TIOL - COB( WEB) - 475

NOVEMBER 19, 2015

By Shailendra Kumar, Editor

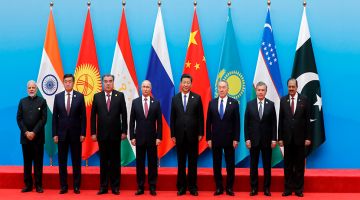

THE Prime Minister, Mr Narendra Modi, is back home after a successful foreign tour to the UK and the G-20 Summit in Turkey where, besides other issues, he called for global cooperation on recovery and repatriation of stolen assets. Even in Delhi yesterday, while speaking at the Sixth Global Focal Point Conference on Asset Recovery hosted by the CBI and the INTERPOL, he continued his emphasis on relentless fight against corruption and recovery of stolen assets. In a nutshell, he did not lose focus of a Swachh administration and also shared the least known fact about the REMOVAL and pension-cut of 45 senior civil servants. They were probably penalised for their unsatisfactory performance under Rule 56(j) of the Fundamental Rules.

This brings us to another 'Swachh' issue which appears to be snowballing into a mega cess-pool of controversies. Early this month, the Ministry of Finance notified the new levy of Swachh Bharat Cess (SBC) under the 'almost-forgotten' Section 119 of the Finance Act, 2015. Forgotten because it was over six months since the Finance Bill was enacted in May, 2015, and one fine morning the Government woke up to mop up a few hundred crores in the name of Swachh Bharat in the current fiscal. Before I talk about the SBC, let me first talk about the Prime Minister's favourite Mission. Undoubtedly, the Mission is laudable. But, equally undoubtedly, the politics of ground reality is deplorable. Only a few weeks ago, New Delhi hosted a mega African Summit but the reality on the ground across Delhi was the story of piles of garbage out on the streets as municipal staff were on strike because they were not paid their salaries. This story clearly tells us the constitutional fact that sanitation and hygiene are truly the 'municipal' issues and they should be left to be handled by the local bodies and the State Governments. There is no harm if the Centre sensitises them and also creates a distinct head for fund allocation as per their Annual Plans. With the Prime Minister involving the States and putting his personal weight behind this Mission it would truly have turned into a possible National Mission.

But, what seem to have gone wrong are both - the politics as well as the economics! Although sanitation and hygiene are the much desired traits in India but when the PM put on the headgear to pick up the broom, the Mission came to be seen by a large swathe of the nation as a leaf of BJP politics. Such a perception indeed did a mortal damage to the Mission right in the National Capital.

Anyway, let me now take you to the economics. Since for the ruling party, it was a matter of political ego, the great brains in the Government suggested an exclusive levy for this Mission, so dear to the PM. And, as the history of CESS suggests whether it was health cess or education cess it was not 100% required to meet a noble objective but to largely satisfy some political whims. And wherever whims and fancies come into play in a political decision, it takes a heavy toll on fiscal economics of a nation. Even common rationale paves the way for the demon of irrationality!

Let me now substantiate this old adage. To finance the Swachh Bharat Mission, the NDA Government required funds. There is so far no proper estimate of any quantum of funds required for this Mission except for some fancy figures. Such a fund could have been earmarked as a part of the budgetary allocation but it was the ego of the political power that prevailed over the fiscal wisdom and the Union Finance Minister proposed a CESS to be notified by the Government at a later date. Initially it was to be levied on a few services only (please refer to post-budget clarifications). God knows what transpired within the Government that compelled it to leave behind its promises and levy it on all taxable services. Then yet another unfathomable wisdom dawned on the Government to change the conventional definition of CESS which is normally a tax on tax. One good example was the Education Cess which was a tax on tax. This brought to reality an additional half a per cent tax to the prevailing rate of 14% service tax. So far so good! Then comes the great idea of forcing the taxpayers to show it as an independent item line in invoices and deposit it in a separate accounting head. When this CESS is not a tax on tax and it is nothing but half a per cent Service Tax what purpose will it serve to complicate the compliance burden of the taxpayers? When the collections from this half a per cent SBC is going to merge with the large ocean called Consolidated Fund of India why should the Ministry of Finance create so much of trappings around the compliance of SBC?

Now comes the tell-tale evidence of irrationality prevailing over the decision-making - NO CENVAT credit for SBC!! When all the normal provisions of the Service Tax laws are going to govern the collections or exemption of the SBC, it is nothing but service tax and when it is a part of service tax how irrational the Government can be to deny Credit of the tax paid on input services. When the normal service tax provisions will apply, input tax credit will automatically come into picture. Let's leave aside this line of argument and look at the horrific consequences of such a denial. If the credit of SBC is denied on input services consumed by 'X' the same is going to be passed on to 'Y' as a cost and if it happens 5 times in a chain of business it is going to jack up the cost of service by 2.5% at the end of the chain!! Is it the intention of the Government?

Let's now evaluate the largely perceived impact of SBC on the oft-repeated commitment of the Government to the proposed Goods & Services Tax (GST). Whether it is India or a foreign land the duo of the Prime Minister and the Finance Minister never tire of demonstrating their commitment to turn the biggest indirect tax reform into a reality i.e GST. It is worldwide known that the essence of GST lies in the seamless credit chain. When the same Government has made a beginning by denying input credit for the SBC and also proposes to deny the Credit for the one per additional tax on inter-state trade of goods as part of the IGST, how does the Government expect the industry and trade and even FDI carriers to trust the final outcome of the proposed GST? If we talk about the Opposition, they can clearly see from the example of SBC that the so-called commitment to the GST is nothing but empty words and the good intention is evidently missing.

If we leave aside the SBC, and re-visit the draft documents relating to business processes under the proposed GST, one may come across the startling fact that notwithstanding all the computerisation by the GSTN, there is not going to be automatic refund of excess ITC. No auto-refund means a major setback for exporters and business starts-up (a term so dear to the Prime Minister). YES, it can be granted with manual approval given in 90 days - where is the need for such an interface with the tax officials? When invoices have been matched by the system what purpose this manual approval would serve? Secondly, as against 18% or more of interest rate to be collected the Govt would pay only 6% on delayed refund - a mockery of fair play in any jurisprudence.

Let's hope good sense prevails over Mr Arun Jaitley who can certainly understand the compulsions of businesses and reverses the decision relating to denial of SBC Credit. More than anything else such a decision would hurt the political capital of the NDA Government and also compromise their commitment and ability to ensure a smooth switchover from the present regime to the proposed GST. Secondly, Mr Jaitley should remember that whether it is half a per cent or one per cent, every bit of indirect tax hurts the poor in the economy more as the incidence of indirect tax is equal for all. It is high time Mr Jaitley strives for a more 'Swachh' tax policy along with tax administration!

|

Download PDF

Download PDF