20.06.2014

Friday

THE Supreme Court Bar Association has virtually opposed the proposed 365 days of working by Courts. The Bar Association President in a letter to the Chief justice of India states members of the bar cannot possibly work for 365 days as no human being can or should work 365 days.

However the Association has suggested certain measures for clearing the increasing backlog of cases in our courts.

1. Fill up of all the posts of Judges in all courts on the day of vacancy: As on date the Supreme Court has 5 vacancies. For High Courts throughout the country, the approved strength of Judges is 875, as on 1st April, 2014 the working strength has been 623 and therefore the vacancies as on 1st April, 2014 are 252. Against the sanctioned strength of 17,715 Judges, more than 3,300 posts are vacant.

2. Punctuality of the Judges to work in Court room full time is very essential: Punctuality of working in the Court rooms on time and for the full time must be strictly followed by all the Judges throughout the country. It is well known that some Judges come late, taking tea breaks, break for signing orders etc. during working hours and there is no control on this.

3. Strikes by lawyers: The strike by lawyers is another reason for arrears. There can be no justification for going on strike by lawyers except in rarest of rare cases because it affects their own clients and it affects their image also.

4. Governments as litigants: The Governments central as well as state and statutory authorities etc. in most of their litigations always go right up to the Hon'ble Supreme Court. This many times happens because the officers making these decisions have a fear that, if they do not go up to Supreme Court somebody may make allegations against them.

Anti-dumping duty on injection moulding machines - retrospective extension

THE resurrection in CBEC continues unabated - a change in Government is immaterial for the babus - for they know that they are the Government - whatever the politician thinks. Bringing back to life dead notifications at the drop of a hat is a common habit with the anti-dumping section of the Board.

By Notification No. 39/2010- Customs, dated 23 March, 2010, the Government imposed anti-dumping duty on all kinds of plastic processing or injection moulding machines, also known as injection presses, having clamping force not less than 40 tonnes and not more than 1000 tonnes, originating in or exported from China PR with effect from 12 May 2009. This notification expired on 12 May 2014. Now after more than a month of deep slumber they just woke up and extended its life till 11 May 2015.

When will they learn to have some respect for the laws and procedures created by them?

Notification No. 28/2014-Customs(ADD), Dated: June 19, 2014

23th March - CBEC's contribution to lexicon?

YOU must have heard of 23rd March, but have you heard of 23th March? In the above notification, the Government uses the expression 23th March four times! Incidentally in the Note to the Notification, this is correctly shown as 23rd March. Is the CBEC trying to create new words in English or is it yet another example of how callously notifications are manufactured by the Board? A simple spell check would have told them the correct usage

Corporate Social Responsibility (CSR) under section 135 of Companies Act, 2013 - Ministry Clarifies:

THE Ministry of Corporate Affairs has received several references and representation from stakeholders seeking clarifications on the provisions under Section 135 of the Companies Act, 2013 and the Companies (Corporate Social Responsibility Policy) Rules, 2014.

The Ministry clarifies:

1. The statutory provision and provisions of CSR Rules, 2014, is to ensure that while activities undertaken in pursuance of the CSR policy must be relatable to Schedule VII of the Companies Act 2013, the entries in the said Schedule VII must be interpreted liberally so as to capture the essence of the subjects enumerated in the said Schedule.

2. CSR activities should be undertaken by the companies in project/ programme mode. One-off events such as marathons/awards/charitable contribution/advertisement/ sponsorships of TV programmes etc. would not be qualified as part of CSR expenditure.

3. Expenses incurred by companies for the fulfillment of any Act/ Statute of regulations (such as Labour Laws, Land Acquisition Act etc.) would not count as CSR expenditure under the Companies Act.

4. Salaries paid by the companies to regular CSR staff as well as to volunteers of the companies (in proportion to company's time/hours spent specifically on CSR) can be factored into CSR project cost as part of the CSR expenditure.

5. "Any financial year" referred under Sub-Section (1) of Section 135 of the Act read with Rule 3(2) of Companies CSR Rule, 2014, implies ‘any of the three preceding financial years'.

6. Expenditure incurred by Foreign Holding Company for CSR activities in India will qualify as CSR spend of the Indian subsidiary if, the CSR expenditures are routed through Indian subsidiaries and if the Indian subsidiary is required to do so as per section 135 of the Act.

7. ‘Registered Trust' (as referred in Rule 4(2) of the Companies CSR Rules, 2014) would include Trusts registered under Income Tax Act 1956 (sic), for those States where registration of Trust is not mandatory.

8. Contribution to Corpus of a Trust/ society/ section 8 companies etc. will qualify as CSR expenditure as long as the Trust/ society/ section 8 companies etc. is created exclusively for undertaking CSR activities or where the corpus is created exclusively for a purpose directly relatable to a subject covered in Schedule VII of the Act.

Now the Ministry of Corporate Affairs mentions the Income Tax Act 1956 !Perhaps, they got it mixed up with the earlier Companies Act, 1956.

MoCA General Circular No. 21/2014, Dated: June 18 2014

No booking of air tickets through private agents - Government tells babus

DOPT reminds all the Ministries/Departments of Government of India that the Government employees are required to book their air tickets directly from the airlines (Booking counters, websites of airlines) or by utilizing the service of Authorized Travel Agents viz. Balmer Lawrie & Company, Ashok Travels and Tours and ‘IRCTC' while undertaking LTC journey(s).

In a number of cases, it has been noticed that instructions are not being followed and as a result various Ministries/ Departments continue to make references to DoPT seeking relaxation of the conditions for one reason or the other. The most common reason given by the employees is unawareness of the rules and non-availability of Authorized Travel Agents at places where the tickets have been booked from.

DoPT clarifies that even in such cases, the option of booking directly from the airlines through their website is available. In no case is the booking of tickets through any other agency is permissible.

DOPT OM No. 31011/4/2014-Estt(A.IV), Dated: June 19 2014

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 20th June 2014. The US Dollar is 60.45 rupees for imports and 59.45 rupees for exports.

Forex dealers attributed the rupee's fall to increased dollar demand from importers amidst rising global crude prices.

The Exchange rates were last notified on 5th June, 2014.

Notification No.47/2014-Cus (N.T.), Dated: June 19, 2014

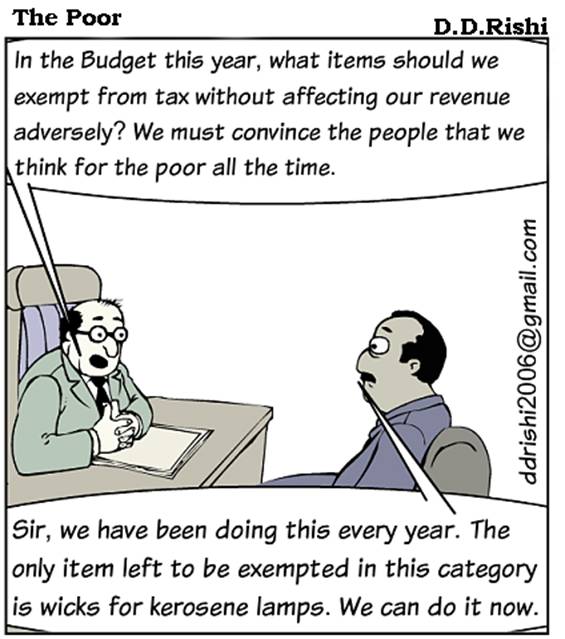

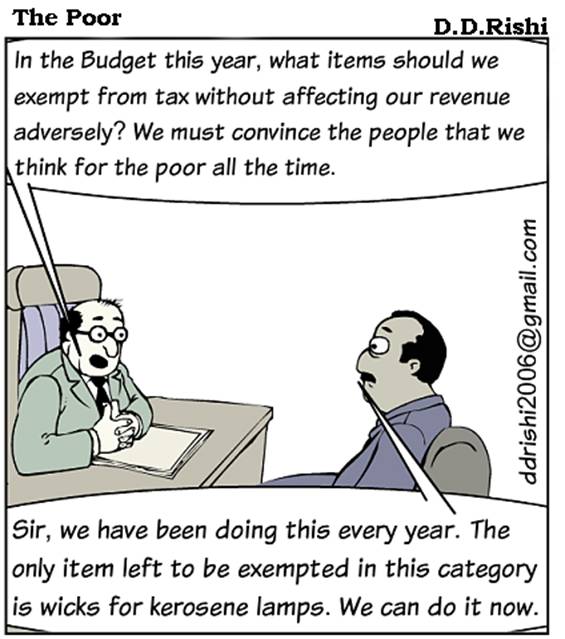

DDT Cartoon

Jurisprudentiol - Monday's cases

Customs Customs

When an issue is not subject matter of the SCN first issued and was not agitated before lower authorities, it has to be held that Revenue has no justification in agitating an issue before CESTAT which was not agitated before lower authorities - no merit in Revenue appeal: CESTAT

The respondent filed a bill of entry seeking classification of the imported Palm Kernal Acid Oil under CTH 38231900.

Samples were drawn and sent to Chemical Examiner and based on the reports received a SCN was issued for classifying the imported goods under CTH 15132910 and this was upheld by the Assistant Commissioner.

The lower appellate authority decided the classification of the imported goods under CTH 38231900 and allowed the appeal of the respondent.

As this order was not honoured, the respondent approached the Gujarat High Court and the High Court disposed of the petition by ordering the release of the goods subject to certain conditions but without expressing any opinion on the merits of the classification and suggested to the Department to request the Tribunal to give an early hearing in the matter of the appeal filed by them.

Income Tax

Whether trading addition on account of low Gross Profit is justifiable where assessee is engaged in jobwork and GP rate depended on nature of jobwork assigned only by Principal - NO: ITAT

THE assessee company derives income from the business of job work of manufacturing of alloys, steel casting as in past. The assessee had declared Gross Profit at 22.57% as against gross profit of 26.37% for the preceding year. The A.O. gave reasonable opportunity of being heard on this issue as GP declined compared to preceding year. AO observed that the assessee was not maintaining the stock register of raw materials required for its manufacturing activities, due to which the valuation of closing stock was not verifiable in quantum as well as in valuation. After applying Section 145(3), trading addition was made on account of low Gross Profit. In appeal, CIT(A) confirmed the addition.

The issues before the bench are - Whether trading addition on account of low Gross Profit is justifiable where the assessee is engaged in the job work and the GP rate depended on the nature of job work assigned only by the Principal and whether addition on account of freight and octroi expenses is justified where the expenditure was claimed by the assessee on purchase of consumable and store material. And the answer favours the assessee.

Central Excise

Fly Ash whether dutiable from 01.03.2011 - Apex Court in Ahmedabad Electricity Co. had held that ‘fly ash' is non-excisable and which decision was relied by Commr(A) - no case made by Revenue for stay of order: CESTAT

VIDE an o-in-a dated 19/08/2013, the Commissioner(A), Nagpur held that the fly ash generated in the respondent's power plant situated at Chandrapur is not excisable and accordingly not dutiable. Consequently, a demand of excise duty of Rs.6,61,885/- along with interest thereon and also imposing penalties have been set aside.

Revenue is in appeal before the CESTAT against this order and in their appeal memorandum has taken the plea that an excise levy of 1% was introduced on fly ash under Chapter 26 with effect from 01/03/2011 and since the demand pertains to the period 01/03/2011 to 28/02/2012, the demand is sustainable.

See our Columns Monday for the judgements

Until Monday with more DDT

Have a nice weekend.

Mail your comments to vijaywrite@taxindiaonline.com |

Download PDF

Download PDF

Customs

Customs