23 06 2015

Tuesday

CBEC has noticed that even after more than fifteen years of operation, the scheme of settlement of cases through Settlement Commission has not yielded the desired results and very minuscule percentage of all the show cause notices issued are taken up by the assessees for settlement. One of the reasons for not many assessees opting for the said scheme may be lack of awareness of the scheme amongst them.

To encourage voluntary compliance and for settlement of the disputes by making use of the Scheme, Board directs that immediately after issuance of Show Cause Notice, a letter should invariably be written to the noticee informing him about the scheme of the settlement. Board has even given a model letter to be written by the Department to the assessee suggesting the option of applying to the Settlement Commission.

While this is a good step, Board should also instruct that the assessees are not put to further trouble to get this letter. Perhaps the Board does not know how the officers serve the Show Cause Notices and letters on the assessees. The representatives of the assessees are asked to go over to the Departmental offices and collect the notices/letters. The Department should be asked to use the normal/legal/prescribed mode of communication.

CBEC Letter in F. No. F. No 275/72/2014-CX.8A., Dated: June 19, 2015

Why very few cases go to Settlement Commission?

THE foremost reason is that there is nothing to settle. Most of the Show Cause Notices are so pathetically illegal, baseless and highly inflated that they will not survive beyond the Tribunal. So, nobody is persuaded to go the Settlement Commission.

Even in the few cases that actually go to the Commission, the Departmental officers in the Commission behave as if they are just adjudicating another case.

The Board should impress upon all its officers starting with Members of the Commission that the Commission is more of a Panchayat to settle a dispute and not a court to adjudicate a case. The applicant in the Settlement Commission has already confirmed that he has not paid the tax and he has come to the Commission to make good the omission. He should not be treated as a criminal. After he is ready to pay (or paid) the admitted tax due, which would have come to the State kitty, if at all, after ten years.

Recently a former vice-chairman of the Settlement Commission told me that it takes about six months for a new Member to realise that he is no more an adjudicator or a tax collector and a Member stays in the Commission for hardly two years.

The proceedings of the Commission should be made more informal. The awe-inspiring courtroom setting should go. Even lawyers should be more informally dressed and not in their usual court attire. In the District Courts when they organise Lok Adalats, the Judge does not sit on the elevated pulpit; removes his coat, comes down and sits across the table along with the litigants. The idea is to provide a less formal and more congenial atmosphere to the parties, which encourages them to freely deliberate at such Lok Adalats thereby increasing the possibility of settlements. The Department should not routinely contest every application for settlement. I know a Commissioner who threatened an Assistant Commissioner (who represented for the department before the Settlement Commission) with a charge sheet for conceding a point before the Commission. The Department should also send fairly senior officers who should be authorised to take decisions.

This is an incident that happened in a Settlement Commission Bench.

The commission was convinced that the assessee had a fair case and he had truthfully admitted his liability. The Bench asked the departmental representative (a Superintendent) whether he would agree. He said, "No". "But why?", asked the Commission. "I have been asked to oppose settlement", was his humble reply. The Bench then took a break and asked the Superintendent to contact his Commissioner and come back with his decision. When the Member asked the Superintendent if he was ready with the Commissioner's view, he was told that the Superintendent tried to contact his Commissioner and was told that the Commissioner was having his lunch (to be followed by a siesta) and was not to be disturbed for the next two hours. And there was no way to get to the Commissioner. The Member who was a former Chief Commissioner said, "I will connect you to your Commissioner." So, he called up the Commissioner and asked him to speak to the Superintendent. After five minutes everybody assembled in the court and the Member asked the Superintendent, "what is your decision?" "My Commissioner has not agreed for settlement sir; he says the whole amount demanded in the Show Cause Notice should be confirmed." (Commissioners are used to that).

Draft Proposals for Facilitating Electronic Transactions - Tax Benefits!

THE Finance Minister in his budget speech for the Union Budget 2015 - 16 made the following announcement:

"One way to curb the flow of black money is to discourage transactions in cash. Now that a majority of Indians has or can have, a RUPAY debit card. I therefore, proposes (as in the text - they don't bother to correct even the FM's Budget speech) to introduce soon several measure that will incentivize credit or debit card transactions and disincentivize cash transaction".

Accordingly, draft proposals for facilitating electronic transactions (E-transactions) have been prepared. Comments and views are invited on the Draft Proposals.

There is a disclaimer: The Proposals are only at the draft stage and are being placed to obtain public opinion. The proposals as they stand at this stage, do not imply any commitment from the government.

Comments/suggestions are invited on the draft and last date to share your views is 29 June, 2015 by 5:00 p.m.

Salient features:

• Tax benefits could be provided to merchants for accepting electronic payments, e.g. an appropriate tax rebate can be extended to a merchant if at least say 50% value of the transactions is through electronic means. Alternatively, 1-2% reduction in value added tax could be considered on all electronic transactions by the merchants.

• Tax benefits in terms of income tax rebates to be considered to consumers for paying a certain proportion of their expenditure through electronic means.

• Utility service providers could be advised to give a discount to users for small ticket payments through E-payments, on the lines of BSNL, which provides an incentive of 1 per cent of the billed amount if the payment is done through electronic mode.

• At present, there is a Merchant Discount Rate (MDR) of 0.75% on Debit Card transactions upto Rs.2000 and 1% on all transactions above Rs.2000. The possibility of reduction in the MDR and the rationalization of the distribution of the MDR across different stakeholders will be examined.

• Consider a levy of a nominal cash handling charge on transactions greater than a specified level.

• At present, banks have to report the aggregate of all the payments made by a credit cardholder as one transaction, if such an amount is Rs. 2 lakhs in a year. To facilitate high value transactions, the ceiling of Rs. 2 lakhs could be increased to say Rs. 5 lakhs or more.

Awareness and grievance redressal: Assurance mechanisms for fraudulent transactions to be created wherein, in case of a fraudulent transaction, the money will be credited back to customer's account and blocked and subsequently released after the investigation is complete/ limited to say a maximum of 3 months.

The Draft Proposals

Come to Office on Time - Govt tells babus

GOVERNMENT invites the attention of its employees to Rule 3(1)(ii) of CCS (Conduct) Rules, 1964 which stipulates that every Government servant shall at all times maintain devotion to duty. Habitual late attendance is viewed as conduct unbecoming of a Government servant and disciplinary action may be taken against such a Government servant.

Government has emphasised that punctuality in attendance is to be observed by Government servants at all levels.

The decision to introduce AADHAAR enabled Bio-metric Attendance System (AEBAS) in Central Government offices, including attached/ sub-ordinate offices, to replace the manual system of marking of attendance to ensure punctuality is to be implemented in all Ministries/ Departments.

As per the Government's instructions, Biometric Attendance System (BAS) was to be implemented in all Central Government offices by 31st December 2014. They are already six months behind schedule and now the Government reminds the babus of the Conduct Rules. Does anyone really wish to reach office on time?

Also see DDT 2440, 2526, 2531, 2535, 2554.

DoPT Office Memorandum No. 11013/9/2014-Estt.A-III., Dated June 22, 2015

Export Certificate for Passengers - Why can't Board prescribe a uniform procedure?

AS per the Baggage Rules, a lady Indian returning from a foreign country can bring gold worth one lakh rupees (this is only fifty thousand for a gentleman). In one lakh, you can hardly get 40 grams of gold - maybe one good necklace. Then what will happen to earrings, bangles and other ornaments?

She can bring back gold taken out earlier by her or a family member, but she has to prove to the satisfaction of the Assistant Commissioner that the gold was indeed taken out earlier from India. But how do you satisfy the Assistant Commissioner?

They have a system called export certificate issued by the Customs when you leave the country. And different Air Customs offices have prescribed different procedures.

The Chennai Air Customs prescribes:

1. Log on to Chennai Air Customs Commissionerate Website at www.aircustomschennai.gov.in and Click the Link "Download Export Certificate Format" under the option "Online Export Certificate". The Export Certificate in editable format will be opened to the user which has to be duly filled in. After filling all the particulars in the downloaded Export Certificate Format, the same has to be taken as a printout in duplicate or can be saved as a "pdf" file for future reference and use.

2. The downloaded Export Certificate Form, duly filled in all respects, should be brought by the passenger in duplicate alongwith the goods for which the Export Certificate is sought. The passengers are advised to reach the Departure Customs Counter well in advance to the scheduled time of departure of their flight.

3. After Immigration Clearance, the Passengers shall approach the Customs Officer posted at the Departure Customs and produce Passport, Boarding Pass and the items, for which the Export Certificate is required, to the Customs Officer for examination. The items will be examined by the Customs Officer and the particulars mentioned in the Export Certificate Form by the passengers will be verified before the issue of Export Certificate, duly certified by the Customs.

4. In case of high valued items like Notebook / Laptop, Computers, Camcorder, Digital Cameras, Smart Phones etc., the Manufacturer's name, Model, Serial Number of the Product, Year of Manufacture and the value of the Items have to be furnished by the Passengers in the Online Export Certificate Form. Any document / invoice which contain the above details may also be produced to the Customs Officer for verification.

5. In case of Gold / Silver / Diamond / Studded Jewellery, the passengers should produce the following documents to the Customs Officer in support of their claim of valuation of those items furnished in the Export Certificate:-

(a) Purchase invoice / Valuation Certificate issued by the Authorised Valuer and

(b) Attested Photographs of the Jewellery by the Authorised Valuers

6. The photographs of the Jewellery must be of utmost clarity so that the Customs Officer is able to identify and verify the jewellery produced to him with respect those mentioned by the Passenger in the Export Certificate Forms.

7. The List of Authorised Valuers is Annexed to this Page. The same may be viewed by clicking here (Provide Link to the List).

8. On arrival in India, to obtain exemption from duty on re-importation of the items for which Export Certificate has been obtained, the respective items should be in the possession of the passenger or his / her family.

9. The person re-importing the items, for which Export Certificate has been obtained, shall produce the Export Certificate to the Customs Officer on Arrival and get the same endorsed from Customs before every departure out of the Country.

Why can't the Board prescribe a uniform procedure for all airports? And they should educate people going abroad, especially ladies that they are not allowed to bring in any amount of ornaments, just by wearing them - there is such a misconception.

Please also see DDT 2502 , 2524.

Union of India vs... - Who is UOI?

AS per Article 300 of the Constitution of India, the Government of India may sue or be sued by the name of the Union of India.

So, if the Government is the petitioner/appellant in a case, the first appellant should be shown as Union of India - similarly as respondent.

We see many cases like Commissioner of Central Excise vs…..

The CBEC has recently noticed that there is no uniformity and clarity in respect of the procedure to be adopted by the field formations in matters relating to representation of the cases before the High Court on behalf of Union of India (UOI) and the officers in the Ministry/ Board.

Accordingly, Board has issued instructions to streamline the process of filing the counter affidavit by the Commissioner in whose name such authorization has been issued.

|

Whether the jurisdictional Commissioner can further authorize any of his subordinates to represent the interests of UOI or officers in Ministry/ Board.

|

|

Commissioner does not have the authority to authorize anybody else. Accordingly, Commissioner should himself sign the vakalatnama and counter affidavit in all such cases.

|

|

Procedure for obtaining comments on policy issues from the policy wing or the concerned sections in the Ministry/ Board for drafting the counter.

|

|

In case where the comments of policy wings or the concerned section in the Board/ Ministry are needed, the Commissioner in whose name the authorization is issued should obtain comments directly from the said section under intimation to legal section. On the basis of the comments so received from the policy sections in the Ministry/ Board, the Commissioner who is authorized, will vet and file the counter affidavit.

|

Please also see DDT 2256 20.12.2013

Nathu La passed opened for pilgrims

|

China yesterday welcomed Indian pilgrims to Mansarovar and Mt. Kailash through the Nathu La pass.

"Made in India" is making a big effect in the border villages.

The Nathu La Pass sits 4,545 meters above sea level and is wedged between Tibet's Yadong County in Xigaze prefecture, and India's Sikkim state.

The opening of the pass was agreed upon a year ago, when Chinese president Xi Jinping had visited India and signed the pact for improving ties between the two countries. The entire distance of 1,500 km would be covered over three days.

An Indian Pilgrim entering through the Nathu La pass yesterday.

|

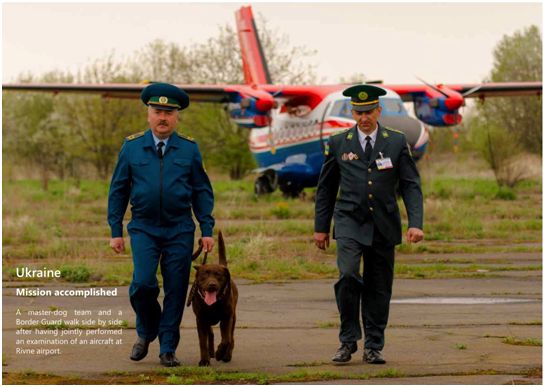

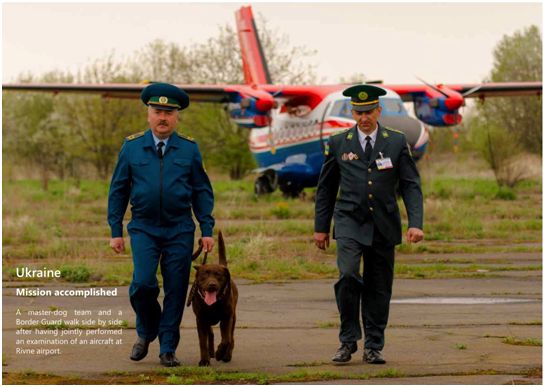

WCO Photo Competition 2015 - The Ukraine Entry - Mission accomplished

Until Tomorrow with more DDT

Have a nice day.

Mail your comments to vijaywrite@tiol.in |

Download PDF

Download PDF