TIOL-DDT 2236 TIOL-DDT 2236

22.11.2013

Friday

IN response to our story VCES - CENVAT Credit and Trading - Am I eligible? (DDT 2232), a Netizen posted this message:

Sir, trading activity is covered under negative list (Sec.67D(e)) of Finance Act, 1994 which means the said activity is not at all a taxable service. In such case, where is the question of looking into exemption or taxable. Moreover, Rule 6(3)/6(3A) of CER, 2004 is applicable where both taxable and exempted services/goods exist. Since as per my opinion, trading is not a service at all being under negative list, the question of exemption arises. Accordingly, rule 6(3) / 6(3A) of CCR, 2004 is not applicable. Would you please clarify further?

Firstly, the VCES is applicable for the period from 1.10.2007 to 31.12.2012. So, except for a period of six months, (1.7.2012 to 31.12.2012), the provisions existing before the negative list will apply.

Secondly, there is a widespread opinion that with effect from 01.07.2012, trading is a negative list service and hence the provisions of Rule 6(3)/6(3A) of the CENVAT Credit Rules, 2004 are not applicable.

As per the definition of Rule 2(e) of CCR 2004,

(e) "exempted service" means a-

(1) taxable service which is exempt from the whole of the service tax leviable thereon; or

(2) service, on which no service tax is leviable under section 66B of the Finance Act; or

(3) taxable service whose part of value is exempted on the condition that no credit of inputs and input services, used for providing such taxable service, shall be taken;

Service on which no service tax is leviable under Section 66B are nothing but Negative list services. Section 66B reads:

There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent on the value of all services, other than those services specified in the negative list, provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed.

So, with effect from 01.07.2012, all Negative list services including trading are exempted services for the purpose of CENVAT Credit Rules, 2004. Though the definition of service given under Section 65B(44) excludes sale of goods, for the purpose of CENVAT Credit Rules, trading is treated as an exempted service. Hence, the provisions of Rule 6 of the CCR 2004 are applicable. Even when trading was not defined as an exempted service, the Tribunal in 2010-TIOL-752-CESTAT-AHM held:

Trading activity is not an exempted service - rule 6 of the CCR, 2004 does not apply - there is no provision in the Cenvat Credit Rules, 2004 to cover such situations - only obvious solution which is legally correct is to ensure that once in a quarter or once in a six months, the quantum of input service tax credit attributed to trading activities according to standard accounting principles is deducted - Matter remanded for quantification

Also, explanation under Rule 6 of CENVAT Credit Rules, 2004 carries the procedure of how to compute value in case of trading activity for the purpose of Rule 6(3) and 6(3A).

Advocates without Authorisation

THE Mumbai Bench of the ITAT in a recent order observed,

In Mumbai, despite repeatedly pointing out in each and every case, learned counsels rarely follow the practice of filing the power of attorney and many Members of the Tribunal, who do not believe it be their obligation to verify the availability of power of attorney, may not point out the same to the counsels and it results in counsels appearing without filing a power of attorney. There are equal numbers of occasions where several other Members, including Members of this Bench, have had occasion to point out that there was no power of attorney and counsels filed xerox copies or take further time to file power of attorney. In fact some would go to the extent of stating that they assumed that the power of attorney is on record and when we verify the file (though it is their duty to file power of attorney) and inform the counsel that there is no power of attorney then fresh power of attorney is filed. Particularly in the bench which is presided over by the Vice President, the registry notes on the file that the power of attorney of a person, who is representing the matter, is not on record and then the power of attorney is filed, notwithstanding the fact that before filing the power of attorney the same counsel or Chartered Accountant must have already taken adjournments on several occasions.

Can an advocate give vakalat to another advocate with or without the consent of his client? Your views are welcome.

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 22nd November 2013. The US Dollar is 63.30 rupees for imports and 62.30 for exports.

The Exchange rates were last notified on 7th November 2013.

Notification No. 112/2013-Cus (NT), Dated: November 21, 2013

Sanction to prosecute Government Servant-Sanctioning Authority not quasi-judicial and no reasoned judgement required - Bombay HC

THIS was a writ petition filed by an Additional Commissioner of Income Tax against sanction of prosecution against him by the Central Government.

It started somewhere in 2005 when the CBI filed a case against the Additional Commissioner for possessing disproportionate assets to the tune of 1.27 Crores accumulated during the period 1993 to 2004. The wheels of Government moved slowly and in October 2012, the Government had finally accorded sanction to prosecute the Additional Commissioner. It is against this sanction that the Additional Commissioner is before the Bombay High Court.

The High Court in a detailed order running into 44 pages declined to allow the petition. The High Court observed,

A bare perusal of Section 19 and these conclusions of the Honourable Supreme Court leave us in no manner of doubt that at the stage of grant of sanction, the Sanctioning Authority does not exercise any quasijudicial power nor does it perform any quasijudicial function. The Sanctioning Authority is not obliged to grant any personal hearing to persons like the Petitioner. Its duty is to record a prima facie satisfaction and after perusal of the relevant material. It is not expected to deliver a reasoned judgment. It is not empowered to consider whether the evidence collected would prove the guilt. Once the Sanctioning Authority is competent to remove a public servant and it fully and carefully examines the material placed before it and having regard to the same, considers the matter as fit for grant of sanction, then, its order is not liable to be interfered with in exercise of writ jurisdiction. This Court cannot sit in judgment over such prima facie views and conclusions of the Sanctioning Authority. Once the opinion is based on relevant and germane considerations and materials, then, such prima facie opinion cannot be interfered with on the ground of any error or irregularity or omission therein. This is the mandate flowing from subsections (3) and (4) of Section 19 of the Prevention of Corruption Act, 1988.

The request for continuation of the stay for enabling the petitioner to appeal to the higher court was also not considered.

The Additional Commissioner has filed an SLP in the Supreme Court.

Rule 5 of Customs (Appeals) Rules, 1982 is with reference to evidence to be produced by appellant - in Revenue appeal, importer is respondent and hence evidence produced ought to have been considered by Commr(A) - Matter remanded

THE appellant filed a refund claim for SAD.

The original authority sanctioned an amount of Rs.1,40,81,672/- and rejected the amount of Rs.4,48,108/-.

The Revenue filed an appeal on the following grounds:

(a) The adjudicating authority has not discussed anything about the validity of the Consignment Sale Agreements.

(b) On close scrutiny of the documents submitted by the importer along with the refund application it is seen that the importer M/s Uttam Galva Steels Ltd. had transferred the gods viz. Hot Rolled Steels totally weighing 405.120 MTs to the consignment agent M/s R.K. Steels under sixteen invoices instead of 43 sales invoices which were submitted by the importer.

(c) From the copy of the Consignment Sale Agreement entered into between the importer - M/s Uttam Galva Steels Ltd. and the Consignment Agent - M/s R.K. Steels, it is seen that the said agreement was made on 31.03.2007 and the same was valid for the period of one year i.e up to 30.03.2008. There is no document on record evidencing renewal of the said agreement or extension of the validity period of the said agreement. Thus, the refund in respect of 405.12 MT transferred by the importer to M/s R.K. Steels has been erroneously sanctioned by the Asst. Commissioner.

Before the appellate authority, the importer (respondent in Revenue appeal) produced a copy of Agreement Extension from 01.04.2008 to 31.03.2011 but the Commissioner (A) refused to take the same into consideration on the ground that under Rule 5 of the Customs (Appeals) Rules, 1982 the appellant is not entitled to produce before the Commissioner (Appeals) any evidence, whether oral or documentary, other than the evidence produced by them during the course of proceedings before the adjudicating authority. In fine, he allowed the Revenue appeal.

Aggrieved, the importer is before the CESTAT and refutes the stand taken by the Commissioner(A).

The Bench observed -

"4. We find that the copy of the Agreement Extension from 01.04.2008 to 31.03.2011 was not asked by the department before sanctioning the refund claim. However, the same was produced when asked before the Commissioner (Appeals). We also note that the Rule 5 of the Customs (Appeals) Rules 1982 is with the reference to the evidence to be produced by the appellant. In this case the above said Agreement Extension was not submitted by the appellant but by the respondent. In view of the above position we set aside the order of the Commissioner (Appeals) and remand the whole matter to the original authority for re-examining the matter with reference to the issues raised in the appeal filed by the Revenue before the Commissioner (Appeals). Needless to say that the appellant will be entitled to produce any documents relevant for the case and the adjudicating authority will pass the order after granting personal hearing."

Suffice to mention that the appeal was allowed by way of remand.

See 2013-TIOL-1743-CESTAT-MUM

Demographic Tax

MUCH of the world is ageing, facing the demographic tax of having to pay for an increasingly elderly population with a shrinking work force. Much of the world has run out of easy paths to growth. Having built infrastructure everywhere and exploited natural resources to their fullest, many countries are left with building bridges to nowhere to stimulate growth. Much of the world is also well-educated, well-fed, and well-connected through roads, telecommunications, and finance. India is unlike the rest of the world. Our population is young, our infrastructure inadequate, and too many Indians are poorly educated, poorly fed, and poorly connected. But this is precisely why our low-hanging opportunities for betterment are plentiful in the coming years. All we need to do is to pluck them.

Our measure of success should be the jobs that are created, not by giving government subsidies or protections to labour-intensive industries or sectors but by developing a facilitating, though competitive, environment that will result in the emergence of the best solutions.

Disciplined focus on four issues:

1. We need to improve the quality of our infrastructure, especially the logistical support and power that industry and services need. Grand plans are on the anvil, such as, the Delhi-Mumbai Industrial Corridor. We need to complete such projects on time, and within budget. The success of the New Delhi Metro suggests that timeliness and cost control are not foreign to the Indian psyche.

2. Our youth need education and training for the jobs that will be created. Some of this will be higher degrees, not just computer science but also design or civil engineering. Some of it will be appropriate vocational education that teaches them to be good plumbers and electricians rather than unemployable low-skilled engineers. Teaching our citizens can be a stepping-stone to teaching the world. India can be at the forefront of providing mass technology-enabled education laced with appropriate human inputs to the world.

3. We need better business regulation. This does not always mean less regulation but it means regulation that is appropriate to the objective and that is enforced. I am told that factories in one state are still required to have a snake trap on the factory floor by law, a law that has not been changed since the days factories were surrounded by jungles. The lack of change may be sheer inertia, but it may be more sinister rent seeking. All too often, we have too much regulation on the books and too little regulation in practice, with the worst of the regulated finding unscrupulous ways around the regulation while the honest are stymied.

We have strong labour laws in theory that are meant to protect employees, but in practice we have a very flexible system with no incentive for firms to invest in their workers or hold on to them, and no loyalty towards the firms from workers. This needs to change if we are to have more skilled manufacturing jobs.

4. And finally, we need a better financial system, which will finance the needed infrastructure and the expansion of every producer ranging from the kirana shop owner to the industrialist even as it allows households to save safely with positive real returns, insure themselves against health emergencies or old age costs, and borrow at low cost to finance consumption. Importantly, the financial system should not require constant subsidies to bail it out.

[Excerpts from a recent speech of RBI Governor Dr. Raghuram G. Rajan]

One-sided adjudications based upon allegations made in the show cause notice needs to be avoided as the same shakes the public confidence in the administration of justice: CESTAT

IN a recent order, the Tribunal observed, "It is cardinal principle of law that nobody should be condemned without hearing and affording the accused person a reasonable opportunity to put forth his defence. In the absence of any defence reply by the accused persons, it is not only difficult but (also) impossible for any adjudicating authority to come to a fair and just finding. His conclusions are bound to be guided by the allegations made in the show cause notice, as admittedly the there would not be any rebuttal to the same by the concerned persons. Such type of one sided adjudications based upon the allegations made in the show cause notice needs to be avoided as the same shakes the public confidence in the administration of justice."

Holding that the order has been passed in gross violation of principles of natural justice, without expressing any opinion on the merits of the case, the Bench deemed it fit to set aside the same and remand the matter to the Commissioner for de novo adjudication.

In this case, though the Member (T) agreed with Member (J) on remanding the case, he ordered that the appellant shall not be entitled to refund of amount of Rs.1.50 crore deposited prior to this remand order as protection measure of Revenue .

Now, is this the opinion of the Bench or only one Member? Should this direction of one Member not be approved by the other Member to make it the order of the Bench?

We will bring you this order on Monday.

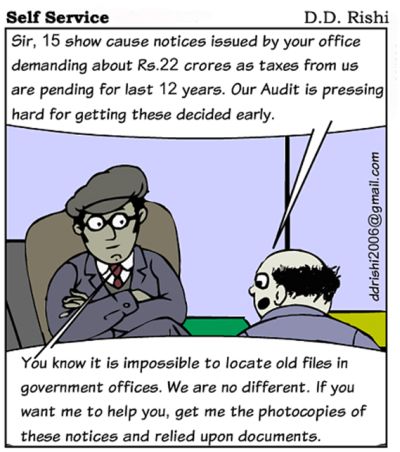

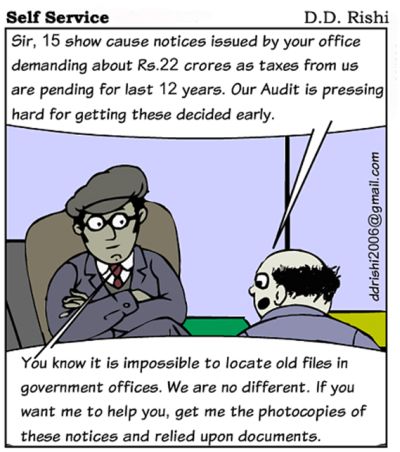

DDT Cartoon

Jurisprudentiol - Monday's cases

Service Tax Service Tax

As Electricity is goods chargeable to duty under CE Tariff as well as under Maharashtra Value Added Tax Act, 2002 supply of electricity to tenant amounts to sale of goods and not supply of service: CESTAT

THE appellants are the owner of premises which have several units and were given on rent to various persons. On this rent collected, the applicant is paying Service Tax under the category of 'Renting of Immovable Property Service'. They are also involved in the activity of maintaining and repairing of the building and the applicant are paying Service Tax on this activity also. The department is more than happy to receive these Service Tax payments on time.

However, the CCE, Pune-III has an objection to another activity which the applicant does - objection to the fact that the applicant is not diligent in including the following charges collected from their tenants while paying Service Tax on the activity of 'Renting of Immovable Property'. Inasmuch as the applicant is under an obligation to supply electricity to their tenants and for that a common electricity connection has been taken by the applicant from MSEB and separate meters have been installed in each of the premises and on the basis of reading in the meter the applicant is charging electricity charges from the tenants. Further, when electricity is not being supplied by MSEB, the same is supplied through DG set to the tenants and on that also they are charging electricity charges from the tenants.

It is the Revenue view that electricity charges recovered from their tenants is to be part of the service of 'Renting of Immovable Property Service' in view of the provisions of Rule 5 of Service Tax (Determination of Value) Rules, 2006 and, therefore, Show-cause notices were issued to the appellants demanding Service Tax running into crores of rupees and seeking imposition of equivalent penalty and interest.

Income Tax

Whether provisions of deemed dividend extend to related parties also - NO: HC

THE question before the Bench is - Whether the provisions of deemed dividend extend to related parties also. And the answer is NO.

Customs

One-sided adjudications based upon allegations made in show cause notice needs to be avoided as same shakes public confidence in administration of justice: CESTAT

HOLDING that the order has been passed in gross violation of principles of natural justice, without expressing any opinion on the merits of the case, the Bench deemed it fit to set aside the same and remand the matter to the Commissioner for de novo adjudication.

See our Columns Monday for the judgements

Until Monday with more DDT

Have a Nice weekend.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Service Tax

Service Tax