a person as an offender, conducting search and seizure, prosecuting an accused, etc., offend Article 21 of the Constitution and are, therefore, liable to be struck down as unconstitutional.

WHETHER THE DSPE ACT, 1946, IS ULTRA VIRES THE CONSTITUTION ?

The fundamental question, raised in the appeal, is: Whether the CBI is an organ of the DSPE under the DSPE Act, 1946? Merely because arguments and counter-arguments have been advanced before, on the validity of the DSPE Act, 1946, the arguments and the counter-arguments do not warrant a decision on this issue inasmuch as no decision, on this issue, is warranted when it is already held that the CBI is not a part or organ of the DSPE, under the DSPE Act, 1946.

The High Court set aside and quashed the impugned Resolution, dated 01.04.1963, whereby CBI has been constituted. The High Court further set aside and quashed the impugned charge sheet, submitted by the CBI, against the appellant and, consequently, the trial, which rests on the impugned charge sheet, shall stand set aside and quashed.

We bring you this order from the Guwahati High Court today

Please see (2013-TIOL-871-HC-GUW-MISC)

The CBI is dead - Will there be resurrection?

NOW that the resolution creating CBI has been set aside, there is no CBI - CBI simply does not exist. CBI cannot even file an appeal against the High Court order, because it (CBI) does not exist. Only Union of India can file an appeal against the High Court order. But will they? This is the best opportunity to kill the CBI, which has recently been too much of a nuisance, especially to politicians - reaching right up to the PMO. All these days, we have been talking of the independence of an organisation, which had existed illegally for the past fifty years. CBI had been created mainly to catch the corrupt babus and as long as the CBI had been doing its job religiously getting hold of telephone linemen and Railway clerks knocking off 5 to 10 rupees, everyone was happy. But the CBI grew too big and started arresting politicians and IAS officers and suddenly these powerful people found themselves helpless and stranded.

Now, will the Government of India file an appeal or keep the issue open for debate for another few months - at least till elections are over?

Will Lalu Yadav who lost his MP ship regain it and be released from jail? Will all the cases against Jagan Mohan Reddy in the CBI court in Hyderabad be quashed and will it make a major change in Andhra (or is it Telangana) politics?

What will happen to all those who were convicted by CBI courts and lost their jobs? Will they get compensation?

Days ahead are going to be sensational!

Will Planning Commission go same way?

THE Planning Commission of India is another unconstitutional/non-constitutional body created by a Government resolution exercising enormous power and clout. Every Chief Minister appears before the Hon'ble Deputy Chairman of the venerable Planning Commission of India once in a year to get their annual plans approved. The Planning Commission was set up by a Resolution of the Government of India in March 1950 - nobody knows under what authority and under what law or which provision of the Constitution of India and it has grown into a monstrous extra constitutional authority.

The best planning the Planning Commission had done in the last 63 years was said to be renovating the toilets in Yojana Bhavan at a cost of Rs. 35 lakhs while telling the Nation that any Indian who earns more than Rs. 35 a day is above poverty line! And the Deputy Chairman is said to spend more than Rs. 2 lakhs a day on his foreign trips, which are absolutely necessary to do the planning for the poor citizens of India!

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 8th November 2013. The US Dollar is 63.10 rupees for imports and 62.10 for exports.

The Exchange rates were last notified on 17th October 2013.

Notification No. 109/2013-Cus (NT), Dated: November 07, 2013

India's Notification of Cyprus as uncooperative tax jurisdiction - Cyprus Reacts

IN a major policy decision, India had recently notified Cyprus as uncooperative tax jurisdiction. Although India and Cyprus had entered into a DTAA, which is in force since December 21, 1994, and there is a legal obligation for both the contracting states to exchange tax information on request to prevent tax frauds, as per the CBDT, Cyprus has not been providing the information sought by the Indian taxmen. This forced India to notify Cyprus under Sec 94A.

Now, Cyprus has reacted:The Ministry of Finance of the Republic of Cyprus wishes to state that:

"The Ministry of Finance of the Republic of India has issued a press release on November 1st, 2013 stating that it has taken the decision to notify Cyprus as a notified jurisdictional area under section 94A of the Income-tax Act, 1961. The Ministry of Finance of the Republic of India has taken the above unilateral measure, considering that in their view the information provided by the competent authorities of the Republic of Cyprus, under the existing Double Tax Treaty between Cyprus and India did not adequately address the inquiries of the relevant authorities of the Republic of India. It is important to clarify that the Double Tax Treaty between the two countries has not been terminated.

Given the fact that Cyprus attaches primary importance to the implementation of its contractual obligations stemming from Bilateral and International Agreements, and paying due respect to the excellent level of its political relations with the Government of India, the Cyprus Government is in direct contact with the Indian Government and is exerting every effort to clarify and resolve the situation that has been created and has directly affected the business communities in both countries.

It is the position of the Cyprus Government that any discrepancies and points that need clarification can only be resolved through direct consultations between the concerned competent authorities, which have been agreed to take place within November 2013.

The Government of the Republic of Cyprus reiterates its commitment to hold direct negotiations with the Government of the Republic of India with the aim of finalising the long pending review of the Double Tax Treaty between Cyprus and India."

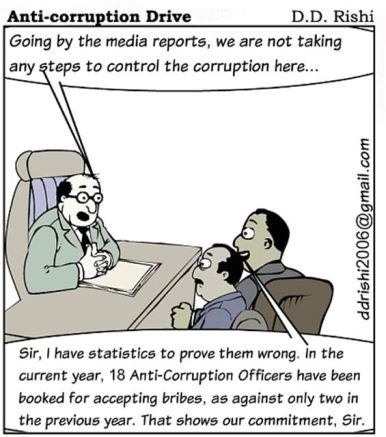

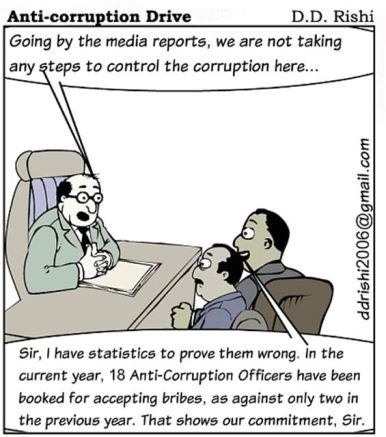

DDT Cartoon

Jurisprudentiol – Monday's cases

Central Excise Central Excise

Inputs supplied to SEZ Units without payment of duty - No provision under CENVAT Rules to export inputs without payment of duty after taking credit - Demand of duty confirmed: CESTAT.

REVENUE contended that the meaning of the word "export" is not defined in Central Excise Act or Rules. It is defined in Customs Act, 1962. This meaning has been applied for the purpose of implementing Central Excise Act and Rules all along. There is a separate definition for this word under SEZ Act, 2005. As per this definition, supply of goods from Domestic Tariff Area to units in SEZ is also to be treated as exports. This is a deeming fiction which can apply only to the provisions in SEZ Act. Whether this deeming fiction will have effect in the context of goods supplied to SEZ units was examined by the Gujarat High Court in the case of Essar Steel Limited Vs. UOI - (2009-TIOL-674-HC-AHM-CUS). In this case, the issue was whether export duty needs to be paid on iron ore supplied from DTA unit to a unit in SEZ since such duty was payable on iron ore exported out of India. The High Court held that the deeming fiction in SEZ Act cannot be applied for the purpose of Customs Act and held that export duty is not payable unless there is export out of India that is to say the definition in Customs Act, 1962, was adopted. Therefore, as per Rule 3 (5) of CCR, the respondents were bound to reverse the credit taken.

Income Tax

Whether proviso to Sec 2(15) will hit assessee-trust for mere selling of some products for profit and assessee cannot avail exemption u/s 11 - NO: ITAT

THE assessee is a trust. Its objects were to breed the cattle and endeavour to improve the quality of the cows and oxen in view of the need of good oxen as India is prominent agricultural country and the cow milk as food is both conducive to and requisite for good health and longevity of human life, and likewise, other objects.

The Revenue authorities denied the exemption u/s 11 by holding that the object of the assessee trust was 'any other object of general public utility' and accordingly covered by proviso to Section 2(15) of the Act since the activities of the assessee trust were commercial in nature.

The issue before the bench is - Whether proviso to Sec 2(15) will hit assessee-trust for mere selling of some products for profit and assessee cannot avail exemption u/s 11. And the verdict favours the assessee.

Service Tax

Section 78 provides for penalty on ‘person liable to pay tax' and since person liable to pay tax is appellant firm, imposition of penalty on MD is not sustainable in law - Appeal disposed of: CESTAT

ACTING on intelligence, the officers of DGCEI, Vadodara initiated investigation regarding the Service Tax payments made by the appellant in respect of security services provided by the firm. In his statement the Managing Director categorically admitted that the appellant firm had deliberately not declared the correct value of security services.

See our Columns Monday for the judgements

Until Monday with more DDT

Have a Nice weekend.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Central Excise

Central Excise