TIOL-DDT 2256 TIOL-DDT 2256

20.12.2013

Friday

THE CESTAT recently delivered a landmark judgement by which all demands by the Customs, Excise and Service Tax Department against Central Government and State Government Departments have become a NULLITY - which cannot be enforced.

The basic question revolves around who should be the appellant/respondent in a case filed by/against a Government Department.

Article 300 of the Constitution states: "The Government of India may sue or be sued by the name of the Union of India and the Government of a State may use or be sued by the name of the State………"

As per Section 79 of the CPC,

"Suits by or against Government.-- In a suit by or against the Government, the authority to be named as plaintiff or defendant, as the case may be, shall be--

(a) in the case of a suit by or against the Central Government, the Union of India; and

(b) in the case of a suit by or against a State Government, the State."

So if you are filing a case against the Government, the respondent should be "Union of India" and if a Department is filing a case, the petitioner/appellant should be "Union of India", but in practice, we find that all appeals before the Tribunal are either filed against a Commissioner of Customs, Excise and Service Tax or filed by a Commissioner. Union of India is never a party. This seems to be against the above provisions.

The CESTAT recently had to consider such an issue.

The appeal was filed by the Divisional Railway Manager, North Western Railway, Ajmer against a Service Tax demand. The Tribunal observed,

Suits or proceedings against the State can be pursued only in the name of the Union of India or the concerned State, as the case may be. It is axiomatic that neither the Secretary to the Government; the Railway Board nor as has been done in the present case, the Divisional Railway Manager, Ajmer Division may in law and per se represent the Indian Railways or the Union of India, in the absence of the Central Government being arrayed as a party.

A decree passed against the Divisional Railway Manager cannot be executed against the Union of India nor can a decree or award passed against the Divisional Railway Manager be satisfied by drawals from the Consolidated Fund of India. The provisions of Chapter II, in particular, the elaborate provisions relating to procedure in financial matters set out in Articles 112 to Article 114 in the Constitution clearly indicate that a charge upon or an appropriation from the Consolidated Fund of India could only be in respect of expenditure of the Government of India.

It is noticed in several cases, clearly oblivious of this fundamental constitutional mandate, proceedings are initiated against state actors instead of the State as duly designated under the Constitutional mandate.

The Tribunal noted a Supreme Court decision wherein it was observed,

Every post in the hierarchy of the posts in the Government set-up from the lowest to the highest, is not recognized as a juristic person nor can the State be treated as represented when a suit/proceeding is in the name of such offices/posts or the officers holding such posts, therefore, in the absence of the State in the array of parties, the cause will be defeated for non-joinder of a necessary party to the lis, in any court or Tribunal.

The Tribunal held:

The adjudicated liability, in the circumstances cannot be charged on the Indian Railways. Since the very initiation of assessment proceedings, in respect of the alleged liability to service tax of the India Railways is patently misconceived, the entire proceedings are a nullity. The appeal before us preferred by the Divisional Railway Manager is also, for reasons alike, mis-conceived and so are the Misc. applications.

And so the appeal by the Divisional Railway Manager was dismissed.

Now, what are the consequences?

1. Are all the demands against Government Departments (where Union of India is not made a party) nullity and the demands simply evaporate into thin air?

2. Are all the appeals filed by Commissioners invalid, as Union of India is not made an appellant?

3. Are all the appeals in which Commissioner is the only respondent invalid, as Union of India is not made a respondent?

4. If a Railway officer has to file an appeal against a Central Excise Commissioner's order, should it be Union of India vs Union of India - can you file an appeal against yourself?

Incidentally, Rule 12 of the Customs, Excise and Service Tax Appellate Tribunal (Procedure) Rules, 1982 reads as:

RULE 12. Who may be joined as respondents - (1) In an appeal or an application by a person other than the Commissioner or the Administrator, the Commissioner concerned or the Administrator shall be made the respondent to the appeal or, as the case may be, the application.

(2) In an appeal or an application by the Commissioner or the Administrator, the other party shall be made the respondent to the appeal or as the case may be, application.

As per this, the Commissioner is to be the respondent/appellant, but what is the status of these Rules before the Constitution and the Supreme Court?

I can share a personal experience: I filed a writ in a High Court against an order of attachmentby a Deputy Commissioner and the attachment was stayed, but when the case came up for final hearing, I was told that my writ is not correct as I had not made the Union of India as a respondent. I prayed for allowing me to file a Miscellaneous Petition for inclusion of Union of India as a respondent, which was allowed by His Lordship. It is a with a sense of déjà vu that I report that it is the same judge of the High Court who, now as President of CESTAT delivered this judgement.

Now, what happens? The Tribunal has sent a copy of this judgement to the CBEC for information and issuance of appropriate guidelines to the field formation.

Let us wait and see what guidelines the CBEC is going to give.

We bring you this judgement today. Please see Breaking News.

Service Tax VCES 2013 drawing to a close

COUNTING from today, there are ONLY NINE WORKING DAYS for the ST VCES, 2013 to come to an end. As per the latest reports, ONLY 14000 declarations have been received and only 2300 Crores have come into the Government kitty. Pitiable show, one may say. Where are those lakhs of non-filers/stop-filers et al ? One may argue that this "number play" was a mirage in the first place - there is no such figure as 10 lakhs of delinquent registered assessees!

But, one thing is certain - that the entire government machinery was in action. Right from launching the advertisement blitzkrieg, which made many stand up and take notice of the existence of the Department, and those seminar caravans of the FM which moved from one metro to another no stone was left unturned to reach out to the masses.

Whereas the Hyderabad-II Commissionerate had come out with manned kiosks placed in parks, the Vadodara Central Excise Commissionerate employed the ubiquitous auto rickshaw draped with the ST VCES banner and loud speakers blaring the VCES commercials to maximum advantage as the photographs below would show -

Only when the dust settles, presuming there is no extension, and the final figures of revenue mop up land on the FM's table, will the critics and the votaries of the scheme head for a showdown.

Perhaps, an enthusiast may even file an RTI application seeking to know the amount of money spent by the department for advertising the scheme.

But, one thing is sure - gauging from the mood of the department, it is clear that those tax evaders who are obstinate and not interested in filing the Form VCES-1 would be hounded the moment they welcome the New Year, 2014.

FTP - Export Policy - Onions - Steep cut in MEP

GOVERNMENT has amended para 2 of Notification No.03(RE-2012)/2009-14 dated 29.06.2012 read with Notification No.57 (RE-2013)/2009-14 dated 16.12.2013 with immediate effect.

Export of onion for the item description at Serial Number 51 & 52 of Schedule 2 of ITC(HS) Classification of Export & Import Items will now be subject to a Minimum Export Price (MEP) of US$ 350 per MT.

It was USD 800 per MT three days back and 1150 USD per MT in September.

Now, this is a steep cut. It is reported that this reduction is aimed at encouraging exports amidst a crash in wholesale prices leading to protest by farmers in producing states

At Lasalgaon APMC (in Nashik, Maharashtra) - the country's largest wholesale onion market, the wholesale price of onion has fallen to as low as Rs.700 per quintal. Even though retail price is still higher, the sudden price crash has angered and shocked the farmers. They are now getting a mere Rs.7 per kilo of onion. Nashik onion farmers are protesting the fall in onion prices and also staging a rastaroko on the Mumbai-Agra national highway.

The onion prices first recorded an all-time high of Rs.4,300 a quintal on August 12 and continued to spiral over the next two months, touching a record rate of Rs.5,600 per quintal on October 18. The earlier all-time high of Rs.3,200 a quintal was recorded in 1998, when onions became one of the factors for the BJP's debacle in assembly polls.

DGFT Notification No. 59 (RE-2013)/2009-2014, Dated: December 19, 2013

Group Company definition in FTP 2009 - 2014 amended

THE Central Government has amended Para 9.28 of FTP to include Limited Liability Partnerships (LLPs) in the definition of "Group Company". It is also emphasized that neither a partnership nor proprietorship firm would come within the ambit of definition of a "Group Company".

Notification No. 58 (RE-2013)/2009-2014 dated December 18, 2013

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 20th December 2013. The US Dollar is 62.90 rupees for imports and 61.90 for exports.

The Exchange rates were last notified on 05 December 2013.

Notification No. 131/2013-Cus (NT), Dated: December 19, 2013

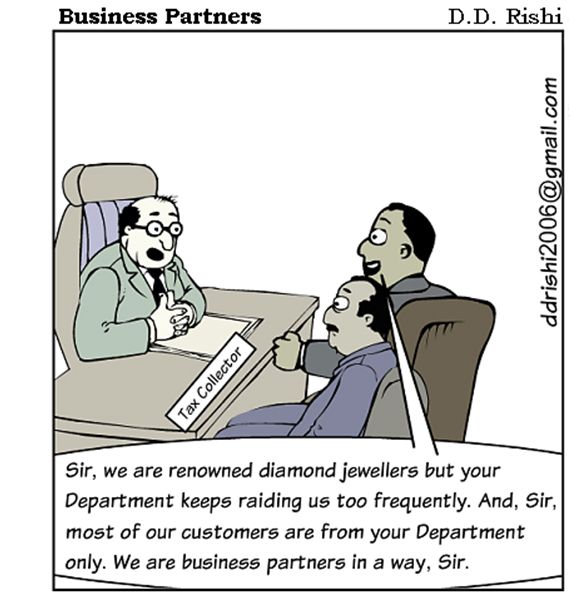

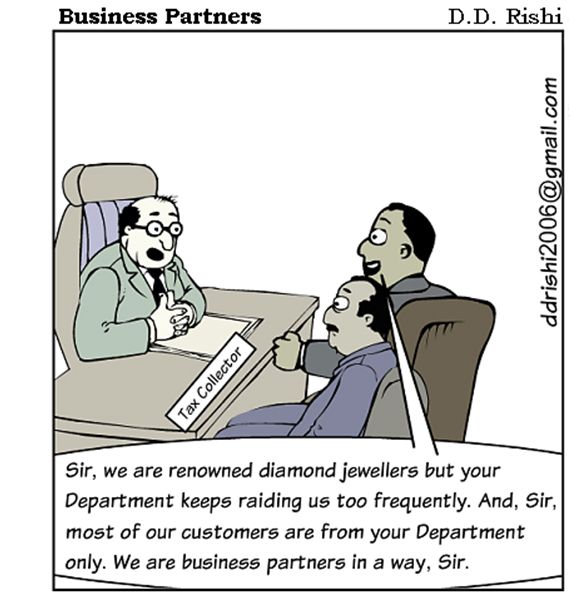

DDT Cartoon

Jurisprudentiol - Monday's cases

Service Tax

Board Circular 56/5/2003-ST cannot substitute a notification issued u/s 93 of FA, 1994 - ST demand confirmed but cum-tax benefits extended: CESTAT

IT is submitted that prior to 1.07.2001 the appellants were paying the service tax on the assessable value including reimbursable expenses. However, after 1.7.2001, they were not including the reimbursable expenses in the assessable value of service. It is submitted that the issue was settled only by the Larger Bench in the case of Sri Bhagvathy Traders vs. CCE 2011-TIOL-478-CESTAT-BANG and prior to that there were divergent views on the issue. Inasmuch as since they were in bonafide belief that the reimbursable expenses are not to be included in the assessable value, the larger period cannot be invoked and, therefore, the demand is not sustainable.

Income Tax

Whether when assessee has declared income from partnership firm he is right in pleading for exclusion of income from property occupied by firm - NO: ITAT

THE assessee files salary income stated to have been received from five partnership firms. The assessee also disclosed income as a financial advisor for investment in mutual fund. The assessee also received commission income. As per the AO, the assessee had not shown any "notional income" from the residential flat. According to the AO, the assessee was required to show rental income from the said flat in terms of Section 22. The AO held that the assessee was unable to prove that flat was indeed used for the business purpose of the assessee. The CIT(A) held that the assessee had not established that the property was used by the staff member, therefore, action of the AO was confirmed by rejecting the ground of the assessee.

The issue before the Tribunal is - Whether when the assessee has declared the income from the partnership firm he is right in pleading for exclusion of the income from the property occupied by the firm. And the verdict goes in favour of the Revenue.

Central Excise

Stay/Dispensation of pre-deposit - Fatty Acid, Soap stock and Spent Earth which are resultant products of processing of crude oil - Whether exempted under Notification No 89/95 CE as waste arising in the course of manufacture of exempted goods - Pre-deposit reduced to 75 lakhs from 1 Crore - High Court

TAKING note of the reasons stated by the Counsel for the assessee, and the decisions cited, the High Court found that interest of justice would be served and the interest of the revenue would also be protected by directing the assessee to deposit a sum of Rs.75,00,000/- within a period of six weeks as against the direction of the Tribunal to deposit Rs.1crore. As regards the applicability of the decision of the Mumbai Bench of the Tribunal, the same has to be thrashed out by the appellant/assessee only at the time of the final hearing of the appeal before the Tribunal.

See our Columns Monday for the judgements

Until Monday with more DDT

Have a nice weekend.

Mail your comments to vijaywrite@taxindiaonline.com

|

Download PDF

Download PDF